Form 720s - Kentucky S Corporation Income And License Tax Return - 2003

ADVERTISEMENT

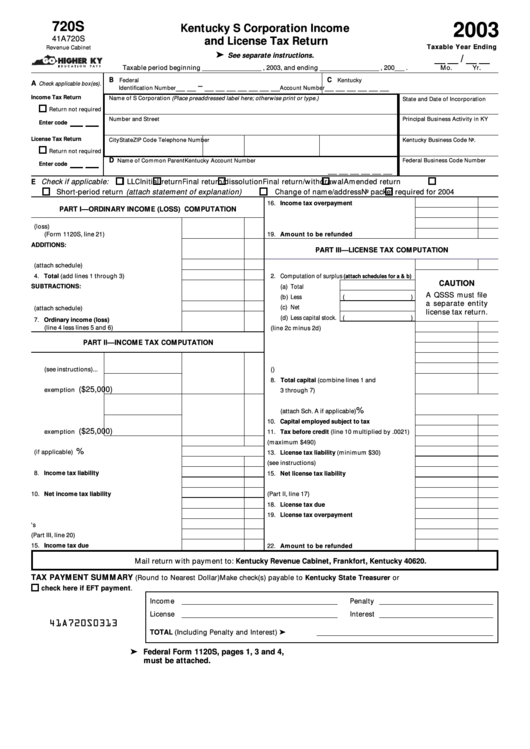

720S

2003

Kentucky S Corporation Income

41A720S

and License Tax Return

ä

Taxable Year Ending

Revenue Cabinet

See separate instructions.

__ __ / __ __

Taxable period beginning __________________ , 2003, and ending __________________ , 200___ .

Mo.

Yr.

B

C

Federal

Kentucky

A

Check applicable box(es).

__ __ – __ __ __ __ __ __ __

__ __ __ __ __ __

Identification Number

Account Number

Income Tax Return

Name of S Corporation (Place preaddressed label here; otherwise print or type.)

State and Date of Incorporation

Return not required

Number and Street

Principal Business Activity in KY

Enter code

License Tax Return

City

State

ZIP Code

Telephone Number

Kentucky Business Code No.

Return not required

D

Name of Common Parent

Kentucky Account Number

Federal Business Code Number

Enter code

__ __ __ __ __ __

E Check if applicable:

LLC

Initial return

Final return/dissolution

Final return/withdrawal

Amended return

Short-period return (attach statement of explanation)

Change of name/address

No packet required for 2004

16. Income tax overpayment .................................

PART I—ORDINARY INCOME (LOSS) COMPUTATION

17. Credited to 2003 license tax .............................

18. Credited to 2004 ................................................

1. Federal ordinary income (loss)

(Form 1120S, line 21) ...........................................

19. Amount to be refunded .................................

ADDITIONS:

PART III—LICENSE TAX COMPUTATION

2. State taxes ............................................................

3. Other (attach schedule) .......................................

1. Capital stock .......................................................

4. Total (add lines 1 through 3) ..............................

2. Computation of surplus

(attach schedules for a & b)

CAUTION

SUBTRACTIONS:

(a) Total assets ..........

A QSSS must file

5. Federal work opportunity credit .........................

(b) Less debt .............. (

)

a separate entity

(c) Net assets .............

6. Other (attach schedule) .......................................

license tax return.

(d) Less capital stock . (

)

7. Ordinary income (loss)

(line 4 less lines 5 and 6) .....................................

3. Surplus (line 2c minus 2d) ...............................

4. Advances by affiliated companies ....................

PART II—INCOME TAX COMPUTATION

5. Intercompany accounts .....................................

6. Borrowed moneys .............................................

1. Taxable income

(see instructions) ...

7. Less moneys borrowed for inventory ..............

(

)

8. Total capital (combine lines 1 and

2. Less statutory

($25,000)

exemption ..............

3 through 7) ........................................................

9. Apportionment fraction

%

3. Net capital gain ......

(attach Sch. A if applicable) ................................

10. Capital employed subject to tax ........................

4. Less statutory

($25,000)

exemption ..............

11. Tax before credit (line 10 multiplied by .0021)

5. Enter lesser of line 2 or line 4 .............................

12. License tax credit (maximum $490) .................

%

6. Apportionment fraction (if applicable) ...............

13. License tax liability (minimum $30) .................

7. Taxable income ...................................................

14. KIRA tax credit (see instructions) .....................

8. Income tax liability ..............................................

15. Net license tax liability ......................................

9. Enterprise zone tax credit ...................................

16. Extension payment ............................................

10. Net income tax liability .......................................

17. Income tax overpayment (Part II, line 17) ........

11. Estimated payments ............................................

18. License tax due ..................................................

12. Extension payment ..............................................

19. License tax overpayment ..................................

13. Prior year's credit ................................................

20. Credited to 2003 income tax .............................

14. License tax overpayment (Part III, line 20) .........

21. Credited to 2004 .................................................

15. Income tax due ....................................................

22. Amount to be refunded ..................................

Mail return with payment to: Kentucky Revenue Cabinet, Frankfort, Kentucky 40620.

TAX PAYMENT SUMMARY

(Round to Nearest Dollar) Make check(s) payable to Kentucky State Treasurer or

check here if EFT payment.

Income

Penalty

License

Interest

TOTAL (Including Penalty and Interest) ..............

Federal Form 1120S, pages 1, 3 and 4,

must be attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3