Instructions For Tax020 Form - Employer'S Quarterly Unemployment Insurance Tax Report - 2012

ADVERTISEMENT

(Rev. 1/1/2012)

(TAX020 Form Inst.)

TAX020 FORM

EMPLOYER'S QUARTERLY UNEMPLOYMENT INSURANCE TAX REPORT

INSTRUCTIONS FOR 2012

LINE 1. Legal Entity Name - CHANGES or CORRECTIONS - It is important that any changes or error

corrections concerning your business be indicated in the space provided next to line 1. Please make

certain that the necessary corrections are made to avoid possible penalties that could arise from incor-

rect information. It is essential that we be advised of changes so that timely application can be made for

transfer of reduced rate to the new changed entity. Failure to apply for rate transfer within the ninety

days as prescribed by law may result in assignment of standard rate as a new employer.

LINE 2. Your report and payments must be submitted by this date to avoid late penalty.

LINE 3. Year and quarter wages were paid.

LINE 4. This is your tax rate. Contribution rate plus administrative reserve rate plus workforce development

rate. The contribution rate, administrative reserve rate, and workforce development rates are shown for

your information. Only the contribution rate should be used in reference to state experience rate or state

contributions when completing Form 940 or 940EZ for annual FUTA reporting [Ref. 72-1350(H)].

LINE 5. Enter all wages paid in covered employment this calendar quarter whether in money or in kind, such as

meals and lodging. (This total must equal the total of the individual wages listed on the employer's

Wage Report line 18). DO NOT include wages paid to employees who performed services that are

exempt under Idaho Employment Security Law. For example, the individual owner of a business

should not report his parents, spouse, or his children of less than 21 years of age , unless a corporation.

(Refer to the Employer Handbook for other specific exemptions.) Go to the Internet Address:

Unemployment Insurance” and click on the

Place curser over the bullet for “

line “UI Taxes”.

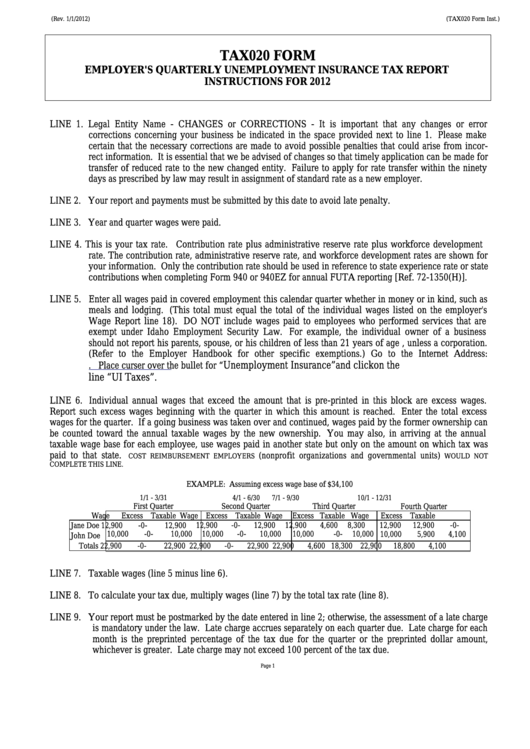

LINE 6. Individual annual wages that exceed the amount that is pre-printed in this block are excess wages.

Report such excess wages beginning with the quarter in which this amount is reached. Enter the total excess

wages for the quarter. If a going business was taken over and continued, wages paid by the former ownership can

be counted toward the annual taxable wages by the new ownership. You may also, in arriving at the annual

taxable wage base for each employee, use wages paid in another state but only on the amount on which tax was

paid to that state.

(nonprofit organizations and governmental units)

COST REIMBURSEMENT EMPLOYERS

WOULD NOT

COMPLETE THIS LINE.

EXAMPLE: Assuming excess wage base of $34,100

1/1 - 3/31

4/1 - 6/30

7/1 - 9/30

10/1 - 12/31

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Wage

Excess Taxable

Wage Excess Taxable

Wage

Excess Taxable Wage

Excess Taxable

Jane Doe 12,900

-0-

12,900

12,900

-0-

12,900

12,900

4,600

8,300

12,900

12,900

-0-

10,000

-0-

10,000

10,000

-0-

10,000

10,000

-0-

10,000

10,000

5,900

4,100

John Doe

Totals

22,900

-0-

22,900

22,900

-0-

22,900

22,900

4,600 18,300 22,900

18,800

4,100

LINE 7. Taxable wages (line 5 minus line 6).

LINE 8. To calculate your tax due, multiply wages (line 7) by the total tax rate (line 8).

LINE 9. Your report must be postmarked by the date entered in line 2; otherwise, the assessment of a late charge

is mandatory under the law. Late charge accrues separately on each quarter due. Late charge for each

month is the preprinted percentage of the tax due for the quarter or the preprinted dollar amount,

whichever is greater. Late charge may not exceed 100 percent of the tax due.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2