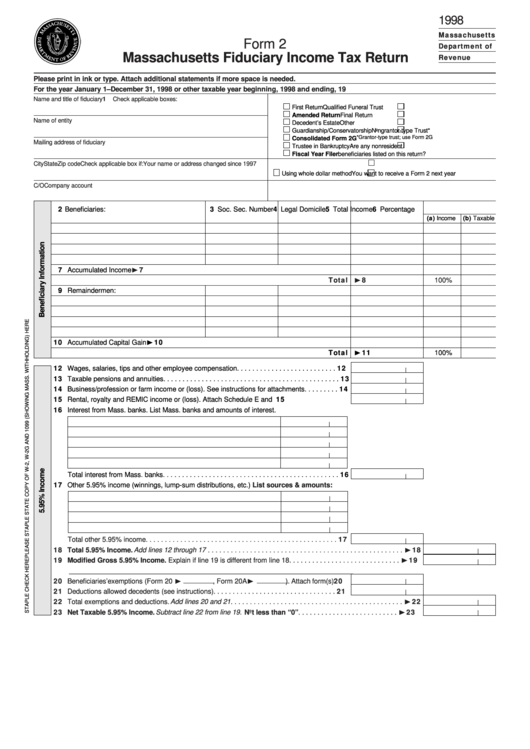

1998

Massachusetts

Form 2

Department of

Massachusetts Fiduciary Income Tax Return

Revenue

Please print in ink or type. Attach additional statements if more space is needed.

For the year January 1–December 31, 1998 or other taxable year beginning

, 1998 and ending

, 19

Name and title of fiduciary

1 Check applicable boxes:

First Return

Qualified Funeral Trust

Amended Return

Final Return

Name of entity

Decedent’s Estate

Other

Guardianship/Conservatorship

Nongrantor-type Trust*

*Grantor-type trust; use Form 2G

Consolidated Form 2G

Mailing address of fiduciary

Trustee in Bankruptcy

Are any nonresident

Fiscal Year Filer

beneficiaries listed on this return?

City

State

Zip code

Check applicable box if:

Your name or address changed since 1997

Using whole dollar method

You want to receive a Form 2 next year

C/O

Company account number

U.S. taxpayer number

Date entity created

12 Beneficiaries:

3 Soc. Sec. Number

4 Legal Domicile

5 Total Income

6 Percentage

(a) Income

(b) Taxable

¨ 7

17 Accumulated Income

Total ¨ 8

100%

19 Remaindermen:

¨ 10

10 Accumulated Capital Gain

Total ¨ 11

100%

12 Wages, salaries, tips and other employee compensation . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Taxable pensions and annuities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Business/profession or farm income or (loss). See instructions for attachments . . . . . . . . . 14

15 Rental, royalty and REMIC income or (loss). Attach Schedule E and U.S. Schedule E . . . 15

16 Interest from Mass. banks. List Mass. banks and amounts of interest.

Total interest from Mass. banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Other 5.95% income (winnings, lump-sum distributions, etc.)

List sources & amounts:

Total other 5.95% income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total 5.95% Income. Add lines 12 through 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 18

19 Modified Gross 5.95% Income. Explain if line 19 is different from line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 19

__________________________________________________________________________________

20 Beneficiaries’ exemptions (Form 20 ¨

, Form 20A ¨

). Attach form(s) 20

21 Deductions allowed decedents (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Total exemptions and deductions. Add lines 20 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 22

23 Net Taxable 5.95% Income. Subtract line 22 from line 19. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 23

1

1 2

2