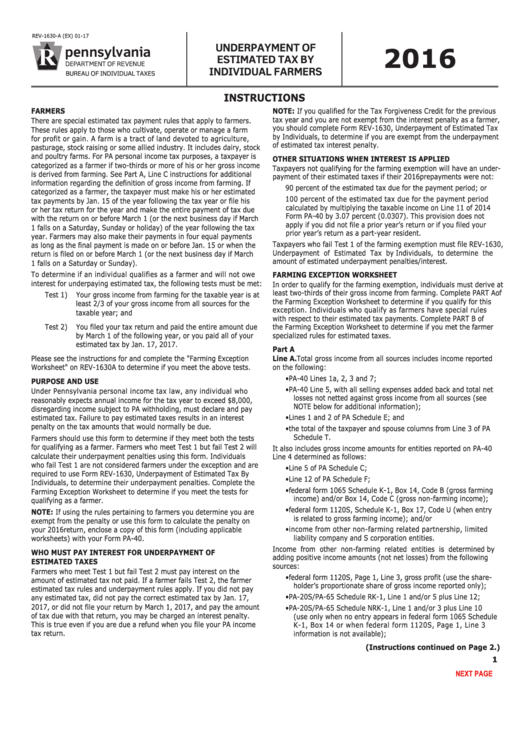

Instructions For Form Rev-1630-A (Ex) - Underpayment Of Estimated Tax By Individual Farmers - 2016

ADVERTISEMENT

REV-1630-A (EX) 01-17

2016

UNDERPAYMENT OF

ESTIMATED TAX BY

INDIVIDUAL FARMERS

BUREAU OF INDIVIDUAL TAXES

INSTRUCTIONS

FARMERS

NOTE: If you qualified for the Tax Forgiveness Credit for the previous

tax year and you are not exempt from the interest penalty as a farmer,

There are special estimated tax payment rules that apply to farmers.

you should complete Form REV-1630, Underpayment of Estimated Tax

These rules apply to those who cultivate, operate or manage a farm

by Individuals, to determine if you are exempt from the underpayment

for profit or gain. A farm is a tract of land devoted to agriculture,

of estimated tax interest penalty.

pasturage, stock raising or some allied industry. It includes dairy, stock

and poultry farms. For PA personal income tax purposes, a taxpayer is

OTHER SITUATIONS WHEN INTEREST IS APPLIED

categorized as a farmer if two-thirds or more of his or her gross income

Taxpayers not qualifying for the farming exemption will have an under-

is derived from farming. See Part A, Line C instructions for additional

payment of their estimated taxes if their 2016 prepayments were not:

information regarding the definition of gross income from farming. If

90 percent of the estimated tax due for the payment period; or

categorized as a farmer, the taxpayer must make his or her estimated

100 percent of the estimated tax due for the payment period

tax payments by Jan. 15 of the year following the tax year or file his

calculated by multiplying the taxable income on Line 11 of 2014

or her tax return for the year and make the entire payment of tax due

Form PA-40 by 3.07 percent (0.0307). This provision does not

with the return on or before March 1 (or the next business day if March

apply if you did not file a prior year’s return or if you filed your

1 falls on a Saturday, Sunday or holiday) of the year following the tax

prior year’s return as a part-year resident.

year. Farmers may also make their payments in four equal payments

Taxpayers who fail Test 1 of the farming exemption must file REV-1630,

as long as the final payment is made on or before Jan. 15 or when the

Underpayment of Estimated Tax by Individuals, to determine the

return is filed on or before March 1 (or the next business day if March

amount of estimated underpayment penalties/interest.

1 falls on a Saturday or Sunday).

To determine if an individual qualifies as a farmer and will not owe

FARMING EXCEPTION WORKSHEET

interest for underpaying estimated tax, the following tests must be met:

In order to qualify for the farming exemption, individuals must derive at

least two-thirds of their gross income from farming. Complete PART A of

Test 1)

Your gross income from farming for the taxable year is at

the Farming Exception Worksheet to determine if you qualify for this

least 2/3 of your gross income from all sources for the

exception. Individuals who qualify as farmers have special rules

taxable year; and

with respect to their estimated tax payments. Complete PART B of

Test 2)

You filed your tax return and paid the entire amount due

the Farming Exception Worksheet to determine if you met the farmer

by March 1 of the following year, or you paid all of your

specialized rules for estimated taxes.

estimated tax by Jan. 17, 2017.

Part A

Please see the instructions for and complete the "Farming Exception

Line A. Total gross income from all sources includes income reported

on the following:

Worksheet" on REV-1630A to determine if you meet the above tests.

• PA-40 Lines 1a, 2, 3 and 7;

PURPOSE AND USE

• PA-40 Line 5, with all selling expenses added back and total net

Under Pennsylvania personal income tax law, any individual who

losses not netted against gross income from all sources (see

reasonably expects annual income for the tax year to exceed $8,000,

NOTE below for additional information);

disregarding income subject to PA withholding, must declare and pay

estimated tax. Failure to pay estimated taxes results in an interest

• Lines 1 and 2 of PA Schedule E; and

penalty on the tax amounts that would normally be due.

• the total of the taxpayer and spouse columns from Line 3 of PA

Schedule T.

Farmers should use this form to determine if they meet both the tests

for qualifying as a farmer. Farmers who meet Test 1 but fail Test 2 will

It also includes gross income amounts for entities reported on PA-40

calculate their underpayment penalties using this form. Individuals

Line 4 determined as follows:

who fail Test 1 are not considered farmers under the exception and are

• Line 5 of PA Schedule C;

required to use Form REV-1630, Underpayment of Estimated Tax By

• Line 12 of PA Schedule F;

Individuals, to determine their underpayment penalties. Complete the

• federal form 1065 Schedule K-1, Box 14, Code B (gross farming

Farming Exception Worksheet to determine if you meet the tests for

income) and/or Box 14, Code C (gross non-farming income);

qualifying as a farmer.

• federal form 1120S, Schedule K-1, Box 17, Code U (when entry

NOTE: If using the rules pertaining to farmers you determine you are

is related to gross farming income); and/or

exempt from the penalty or use this form to calculate the penalty on

your 2016 return, enclose a copy of this form (including applicable

• income from other non-farming related partnership, limited

liability company and S corporation entities.

worksheets) with your Form PA-40.

Income from other non-farming related entities is determined by

WHO MUST PAY INTEREST FOR UNDERPAYMENT OF

adding positive income amounts (not net losses) from the following

ESTIMATED TAXES

sources:

Farmers who meet Test 1 but fail Test 2 must pay interest on the

• federal form 1120S, Page 1, Line 3, gross profit (use the share-

amount of estimated tax not paid. If a farmer fails Test 2, the farmer

holder’s proportionate share of gross income reported only);

estimated tax rules and underpayment rules apply. If you did not pay

• PA-20S/PA-65 Schedule RK-1, Line 1 and/or 5 plus Line 12;

any estimated tax, did not pay the correct estimated tax by Jan. 17,

2017, or did not file your return by March 1, 2017, and pay the amount

• PA-20S/PA-65 Schedule NRK-1, Line 1 and/or 3 plus Line 10

of tax due with that return, you may be charged an interest penalty.

(use only when no entry appears in federal form 1065 Schedule

This is true even if you are due a refund when you file your PA income

K-1, Box 14 or when federal form 1120S, Page 1, Line 3

tax return.

information is not available);

(Instructions continued on Page 2.)

1

GO DIRECTLY TO FORM

NEXT PAGE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3