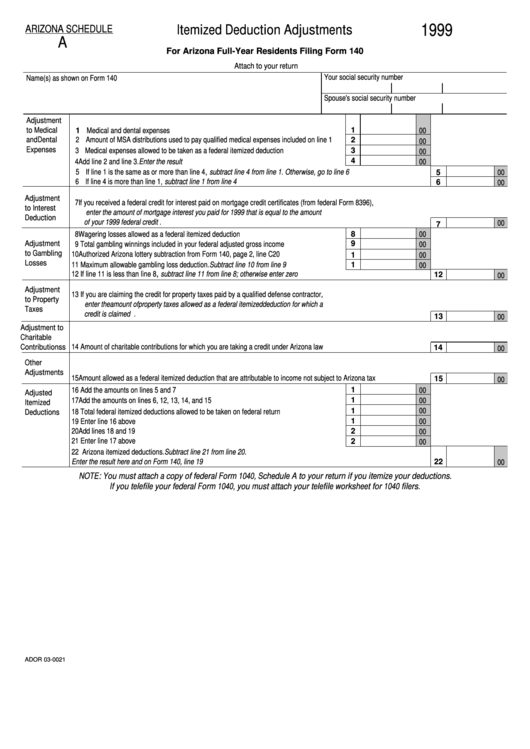

Schedule A - Itemized Deduction Adjustments For Arizona Full-Year Residents Filing Form 140 - 1999

ADVERTISEMENT

1999

Itemized Deduction Adjustments

ARIZONA SCHEDULE

A

For Arizona Full-Year Residents Filing Form 140

Attach to your return

Your social security number

Name(s) as shown on Form 140

Spouse's social security number

Adjustment

to Medical

1 Medical and dental expenses .................................................................................................

00

1

2 Amount of MSA distributions used to pay qualified medical expenses included on line 1 .....

and Dental

00

2

Expenses

3 Medical expenses allowed to be taken as a federal itemized deduction ...............................

00

3

4 Add line 2 and line 3. Enter the result .....................................................................................

00

4

5 If line 1 is the same as or more than line 4, subtract line 4 from line 1. Otherwise, go to line 6 .............................................

00

5

6 If line 4 is more than line 1, subtract line 1 from line 4 ...........................................................................................................

00

6

Adjustment

7 If you received a federal credit for interest paid on mortgage credit certificates (from federal Form 8396),

to Interest

enter the amount of mortgage interest you paid for 1999 that is equal to the amount

Deduction

of your 1999 federal credit ......................................................................................................................................................

00

7

8 Wagering losses allowed as a federal itemized deduction .....................................................

00

8

Adjustment

9 Total gambling winnings included in your federal adjusted gross income .............................

00

9

to Gambling

10 Authorized Arizona lottery subtraction from Form 140, page 2, line C20 ..............................

00

1

Losses

11 Maximum allowable gambling loss deduction. Subtract line 10 from line 9 ...........................

00

1

12 If line 11 is less than line 8, subtract line 11 from line 8; otherwise enter zero .......................................................................

00

12

Adjustment

13 If you are claiming the credit for property taxes paid by a qualified defense contractor,

to Property

enter the amount of property taxes allowed as a federal itemized deduction for which a

Taxes

credit is claimed .....................................................................................................................................................................

00

13

Adjustment to

Charitable

14 Amount of charitable contributions for which you are taking a credit under Arizona law ........................................................

Contributionss

00

14

Other

Adjustments

15 Amount allowed as a federal itemized deduction that are attributable to income not subject to Arizona tax .........................

00

15

16 Add the amounts on lines 5 and 7 ..........................................................................................

00

1

Adjusted

17 Add the amounts on lines 6, 12, 13, 14, and 15 .....................................................................

00

1

Itemized

00

18 Total federal itemized deductions allowed to be taken on federal return ...............................

Deductions

1

00

19 Enter line 16 above ................................................................................................................

1

20 Add lines 18 and 19 ................................................................................................................

00

2

21 Enter line 17 above ................................................................................................................

00

2

22 Arizona itemized deductions. Subtract line 21 from line 20.

Enter the result here and on Form 140, line 19 ......................................................................................................................

00

22

NOTE: You must attach a copy of federal Form 1040, Schedule A to your return if you itemize your deductions.

If you telefile your federal Form 1040, you must attach your telefile worksheet for 1040 filers.

ADOR 03-0021

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1