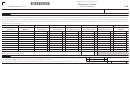

160011BC

Alabama Department of Revenue

Business Credits

5

PAGE

ALABAMA SCHEDULE BC – 2016

ATTACH TO FORM 20C

NAME(S) AS SHOWN ON FORM 20C

FEDERAL EMPLOYER IDENTIFICATION NUMBER

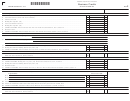

SECTION D

Credit Carry Forward Prior Years

For each carryforward available for utilization listed below, repeat the steps that follow: Subtract the Remaining Tax to be Offset (Section C, Part P, Column 6) from the Amount Available to use this Period (Section

D, Column 5). If the Remaining Tax to be Offset is less than or equal to the Amount Available to use this Period, enter the Remaining Tax to be Offset in Column 6 and enter the excess of the Amount Available to

use this Period in Column 7. If the Remaining Tax to be Offset is greater than Section D, Column 5, enter the Amount Available to use this Period in Column 6 and enter the difference of the Remaining Tax to be

Offset and the Amount used this Period in Column 8, then proceed to the next available prior year credit. For the remaining rows, the Amount used this Period in Column 6 is limited to the Remaining Tax to be Offset

in Column 8 of the preceding row.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Column 7

Column 8

Year Carryforward Generated

Amount used in years

Amount available to use

Remaining unused Credit

Remaining Tax

Type of Credit

MM/DD/YYYY

Amount of Credit

prior to this Period

this Period (Col. 3 – Col. 4)

Amount used this Period

Carryforward (Col. 5 – Col. 6)

to be Offset

•

1.

•

2.

•

3.

•

4.

•

5.

•

6.

•

7.

•

8.

•

9.

•

10.

•

Total Prior Year Credit Carryfoward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

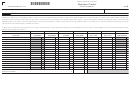

SECTION E

TOTAL CREDITS

•

E1 Current Year Credits. Total Current Credits, Section C, Column 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E1

•

E2 Prior Year Credits. Total Prior Year Credit Carry Forward, Section D, Column 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E2

•

E3 Total Credits Utilized in the Current Period. Add lines E1 and E2. Enter the results here and on Form 20C, page 1, line 16f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E3

1

1 2

2 3

3 4

4 5

5