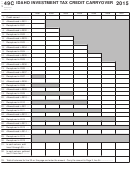

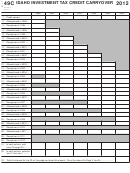

Instructions For Idaho Form 49c - Idaho Investment Tax Credit Carryover

ADVERTISEMENT

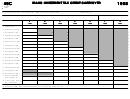

TC49C82

7-1-98

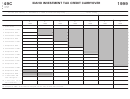

Instructions for Idaho Form 49C

Complete this form if an investment tax credit carryover

Replacement Property Acquired Before 1995

is included in the current year's available credit. Once

Carryovers of credit for property acquired prior to Janu-

the Form 49C is completed, the carryover will be carried

ary 1, 1995 may not include property acquired as re-

to Form 49.

placement property unless you replaced the property

solely due to technical obsolescence.

Carryover Period

Unused credit earned on investments made after 1989

Use of Other Schedules

may be carried forward up to seven years. If you have a

If this form does not allow you to properly reflect the

carryover of investment tax credit earned before 1992

application of carryovers and recapture, you may pro-

on property used both in and outside Idaho, the carryover

vide the information on a separate schedule.

must be recomputed using either the percentage-of-use

method or the property factor.

SPECIFIC INSTRUCTIONS

Conversion of a C Corporation to S Corporation

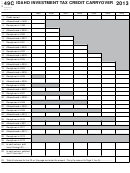

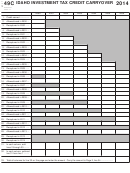

Lines 2, 4, 6, 8, 10, 12, and 14. For each year, enter

An investment tax credit carryover earned by a C corpo-

the amount of credit allowed against tax, the amount of

ration that has converted to an S corporation is allowed

credit you earned that was shared with another member

against the S corporation's tax on built-in gains, net capital

of the unitary group, and the amount of credit that passed

gains, and excess net passive income. The credit is not

through to an owner or beneficiary.

allowed against the tax paid by an S corporation for non-

resident shareholders. A separate Form 49C should be

used to account for this credit carryover.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1