Instructions For Form 200-01-X-I - Resident Amended Delaware Personal Income Tax Return - 2013

ADVERTISEMENT

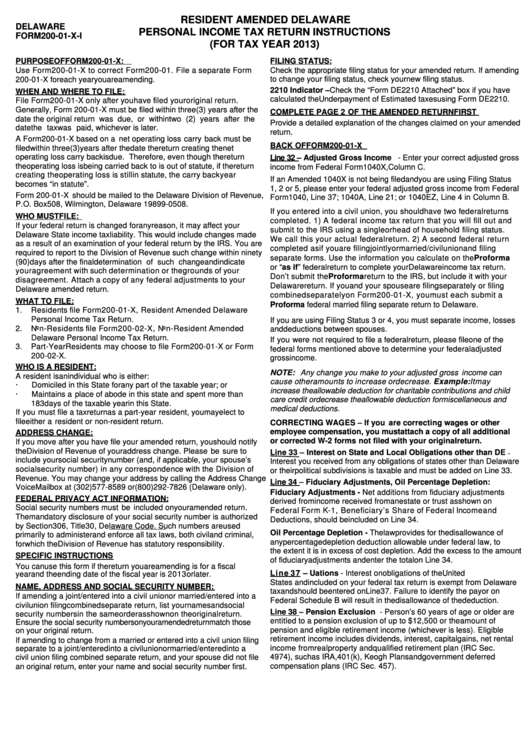

RESIDENT AMENDED DELAWARE

DELAWARE

PERSONAL INCOME TAX RETURN INSTRUCTIONS

FORM 200-01-X-I

(FOR TAX YEAR 2013)

PURPOSE OF FORM 200-01-X:

FILING STATUS:

Use Form 200-01-X to correct Form 200-01. File a separate Form

Check the appropriate filing status for your amended return. If amending

200-01-X for each year you are amending.

to change your filing status, check your new filing status.

2210 Indicator – Check the “Form DE2210 Attached” box if you have

WHEN AND WHERE TO FILE:

calculated the Underpayment of Estimated taxes using Form DE2210.

File Form 200-01-X only after you have filed your original return.

Generally, Form 200-01-X must be filed within three (3) years after the

COMPLETE PAGE 2 OF THE AMENDED RETURN FIRST

date the original return was due, or within two (2) years after the

Provide a detailed explanation of the changes claimed on your amended

date the tax was paid, whichever is later.

return.

A Form 200-01-X based on a net operating loss carry back must be

BACK OF FORM 200-01-X

filed within three (3) years after the date the return creating the net

operating loss carry back is due. Therefore, even though the return

Line 32 – Adjusted Gross Income - Enter your correct adjusted gross

the operating loss is being carried back to is out of statute, if the return

income from Federal Form 1040X, Column C.

creating the operating loss is still in statute, the carry back year

If an Amended 1040X is not being filed and you are using Filing Status

becomes “in statute”.

1, 2 or 5, please enter your federal adjusted gross income from Federal

Form 200-01-X should be mailed to the Delaware Division of Revenue,

Form 1040, Line 37; 1040A, Line 21; or 1040EZ, Line 4 in Column B.

P.O. Box 508, Wilmington, Delaware 19899-0508.

If you entered into a civil union, you should have two federal returns

WHO MUST FILE:

completed. 1) A federal income tax return that you will fill out and

If your federal return is changed for any reason, it may affect your

submit to the IRS using a single or head of household filing status.

Delaware State income tax liability. This would include changes made

We call this your actual federal return. 2) A second federal return

as a result of an examination of your federal return by the IRS. You are

completed as if you are filing jointly or married/civil union and filing

required to report to the Division of Revenue such change within ninety

separate forms. Use the information you calculate on the Proforma

(90) days after the final determination of such change and indicate

or “as if” federal return to complete your Delaware income tax return.

your agreement with such determination or the grounds of your

Don’t submit the Proforma return to the IRS, but include it with your

disagreement. Attach a copy of any federal adjustments to your

Delaware return. If you and your spouse are filing separately or filing

Delaware amended return.

combined separately on Form 200-01-X, you must each submit a

WHAT TO FILE:

Proforma federal married filing separate return to Delaware.

1.

Residents file Form 200-01-X, Resident Amended Delaware

Personal Income Tax Return.

If you are using Filing Status 3 or 4, you must separate income, losses

2.

Non-Residents file Form 200-02-X, Non-Resident Amended

and deductions between spouses.

Delaware Personal Income Tax Return.

If you were not required to file a federal return, please file one of the

3.

Part-Year Residents may choose to file Form 200-01-X or Form

federal forms mentioned above to determine your federal adjusted

200-02-X.

gross income.

WHO IS A RESIDENT:

NOTE: Any change you make to your adjusted gross income can

A resident is an individual who is either:

cause other amounts to increase or decrease. Example: It may

·

Domiciled in this State for any part of the taxable year; or

increase the allowable deduction for charitable contributions and child

·

Maintains a place of abode in this state and spent more than

care credit or decrease the allowable deduction for miscellaneous and

183 days of the taxable year in this State.

medical deductions.

If you must file a tax return as a part-year resident, you may elect to

file either a resident or non-resident return.

CORRECTING WAGES – If you are correcting wages or other

employee compensation, you must attach a copy of all additional

ADDRESS CHANGE:

or corrected W-2 forms not filed with your original return.

If you move after you have file your amended return, you should notify

the Division of Revenue of your address change. Please be sure to

Line 33 – Interest on State and Local Obligations other than DE -

include your social security number (and, if applicable, your spouse’s

Interest you received from any obligations of states other than Delaware

social security number) in any correspondence with the Division of

or their political subdivisions is taxable and must be added on Line 33.

Revenue. You may change your address by calling the Address Change

Line 34 – Fiduciary Adjustments, Oil Percentage Depletion:

Voice Mailbox at (302) 577-8589 or (800) 292-7826 (Delaware only).

Fiduciary Adjustments - Net additions from fiduciary adjustments

FEDERAL PRIVACY ACT INFORMATION:

derived from income received from an estate or trust as shown on

Social security numbers must be included on your amended return.

Federal Form K-1, Beneficiary’s Share of Federal Income and

The mandatory disclosure of your social security number is authorized

Deductions, should be included on Line 34.

by Section 306, Title 30, Delaware Code. Such numbers are used

Oil Percentage Depletion - The law provides for the disallowance of

primarily to administer and enforce all tax laws, both civil and criminal,

any percentage depletion deduction allowable under federal law, to

for which the Division of Revenue has statutory responsibility.

the extent it is in excess of cost depletion. Add the excess to the amount

SPECIFIC INSTRUCTIONS

of fiduciary adjustments and enter the total on Line 34.

You can use this form if the return you are amending is for a fiscal

L in e 37 – U.S. Obligations - Interest on obligations of the United

year and the ending date of the fiscal year is 2013 or later.

States and included on your federal tax return is exempt from Delaware

NAME, ADDRESS AND SOCIAL SECURITY NUMBER:

tax and should be entered on Line 37. Failure to identify the payor on

If amending a joint/entered into a civil union or married/entered into a

Federal Schedule B will result in the disallowance of the deduction.

civil union filing combined separate return, list your names and social

Line 38 – Pension Exclusion - Person’s 60 years of age or older are

security numbers in the same order as shown on the original return.

entitled to a pension exclusion of up to $12,500 or the amount of

Ensure the social security numbers on your amended return match those

pension and eligible retirement income (whichever is less). Eligible

on your original return.

retirement income includes dividends, interest, capital gains, net rental

If amending to change from a married or entered into a civil union filing

income from real property and qualified retirement plan (IRC Sec.

separate to a joint/entered into a civil union or married/entered into a

civil union filing combined separate return, and your spouse did not file

4974), such as IRA, 401(k), Keogh Plans and government deferred

compensation plans (IRC Sec. 457).

an original return, enter your name and social security number first.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4