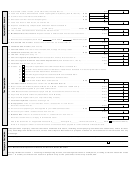

23 Net taxable. 5.95% Income. (From other side). Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Total 12% Interest, dividends and certain capital gains and (losses) (Sch. B, line 22) . . . ¨ 24

25 Common trust fund interest and dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 25

26 Short-term common trust fund capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 26

27 Total 12% Income. Add line 24, 25 and line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Expense and fiduciary compensation deduction. Attach Schedule H.

(a) Exp. ded. ___________________ (b) Fid. comp. _______________ . . . . . . . . Total 28

29 12% income after deductions. Subtract line 28 from line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 29

30 Modified Gross 12% Income. Explain if line 30 is different from line 29. See instructions . . . . . . . . . . . . . . . . . ¨ 30

_________________________________________________________________________

31 Beneficiaries’ exemptions (Form 20 ¨

, Form 20A ¨

). Attach form(s) 31

32 Net Taxable 12% Income. Subtract line 31 from line 30. If loss, enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 32

33 Taxable 5.95% Income (from line 23). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 33

34 Tax from Table. If line 33 is more than $80,000, multiply amount by .0595 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

35 Taxable 12% Income (from line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 35

36 12% Tax. Multiply line 35 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 Tax on Long-term Capital Gains (from Schedule D, line 20). Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 37

38 Tax on Long-term Common Trust Fund Capital Gains (from Schedule D-1, line 6). . . . . . . . . . . . . . . . . . . . . ¨ 38

39 Total Tax. Add lines 34, 36, 37 and 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40 Credits: (a)

Long-term Capital Gains Tax Credit. Attach Mass. Schedule B-1.

(b)

Credit for Taxes Paid to Other Jurisdictions. Attach Mass. Schedule F and other jurisdiction’s returns.

(c)

Lead Paint Credit. Attach Mass. Schedule LP.

(d)

Economic Opportunity Area Credit. Attach Mass. Schedule EOA.

(e)

Full Employment Credit. Attach Mass. Schedule FEC.

Septic Credit. Attach Mass. Schedule SC . . . . . . . . . . . . . . . . . . . . . . . ¨ 40

(f)

41 Tax After Credits. Subtract line 40 from line 39. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Mass. income tax withheld (attach all Mass. W-2, W-2G, 1099-G and 1099R forms) . . . . . . . . . . . . . . . . . . . . . . ¨ 42

43 1997 Overpayment applied to your 1998 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 43

44 1998 Massachusetts estimated tax payments (do not include the amount in line 43). . . . . . . . . . . . . . . . . . . . . . ¨ 44

45 Payments made with extension (attach Mass. Form M-8736). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 45

46 Payment with original return (use only if amending a return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 46

47 Total Tax Payments. Add lines 42 through 46 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

48 Overpayment. If line 41 is smaller than line 47, subtract line 41 from line 47.

Enter the result in line 48. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 48

49 Amount of overpayment you want applied to your 1999 estimated taxes . . . . . . . . . . . . ¨ 49

50 Amount of your refund. Subtract line 49 from line 48 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 50

51 Balance Due. If line 47 is smaller than line 41, subtract line 47 from line 41.

Enter the result in line 51, and pay in full with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¨ 51

Add to the total in line 51, if applicable: Interest ¨ $________, Penalty ¨ $_______, M-2210 amount ¨ $_______ EX ¨

(Attach Form M-2210).

Write U.S. taxpayer number on lower left corner of check and make payable to: Commonwealth of Massachusetts.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief it is true, correct and complete. Declaration of preparer is based on all information of which he/she has any

knowledge.

Fiduciary’s signature

Date

Paid preparer’s signature & Social Security number

Date

Firm name (or yours, if self-employed) and address

Employer identification number

Check if self-employed

Mail to: Massachusetts Department of Revenue, PO Box 7018, Boston, MA 02204.

Warning: Willful tax evasion — including underreporting income, overstating deductions or exemptions, or failing to file and otherwise evade

taxes — is a felony. Conviction can result in a jail term of up to five years and/or a fine of up to $100,000.

1

1 2

2