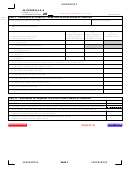

CURRENT YEAR PAYMENT RECORD

INCOME A

INCOME B

QTR. 1 $

QTR. 1 $

QTR. 2 $

QTR. 2 $

QTR. 3 $

QTR. 3 $

QTR. 4 $

QTR. 4 $

TOTAL

TOTAL

(ENTER ON LINE 9b)

(ENTER ON LINE 9b)

INSTRUCTIONS FOR FINAL RETURN FORM

LINE 11-13 - TAX PAYMENT Your remaining tax liability appears on Line 13 of the tax

return. If paying jointly, insert amount enclosed on Line 14. No payments under $1.00

Every resident who had taxable earned income or net profits during any part of the year

are required. NOTE: There will be a $30.00 charge for checks returned from the bank

must file a final tax return form. THIS RETURN MUST BE FILED EVEN IF TAX WAS

for any reason. For a receipt, enclose a stamped, self-addressed envelope. Please

FULLY WITHHELD BY YOUR EMPLOYER OR IF NO ADDITIONAL TAX IS DUE. Two-

Note: by submitting payment by check, you are authorizing our company to convert your

income households may file on the same form provided separate columns are

check into a one-time electronic debit from your account in the financial institution indicated

used. Merging of income/loss is not permitted.

on your check. If this option is exercised, the resulting electronic debit will be for the exact

amount of your check; no additional amount will be added to the check amount.

All returns must be postmarked or delivered on or before April 15 of the following tax

year to avoid penalty, interest and late charges.

PENALTY AND INTEREST CHARGES All returns filed after April 15 will be assessed

penalty and interest charges at the rate of 1% per month. Additional late fees, penalty

LINE 1 - TAXABLE EARNED INCOME AND COMPENSATION Earned Income shall be

and interest charges will be assessed for residents who have failed to file or make proper

determined by the Regulations set forth by the Pennsylvania Department of Revenue

tax payments. At least 85% of the earned income tax liability must have been met

relating to personal income tax. Please refer to Act 166 of 2002. Earned Income

through quarterly payments in order to avoid penalty and interest on unpaid taxes.

includes gross wages; salaries; commissions; bonuses; tips; fees; vacation pay; honoraria;

severance pay; incentive payments; supplemental wage plans; profit distributions; sick

NON-TAXABLE INCOME (DO NOT INCLUDE THESE ITEMS): personal interest and

pay (other than third party sick pay); housing allowance payments; taxes assumed by

dividend income; social security benefits; pensions; disability benefits; cafeteria plans;

the employer for the employee; exercised stock options from employers; employer-reim-

personal use of company auto; military pay; third party sick pay; parsonage housing

bursed moving expenses; deferred income for pensions and annuities; interest earned

allowance payments; lottery winnings; death benefit payments; gifts or bequests;

on premature 401(k) distributions; and other forms of compensation as provided by the

unemployment compensation; supplemental unemployment benefits (SUB); public

employer whether reported on W-2 statements or 1099 Forms.

assistance and income from stocks or trusts.

LINE 2 - DEDUCTIONS FOR UN-REIMBURSED BUSINESS EXPENSES ARE

PERMITTED AS FOLLOWS: business related auto expenses; union dues; professional

DOCUMENTATION Documentation of earnings (W-2 statements and Forms 4797 and/or

license fees; professional dues; small tools required for employment; and uniforms or

1099), net profits (Schedule C, E, F or K-1), and/or business expenses (Pennsylvania

work clothing not suitable for everyday use. Business expenses will not be

Department of Revenue Schedule UE, Federal Form 2106, and other federal and state

processed as a deduction without documentation. Attach PA Schedule UE Form

forms as applicable) must accompany tax returns. TAX RETURNS WITHOUT PROPER

and Federal Form 2106. Contributions to deferred income plans such as IRA’s,

DOCUMENTATION WILL BE CONSIDERED INCOMPLETE AND WILL NOT BE

401(k)’s, and Keoghs cannot be deducted from taxable income. PERSONAL

PROCESSED. REFUNDS OR CREDITS WILL NOT BE ISSUED WITHOUT PROPER

EXPENSES NOT DEDUCTIBLE.

DOCUMENTATION. Indicate the name of the taxing district receiving any money withheld

LINE 4 - OFFSETS AGAINST EARNED INCOME A business loss can be offset against

on withholding statement, or on an attached sheet of paper. Taxpayers must supply the

earned income/compensation but not against the profit earned in another business.

original document or a copy of the document - the tax office will not make copies or

A business profit cannot be offset by a business loss. Losses from Sub-Chapter S

return documents.

income cannot be offset against earned income. Do not include corporate income or

loss.

CREDIT FOR TAXES TO OTHER JURISDICTIONS Payments by residents of a tax on

income to Philadelphia, any state other than Pennsylvania with the exception of states

LINE 6 - TAXABLE NET PROFIT Net Profit shall be determined by the Regulations set

maintaining a reciprocal agreement with Pennsylvania, or any political subdivision locat-

forth by the Pennsylvania Department of Revenue relating to personal income tax.

ed outside Pennsylvania can be credited against this tax. The credit can not exceed

Please refer to Act 166 of 2002. Net Profit includes net profits from a business, profession

local tax rate and no refunds will be allowed on excess. Calculate credit on chart below

or farm; rental income unless reported as passive income to the Pennsylvania

for taxes paid to other states and supply copies of Pennsylvania and other state tax

Department of Revenue; royalties; patents and fees; and partnership or joint venture

income. In addition, taxable gains from the sale of business property shall be reported

returns.

for earned income tax purposes in the year of sale to the extent that they were created

CHECK NAME, ADDRESS, RESIDENT MUNICIPALITY, AND FILL IN SOCIAL

by depreciation deductions (tax benefit) previously deducted to determine net profits.

SECURITY NUMBER Your social security number is important for the prompt and accurate

Supporting documents shall include but not be limited to Federal Form 4797, Schedule

processing of this return. Make any corrections to the name, address, resident municipality,

C, D, E, F, K-1, and related schedules. Sub-Chapter S income will be taxed to the extent

that it represents income for services rendered to a corporation by a party to the extent

and complete social security number section on this return.

that a reasonable salary is not taken that is otherwise subject to the earned income tax.

SIGNATURE REQUIRED All returns must be signed and dated by the taxpayer(s)

Where shareholder provides services and does not receive a reasonable salary, distribution

only. Power of Attorney is required for second party signing. Improperly executed

of S-Corporation profit to that shareholder should be considered compensation for services

returns will be considered unfiled and delinquent.

rendered.

FAILURE TO RECEIVE A TAX RETURN DOES NOT RELIEVE THE TAXPAYER OF

LINE 9(c) - Any person subject to the City of Philadelphia income tax must identify the

amount of tax paid to the City of Philadelphia on Line 9(c). All income, as well as the name

THE RESPONSIBILITY OF FILING A TAX RETURN AND OF PAYING THE TAX.

and address of your employer, must be verified by W-2 or other schedule (Act 72 of 2004).

Failure to file, upon conviction, may result in a fine up to $500.00 per year, plus

penalty, interest, and costs of collection (Local Tax Enabling Act, P.L. 1257).

LINE 10 - OVERPAYMENT Your REFUND amount, if any, appears on Line 10 of the tax

return. OVERPAYMENTS will be credited to other tax liabilities, or refunded. No refunds

Thank you for submitting your payment to Central Tax Bureau of PA/Don Wilkinson

under $5.00 will be issued unless liability ceases this year or there are extenuating

Agency, Inc. By doing so, you are authorizing Central Tax Bureau of PA/Don Wilkinson

circumstances. Amounts under $5.00 will be credited to the next tax year.

Agency, Inc., to convert your check into a one-time electronic debit from your account at

the financial institution indicated on your check. This electronic debit will be for the amount

of your check; no additional amount will be added to the check amount.

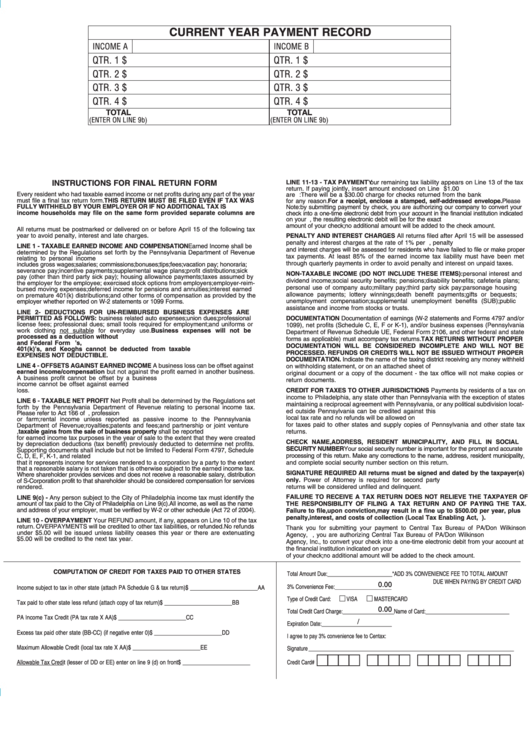

COMPUTATION OF CREDIT FOR TAXES PAID TO OTHER STATES

Total Amount Due: ________________________

*ADD 3% CONVENIENCE FEE TO TOTAL AMOUNT

DUE WHEN PAYING BY CREDIT CARD

0.00

3% Convenience Fee: _____________________

Income subject to tax in other state (attach PA Schedule G & tax return)

$ _______________________ AA

Type of Credit Card:

b

VISA

b

MASTERCARD

Tax paid to other state less refund (attach copy of tax return)

$ _______________________ BB

0.00

Total Credit Card Charge:___________________ Name of Card: _______________________________

PA Income Tax Credit (PA tax rate X AA)

$ _______________________CC

/

Expiration Date: __________________________

Excess tax paid other state (BB-CC) (if negative enter 0)

$ _______________________DD

I agree to pay 3% convenience fee to Centax:

Maximum Allowable Credit (local tax rate X AA)

$ _______________________ EE

Signature ____________________________________________________________________________

bbbb bbbb bbbb bbbb

Allowable Tax Credit (lesser of DD or EE) enter on line 9 (d) on front

$ _______________________

Credit Card#

1

1