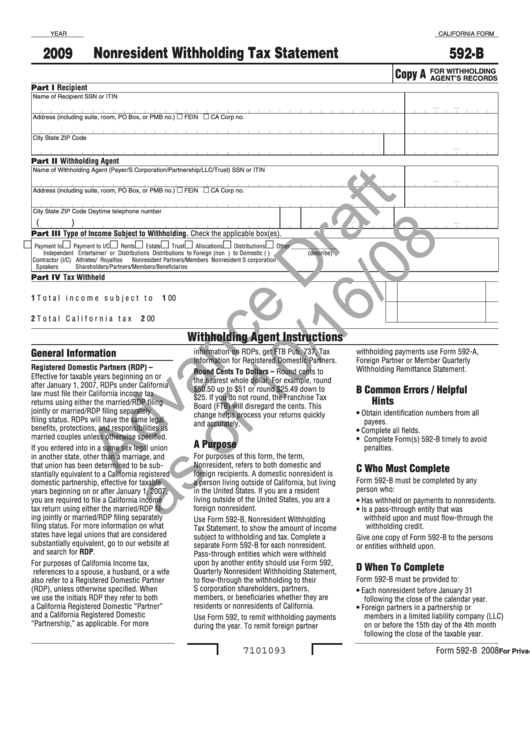

California Form 592-B Draft - Nonresident Withholding Tax Statement - 2009

ADVERTISEMENT

YEAR

CALIFORNIA FORM

Nonresident Withholding Tax Statement

2009

592-B

Copy A

FOR WITHHOLDING

AGENT’S RECORDS

Part I Recipient

Name of Recipient

SSN or ITIN

Address (including suite, room, PO Box, or PMB no.)

FEIN

CA Corp no.

City

State

ZIP Code

Part II Withholding Agent

Name of Withholding Agent (Payer/S Corporation/Partnership/LLC/Trust)

SSN or ITIN

Address (including suite, room, PO Box, or PMB no.)

FEIN

CA Corp no.

City

State ZIP Code

Daytime telephone number

(

)

Part III Type of Income Subject to Withholding. Check the applicable box(es).

Payment to

Payment to I/C

Rents

Estate

Trust

Allocations

Distributions

Other _______________

Independent

Entertainer/

or

Distributions

Distributions

to Foreign (non U.S.)

to Domestic (U.S.)

(describe)

Contractor (I/C)

Athletes/

Royalties

Nonresident Partners/Members

Nonresident S corporation

Speakers

Shareholders/Partners/Members/Beneficiaries

Part IV Tax Withheld

1 Total income subject to withholding. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Total California tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

Withholding Agent Instructions

General Information

information on RDPs, get FTB Pub. 737, Tax

withholding payments use Form 592-A,

Information for Registered Domestic Partners.

Foreign Partner or Member Quarterly

Registered Domestic Partners (RDP) –

Withholding Remittance Statement.

Round Cents To Dollars – Round cents to

Effective for taxable years beginning on or

the nearest whole dollar. For example, round

after January 1, 2007, RDPs under California

B Common Errors / Helpful

$50.50 up to $51 or round $25.49 down to

law must file their California income tax

$25. If you do not round, the Franchise Tax

Hints

returns using either the married/RDP filing

Board (FTB) will disregard the cents. This

jointly or married/RDP filing separately

• Obtain identification numbers from all

change helps process your returns quickly

filing status. RDPs will have the same legal

payees.

and accurately.

benefits, protections, and responsibilities as

• Complete all fields.

married couples unless otherwise specified.

• Complete Form(s) 592-B timely to avoid

A Purpose

penalties.

If you entered into in a same sex legal union

For purposes of this form, the term,

in another state, other than a marriage, and

Nonresident, refers to both domestic and

that union has been determined to be sub-

C Who Must Complete

foreign recipients. A domestic nonresident is

stantially equivalent to a California registered

Form 592-B must be completed by any

domestic partnership, effective for taxable

a person living outside of California, but living

person who:

years beginning on or after January 1, 2007,

in the United States. If you are a resident

living outside of the United States, you are a

you are required to file a California income

• Has withheld on payments to nonresidents.

foreign nonresident.

tax return using either the married/RDP fil-

• Is a pass-through entity that was

ing jointly or married/RDP filing separately

withheld upon and must flow-through the

Use Form 592-B, Nonresident Withholding

filing status. For more information on what

withholding credit.

Tax Statement, to show the amount of income

states have legal unions that are considered

subject to withholding and tax. Complete a

Give one copy of Form 592-B to the persons

substantially equivalent, go to our website at

separate Form 592-B for each nonresident.

or entities withheld upon.

ftb.ca.gov and search for RDP.

Pass-through entities which were withheld

upon by another entity should use Form 592,

For purposes of California Income tax,

D When To Complete

Quarterly Nonresident Withholding Statement,

references to a spouse, a husband, or a wife

Form 592-B must be provided to:

to flow-through the withholding to their

also refer to a Registered Domestic Partner

S corporation shareholders, partners,

(RDP), unless otherwise specified. When

• Each nonresident before January 31

we use the initials RDP they refer to both

members, or beneficiaries whether they are

following the close of the calendar year.

a California Registered Domestic “Partner”

residents or nonresidents of California.

• Foreign partners in a partnership or

and a California Registered Domestic

members in a limited liability company (LLC)

Use Form 592, to remit withholding payments

“Partnership,” as applicable. For more

on or before the 15th day of the 4th month

during the year. To remit foreign partner

following the close of the taxable year.

7101093

Form 592-B 2008

For Privacy Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3