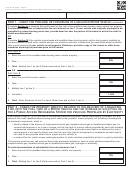

2013 Form 567A - Page 3

Credit for Investment in Clean-Burning Motor Vehicle Fuel Property

Name as Shown on Return

Social Security Number or Federal Employer Identification Number

Part 3 - Credit for a Natural Gas Refueling Station in a Private Residence

A per-location credit equal to the lesser of $2,500 or 50% of the cost of property which is directly related to the com-

pression and delivery of natural gas from a private home or residence, for noncommercial purposes, into the fuel tank

of a motor vehicle propelled by compressed natural gas is allowed. The property must be new and must not have

been previously installed or used to refuel vehicles powered by natural gas.

If the credit is being claimed for more than one location, complete a separate Form 567-A for each location. But fill in

the “Part 4” on only one Form 567-A. The figures in Part 4 should be the combined totals for all credits reported on

your Forms 567-A.

Provide documentation to substantiate the cost entered on line 1.

$

1. Enter the cost of the qualified clean-burning motor vehicle fuel property ..........................

50%

2. Rate ...................................................................................................................................

$

3. Multiply line 1 by line 2 .......................................................................................................

$2,500

4. Limitation ............................................................................................................................

5. Total - Enter the lesser of line 3 or line 4 (Enter here and on Part 4, line 3) .....................

$

Part 4 - Total Credit Available

If you completed multiple Forms 567-A; enter the total from all such forms on the applicable line.

$

1. Credit from Part 1 ...............................................................................................................

$

2. Credit from Part 2 ...............................................................................................................

$

3. Credit from Part 3 ...............................................................................................................

$

4. Total - Credit for Investment in Clean-Burning Motor Vehicle Fuel Property .............

(Add lines 1, 2 and 3; enter here and on Form 511CR, line 3a)

Any credit allowed but not used will have a five-year carryover provision.

General Information and Definitions

68 Oklahoma Statutes (OS) Sec. 2357.22 and Rule 710:50-15-81

The term “motor vehicle”, for purposes of the clean-burning motor fuel property credit, does include forklifts and other similar self-pro-

pelled vehicles. “Vehicle” does not mean conveyor belts or other similar items.

An entity that converts property to qualified clean-burning motor vehicle property may lease such property and retain the right to claim

the credit.

Only conversions to those fuels listed on this form as “qualified clean-burning fuel” qualify for this credit. The conversion of a vehicle to

be propelled by any other fuel, such as to ethanol or E-85, does not qualify.

Property on which the credit has previously been claimed is ineligible for the credit.

A husband and wife who file separate returns for a taxable year in which they could have filed a joint return may each claim only 1/2 of

the tax credit that would have been allowed for a joint return.

“Motor vehicle” means a motor vehicle originally designed by the manufacturer to operate lawfully and principally on streets and high-

ways.

The five year carryover provision for any credit allowed but not used is for credits established in tax year 2010 and thereafter.

Notice

Tax credits transferred or allocated must be reported on Oklahoma Tax Commission (OTC) Form 569. Failure to file Form 569 will result

in the affected credits being denied by the OTC pursuant to 68 OS Sec. 2357.1A-2.

1

1 2

2 3

3