160010BC

Alabama Department of Revenue

Business Credits

4

PAGE

ALABAMA SCHEDULE BC – 2016

ATTACH TO FORM 20C

NAME(S) AS SHOWN ON FORM 20C

FEDERAL EMPLOYER IDENTIFICATION NUMBER

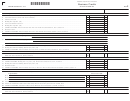

SECTION C

Current Credit Summary

Enter the Current Tax Period Liability due on Part A, Column 4 of the Current Credit Summary. To calculate the Current Credit Summary, repeat the steps that follow for each row: In Column 2, enter the Credit

Available from Section B for the applicable credits. In Column 3, enter the Credit Allowable from Section B. Subtract the Credit Allowable from the Remaining Tax to be Offset. If the Credit Allowable is greater than

the Remaining Tax to be Offset, enter the amount from Column 4 in Column 5 and the excess amount of the Credit Allowable in Column 7. If the Remaining Tax to be Offset is greater than Column 3, enter the Credit

Allowable (Column 3) in Column 5 and enter the difference of Column 4 and Column 5 in Column 6 and proceed to the next available credit. For the remaining rows, use the preceding Tax Remaining after Credit

from Column 6 as the Remaining Tax to be Offset in Column 4.

To compute the Credit Carryforward (Column 8) in the Current Credit Summary, for each credit listed, subtract any Credit Allowable (Column 3) from the Credit Available (Column 2) and add the difference to the

Excess Credit Allowable from Column 7.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Remaining Tax

Tax Remaining after Credit

Excess Credit Allowable

Type of Credit

Credit Available

Credit Allowable

to be Offset

Amount Utilized

(Col. 4 – Col. 5)

(Col. 3 – Col. 5)

Credit Carryforward

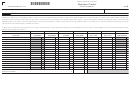

•

Part A

Alabama Enterprise Zone

•

Part B

Basic Skills Education

•

Part C

Income Tax Credit

•

Part D

Coal Credit

•

Part E

Full Employment Act

•

Part F

Alabama New Markets Development

•

Part G

Heroes for Hire – Employee Credit

•

Part H

Heroes for Hire – Start-up Expenses

•

Part I

Irrigation/Reservoir

•

Part J

Alabama Accountability Act

•

Part K

Rehabilitation, Preservation and Development

•

Part L

Dual Enrollment

•

Part M

Alabama Jobs Act – Investment Credit

•

Part N

Port Credit

•

Part O

Growing Alabama Credit

•

Part P

Capital Credit

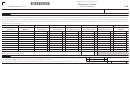

•

Total Current Credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3 4

4 5

5