Instructions For Form Apl-004

ADVERTISEMENT

INSTRUCTIONS

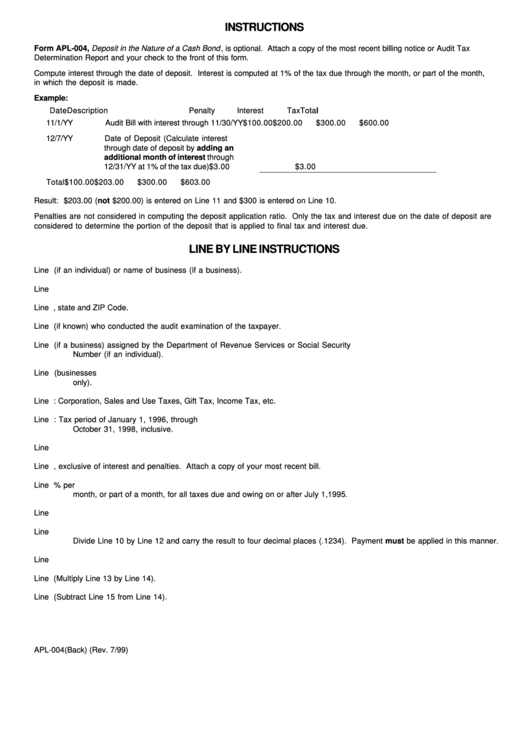

Form APL-004, Deposit in the Nature of a Cash Bond , is optional. Attach a copy of the most recent billing notice or Audit Tax

Determination Report and your check to the front of this form.

Compute interest through the date of deposit. Interest is computed at 1% of the tax due through the month, or part of the month,

in which the deposit is made.

Example:

Date

Description

Penalty

Interest

Tax

Total

11/1/YY

Audit Bill with interest through 11/30/YY

$100.00

$200.00

$300.00

$600.00

12/7/YY

Date of Deposit (Calculate interest

through date of deposit by adding an

additional month of interest through

12/31/YY at 1% of the tax due)

$3.00

$3.00

Total

$100.00

$203.00

$300.00

$603.00

Result: $203.00 (not $200.00) is entered on Line 11 and $300 is entered on Line 10.

Penalties are not considered in computing the deposit application ratio. Only the tax and interest due on the date of deposit are

considered to determine the portion of the deposit that is applied to final tax and interest due.

LINE BY LINE INSTRUCTIONS

Line 1.

Enter name of taxpayer (if an individual) or name of business (if a business).

Line 2.

Enter street address of taxpayer.

Line 3.

Enter city, state and ZIP Code.

Line 4.

Enter name of revenue examiner (if known) who conducted the audit examination of the taxpayer.

Line 5.

Enter CT Tax Registration Number (if a business) assigned by the Department of Revenue Services or Social Security

Number (if an individual).

Line 6.

Enter Federal Employer Identification Number assigned by the United States Department of the Treasury (businesses

only).

Line 7.

Enter the type of tax audited. Examples: Corporation, Sales and Use Taxes, Gift Tax, Income Tax, etc.

Line 8.

Enter the beginning and ending tax periods of the audit examination. Example: Tax period of January 1, 1996, through

October 31, 1998, inclusive.

Line 9.

Check the appropriate box.

Line 10.

Enter the amount of tax assessed, exclusive of interest and penalties. Attach a copy of your most recent bill.

Line 11.

See the example above in the Instructions. Additional interest is calculated on a monthly basis at the rate of 1% per

month, or part of a month, for all taxes due and owing on or after July 1,1995.

Line 12.

Add Line 10 and Line 11.

Line 13.

Compute the ratio of tax assessed over the sum of tax assessed plus interest accrued through the date of deposit.

Divide Line 10 by Line 12 and carry the result to four decimal places (.1234). Payment must be applied in this manner.

Line 14.

Enter the amount deposited with this form. Attach your check to the front of this form.

Line 15.

Compute the portion of the deposit to apply to final tax due. (Multiply Line 13 by Line 14).

Line 16.

Compute the portion of the deposit to apply to final interest due. (Subtract Line 15 from Line 14).

APL-004(Back) (Rev. 7/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1