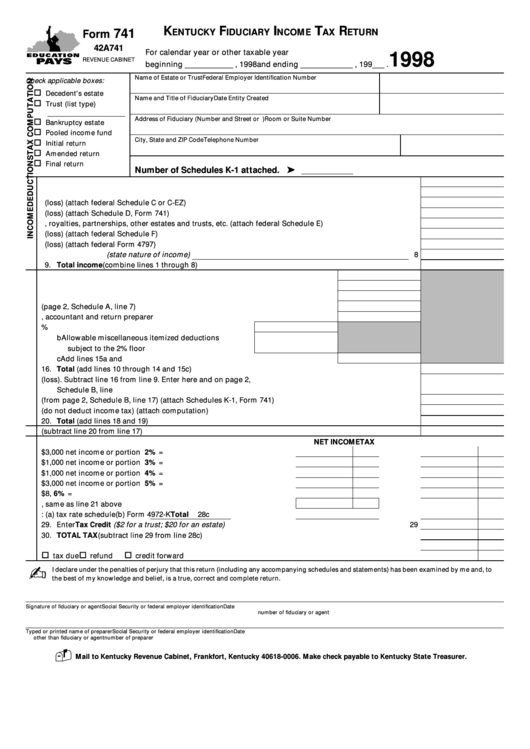

K

F

I

T

R

741

ENTUCKY

IDUCIARY

NCOME

AX

ETURN

Form

42A741

For calendar year or other taxable year

1998

REVENUE CABINET

beginning ____________ , 1998 and ending _____________ , 199___ .

Name of Estate or Trust

Federal Employer Identification Number

Check applicable boxes:

Decedent's estate

Name and Title of Fiduciary

Date Entity Created

Trust (list type)

Address of Fiduciary (Number and Street or P.O. Box)

Room or Suite Number

Bankruptcy estate

Pooled income fund

City, State and ZIP Code

Telephone Number

Initial return

Amended return

Final return

Number of Schedules K-1 attached.

ä

1. Interest income ................................................................................................................................................. 1

2. Dividends ........................................................................................................................................................... 2

3. Business income or (loss) (attach federal Schedule C or C-EZ) ................................................................... 3

4. Capital gain or (loss) (attach Schedule D, Form 741) .................................................................................... 4

5. Rents, royalties, partnerships, other estates and trusts, etc. (attach federal Schedule E) ......................... 5

6. Farm income or (loss) (attach federal Schedule F) ........................................................................................ 6

7. Ordinary gain or (loss) (attach federal Form 4797) ....................................................................................... 7

8. Other income (state nature of income)

8

9. Total income (combine lines 1 through 8) ..................................................................................................... 9

10. Interest ...................................................................................................................... 10

11. Taxes ......................................................................................................................... 11

12. Fiduciary fees ........................................................................................................... 12

13. Charitable deduction (page 2, Schedule A, line 7) ................................................ 13

14. Attorney, accountant and return preparer fees .................................................... 14

15. a Other deductions NOT subject to the 2% floor ..... 15a

b Allowable miscellaneous itemized deductions

subject to the 2% floor ............................................ 15b

c Add lines 15a and 15b ...................................................................................... 15c

16. Total (add lines 10 through 14 and 15c) ......................................................................................................... 16

17. Adjusted total income or (loss). Subtract line 16 from line 9. Enter here and on page 2,

Schedule B, line 1 ............................................................................................................................................. 17

18. Income distribution deduction (from page 2, Schedule B, line 17) (attach Schedules K-1, Form 741) .... 18

19. Federal estate tax deduction (do not deduct income tax) (attach computation) ........................................ 19

20. Total (add lines 18 and 19) ............................................................................................................................... 20

21. Taxable income of fiduciary (subtract line 20 from line 17) ......................................................................... 21

NET INCOME

TAX

22. Enter first $3,000 net income or portion thereof .............................. 22

x 2% =

23. Enter next $1,000 net income or portion thereof .............................. 23

x 3% =

24. Enter next $1,000 net income or portion thereof .............................. 24

x 4% =

25. Enter next $3,000 net income or portion thereof .............................. 25

x 5% =

26. Enter all in excess of $8,000 ................................................................ 26

x 6% =

27. Total taxable income, same as line 21 above ................................... 27

28. Tax: (a) tax rate schedule

(b) Form 4972-K

Total

28c

29. EnterTax Credit ($2 for a trust; $20 for an estate) ......................................................................................... 29

30. TOTAL TAX (subtract line 29 from line 28c) ................................................................................................... 30

31. Enter prepayments and other credits ............................................................................................................. 31

32. Subtract line 31 from line 30. Enter amount of

tax due

refund

credit forward ................ 32

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me and, to

the best of my knowledge and belief, is a true, correct and complete return.

Signature of fiduciary or agent

Social Security or federal employer identification

Date

number of fiduciary or agent

Typed or printed name of preparer

Social Security or federal employer identification

Date

other than fiduciary or agent

number of preparer

Mail to Kentucky Revenue Cabinet, Frankfort, Kentucky 40618-0006. Make check payable to Kentucky State Treasurer.

1

1 2

2