Instructions For Employer'S Quarterly Unemployment Insurance Report

ADVERTISEMENT

INSTRUCTIONS FOR EMPLOYER'S QUARTERLY UNEMPLOYMENT INSURANCE REPORT

DUE DATE

Your report must be postmarked on or before the last day of the month following the end of the quarter to avoid being classed

as delinquent, in which case interest and penalty will be charged. NOTE: The U.S. Post Office does not postmark mail on Sunday.

MAGNETIC

If you report wages electronically, this form is still required, and must be postmarked by the due date.

MEDIA

Please write "Magnetic Media" in the Employee Wage Section. If you report taxes and wages electronically, submit a UI5E, not this UI5.

N O

If you did not have anyone employed during this quarter, indicate this on the report. Write "NONE" in item 1, sign and return

EMPLOYMENT this report to the Unemployment Insurance (UI) Program in the enclosed envelope.

RATES

Contr. Rate means Contribution Rate. AFT Rate means Administrative Fund Tax Rate. Total Rate is the Contribution Rate

plus the Administrative Fund Tax Rate. Use total rate to compute the "TAXES DUE".

ITEM 1

Include total amount of all wages paid for employment, including corporate officers wages, commissions, bonuses, and the

cash value of all remuneration paid in any medium other than cash, such as meals and lodging, house rent, etc. Do not make

adjustments to prior quarters.

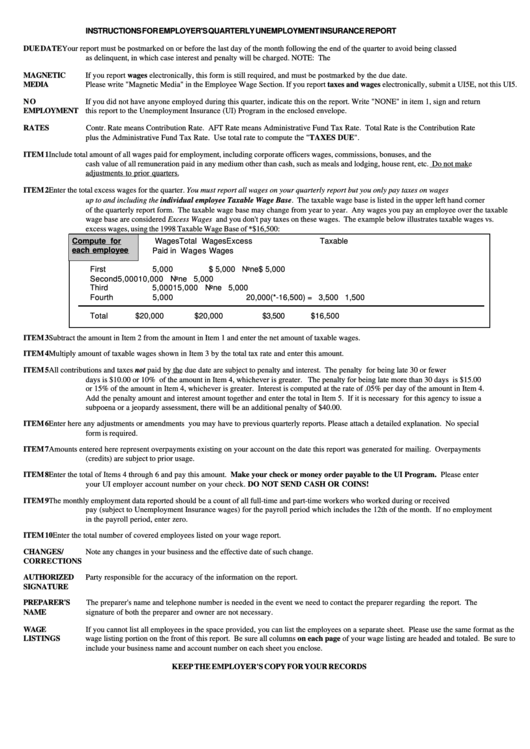

ITEM 2

Enter the total excess wages for the quarter. You must report all wages on your quarterly report but you only pay taxes on wages

up to and including the individual employee Taxable Wage Base. The taxable wage base is listed in the upper left hand corner

of the quarterly report form. The taxable wage base may change from year to year. Any wages you pay an employee over the taxable

wage base are considered Excess Wages and you don't pay taxes on these wages. The example below illustrates taxable wages vs.

excess wages, using the 1998 Taxable Wage Base of *$16,500:

Compute for

Wages

Total Wages

Excess

Taxable

each employee

Paid in Qtr.

Paid to Date

Wages

Wages

First

5,000

$ 5,000

None

$ 5,000

Second

5,000

10,000

None

5,000

Third

5,000

15,000

None

5,000

Fourth

5,000

20,000(*-16,500) =

3,500

1,500

Total

$20,000

$20,000

$3,500

$16,500

ITEM 3

Subtract the amount in Item 2 from the amount in Item 1 and enter the net amount of taxable wages.

ITEM 4

Multiply amount of taxable wages shown in Item 3 by the total tax rate and enter this amount.

ITEM 5

All contributions and taxes not paid by the due date are subject to penalty and interest. The penalty for being late 30 or fewer

days is $10.00 or 10% of the amount in Item 4, whichever is greater. The penalty for being late more than 30 days is $15.00

or 15% of the amount in Item 4, whichever is greater. Interest is computed at the rate of .05% per day of the amount in Item 4.

Add the penalty amount and interest amount together and enter the total in Item 5. If it is necessary for this agency to issue a

subpoena or a jeopardy assessment, there will be an additional penalty of $40.00.

ITEM 6

Enter here any adjustments or amendments you may have to previous quarterly reports. Please attach a detailed explanation. No special

form is required.

ITEM 7

Amounts entered here represent overpayments existing on your account on the date this report was generated for mailing. Overpayments

(credits) are subject to prior usage.

ITEM 8

Enter the total of Items 4 through 6 and pay this amount. Make your check or money order payable to the UI Program. Please enter

your UI employer account number on your check. DO NOT SEND CASH OR COINS!

ITEM 9

The monthly employment data reported should be a count of all full-time and part-time workers who worked during or received

pay (subject to Unemployment Insurance wages) for the payroll period which includes the 12th of the month. If no employment

in the payroll period, enter zero.

ITEM 10

Enter the total number of covered employees listed on your wage report.

CHANGES/

Note any changes in your business and the effective date of such change.

CORRECTIONS

AUTHORIZED

Party responsible for the accuracy of the information on the report.

SIGNATURE

PREPARER'S

The preparer's name and telephone number is needed in the event we need to contact the preparer regarding the report. The

NAME

signature of both the preparer and owner are not necessary.

WAGE

If you cannot list all employees in the space provided, you can list the employees on a separate sheet. Please use the same format as the

LISTINGS

wage listing portion on the front of this report. Be sure all columns on each page of your wage listing are headed and totaled. Be sure to

include your business name and account number on each sheet you enclose.

KEEP THE EMPLOYER'S COPY FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1