Form 720s - Kentucky S Corporation Income And License Tax Return - 2004

ADVERTISEMENT

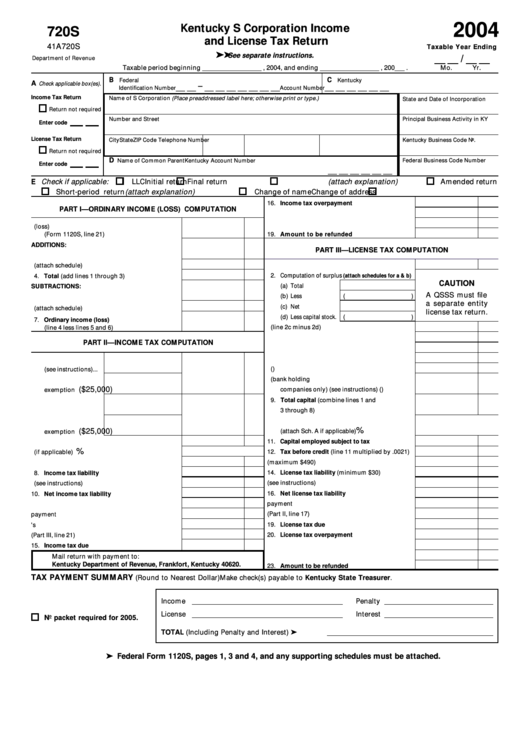

2004

Kentucky S Corporation Income

720S

and License Tax Return

41A720S

Taxable Year Ending

See separate instructions.

__ __ / __ __

Department of Revenue

Taxable period beginning __________________ , 2004, and ending __________________ , 200___ .

Mo.

Yr.

B

C

Federal

Kentucky

A

Check applicable box(es).

__ __ – __ __ __ __ __ __ __

__ __ __ __ __ __

Identification Number

Account Number

Income Tax Return

Name of S Corporation (Place preaddressed label here; otherwise print or type.)

State and Date of Incorporation

Return not required

Number and Street

Principal Business Activity in KY

Enter code

License Tax Return

City

State

ZIP Code

Telephone Number

Kentucky Business Code No.

Return not required

D

Name of Common Parent

Kentucky Account Number

Federal Business Code Number

Enter code

__ __ __ __ __ __

E Check if applicable:

Final return (attach explanation)

LLC

Initial return

Amended return

Short-period return (attach explanation)

Change of name

Change of address

16. Income tax overpayment .................................

PART I—ORDINARY INCOME (LOSS) COMPUTATION

17. Credited to 2004 license tax .............................

18. Credited to 2005 ................................................

1. Federal ordinary income (loss)

(Form 1120S, line 21) ...........................................

19. Amount to be refunded .................................

ADDITIONS:

PART III—LICENSE TAX COMPUTATION

2. State taxes ............................................................

1. Capital stock .......................................................

3. Other (attach schedule) .......................................

4. Total (add lines 1 through 3) ..............................

2. Computation of surplus

(attach schedules for a & b)

CAUTION

(a) Total assets ..........

SUBTRACTIONS:

A QSSS must file

(b) Less debt .............. (

)

5. Federal work opportunity credit .........................

a separate entity

(c) Net assets .............

6. Other (attach schedule) .......................................

license tax return.

(d) Less capital stock . (

)

7. Ordinary income (loss)

3. Surplus (line 2c minus 2d) ...............................

(line 4 less lines 5 and 6) .....................................

4. Advances by affiliated companies ....................

PART II—INCOME TAX COMPUTATION

5. Intercompany accounts .....................................

6. Borrowed moneys .............................................

1. Taxable income

7. Less moneys borrowed for inventory ..............

(

)

(see instructions) ...

8. Less KRS 136.071 deduction (bank holding

2. Less statutory

($25,000)

companies only) (see instructions) ..................

(

)

exemption ..............

9. Total capital (combine lines 1 and

3 through 8) ........................................................

3. Net capital gain ......

10. Apportionment fraction

4. Less statutory

%

($25,000)

(attach Sch. A if applicable) ................................

exemption ..............

5. Enter lesser of line 2 or line 4 .............................

11. Capital employed subject to tax ........................

%

12. Tax before credit (line 11 multiplied by .0021)

6. Apportionment fraction (if applicable) ...............

13. License tax credit (maximum $490) .................

7. Taxable income ...................................................

14. License tax liability (minimum $30) .................

8. Income tax liability ..............................................

9. Enterprise zone tax credit (see instructions) .....

15. KIRA tax credit (see instructions) .....................

16. Net license tax liability ......................................

10. Net income tax liability .......................................

17. Extension payment ............................................

11. Estimated payments ............................................

18. Income tax overpayment (Part II, line 17) ........

12. Extension payment ..............................................

13. Prior year's credit ................................................

19. License tax due ..................................................

20. License tax overpayment ..................................

14. License tax overpayment (Part III, line 21) .........

21. Credited to 2004 income tax .............................

15. Income tax due ....................................................

22. Credited to 2005 .................................................

Mail return with payment to:

Kentucky Department of Revenue, Frankfort, Kentucky 40620.

23. Amount to be refunded ....................................

TAX PAYMENT SUMMARY

(Round to Nearest Dollar) Make check(s) payable to Kentucky State Treasurer.

Income

Penalty

License

Interest

No packet required for 2005.

TOTAL (Including Penalty and Interest) ..............

Federal Form 1120S, pages 1, 3 and 4, and any supporting schedules must be attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3