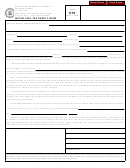

Form AP-111 (Back)(Rev.3-06/7)

INSTRUCTIONS FOR COMPLETING

TEXAS MOTOR FUEL CONTINUOUS BOND

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or phone number listed on this form.

WHO MAY COMPLETE BOND –

SPECIFIC INSTRUCTIONS –

Any license holder required to post a bond to

Item 8 - If the surety company has both a Texas

guarantee the payment of fuels taxes may complete

Taxpayer Number and a Texas Vendor Identification

and submit this bond.

Number, enter only the Vendor Identification Number.

Use only the first eleven digits of the number.

BONDING REQUIREMENTS –

Item 10 - Bonds must be written in accordance with the

Gasoline – A Supplier, Permissive Supplier,

applicable provisions of law for the type of fuel which

Distributor, Importer, Exporter, Distributor/Aviation

this bond will cover. The amount of the bond and the

Fuel Dealer, Blender, or Exporter/Blender shall post

applicable section number of the law must be entered

a bond equal to two times the maximum amount of

for this bond to be effective. Section numbers are:

tax that could accrue on tax-free gasoline purchased

or acquired during a reporting period. The minimum

GASOLINE TAX sec. 162.111(b)

bond is $30,000. The maximum bond is $600,000.

DIESEL FUEL TAX sec. 162.212(b)

Diesel Fuel – A Supplier, Permissive Supplier,

Item 11 – This bond must be dated and signed by an

Distributor, Importer, Exporter, Distributor/Aviation

authorized agent of the surety company.

Fuel Dealer, Blender, Importer/Bonded User, or

Exporter/Blender shall post a bond equal to two

Item 12 – This bond form must be signed by the

times the maximum amount of tax that could accrue

principal or authorized agent to be effective.The

on tax-free diesel fuel purchased or acquired or sold

authorized agent must also attach their power of

during a reporting period. The minimum bond is

attorney.

$30,000. The maximum bond is $600,000.

Mail the completed bond to

Dyed Diesel Fuel Bonded User – A Dyed Diesel

Fuel Bonded User shall post a bond equal to two

Comptroller of Public Accounts

times the maximum amount of tax that could accrue

111 E. 17

Street

th

on tax-free diesel fuel purchased or acquired during

Austin, Texas 78774-0100

a reporting period. The minimum bond is $10,000.

The maximum bond is $600,000.

WHOM TO CONTACT FOR ASSISTANCE -

For assistance with any fuels tax question, please

GENERAL INSTRUCTIONS –

contact the Texas State Comptroller’s Office at

1-800-252-1383 toll free nationwide, or call

• Please type or print only in white areas.

512/463-4600.

• Complete each item carefully.

• Do NOT use dashes when entering a Federal

Employer’s Identification Number or Social

Security Number.

Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and identification of any individual

affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. code §§403.011 and 403.078. Release of information on this form in response to a

public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

1

1 2

2