160008BC

Alabama Department of Revenue

Business Credits

2

PAGE

ALABAMA SCHEDULE BC – 2016

ATTACH TO FORM 20C

NAME(S) AS SHOWN ON FORM 20C

FEDERAL EMPLOYER IDENTIFICATION NUMBER

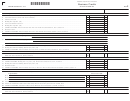

Part I — Irrigation/Reservoir System Credit

•

I1

Purchase cost and installation costs of irrigation system. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I1

•

I2

Conversion costs to convert from fuel to electricity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I2

•

I3

Add lines I1 and I2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I3

•

I4

Multiply line I3 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I4

•

I5

Cost of construction reservoir . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I5

•

I6

Multiply line I5 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I6

•

I7

CREDIT AVAILABLE. Enter the amount from line I4 or line I6 here and Section C, Part I, Column 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I7

$10,000 00

I8

Maximum credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I8

•

I9

CREDIT ALLOWABLE. Enter the lesser of line I7 or line I8. Enter here and on Section C, Part I, Column 3 . . . . . . . . . . . . . . . . . . . . . . . . . .

I9

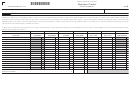

Part J — Alabama Accountability Tax Credit

J1

Name of Scholarship Granting Organization:

J2

Address of Scholarship Granting Organization:

•

J3

CREDIT AVAILABLE. Enter the amount contributed for scholarship(s) here and Section C, Part J, Column 2 . . . . . . . . . . . . . . . . . . . . . . . . .

J3

•

J4

Multiply the current tax liability (Section A) by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

J4

•

J5

CREDIT ALLOWABLE. Enter the lesser of line J3 or line J4. Enter here and on Section C, Part J, Column 3 . . . . . . . . . . . . . . . . . . . . . . . . .

J5

Part K — Rehabilitation, Preservation and Development of Historic Structures Credit

K1 CREDIT ALLOWABLE. Enter the amount from the Alabama Historic Commission Tax Credit Certificate.

•

Enter here and on Section C, Part K, Column 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

K1

Part L — Dual Enrollment Credit

•

L1

Enter amount from the Department of Postsecondary Education Tax Certificate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L1

•

L2

CREDIT AVAILABLE. Multiply line L1 by 50% (.50). Enter here and Section C, Part L, Column 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L2

•

L3

Multiply the current tax liability (Section A) by 50% (.50) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L3

$500,000 00

L4

Maximum Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L4

•

L5

CREDIT ALLOWABLE. Enter the lesser of line L2, or line L3 or line L4. Enter here and on Section C, Part L, Column 3 . . . . . . . . . . . . . . .

L5

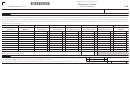

Part M — Alabama Jobs Act – Investment Credit

M1 Enter the information requested for each project.

Project Name:

Amount of Credit:

•

•

M1a.

M1a

•

•

M1b.

M1b

•

•

M1c.

M1c

•

M2 Total Alabama Jobs Act Investment Credits. Enter the sum of all project credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M2

•

M3 Amount of Investment Credit used to offset utility taxes in the current year from Form UT-INV, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M3

•

M4 CREDIT ALLOWABLE. Subtract line M3 from line M2. Enter here and Section C, Part M, Column 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M4

Part N — Port Credit

N1 CREDIT ALLOWABLE. Enter the amount approved by the Alabama Renewal Commission.

•

Enter here and on Section C, Part N, Column 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

N1

1

1 2

2 3

3 4

4 5

5