Reset Form

Print Form

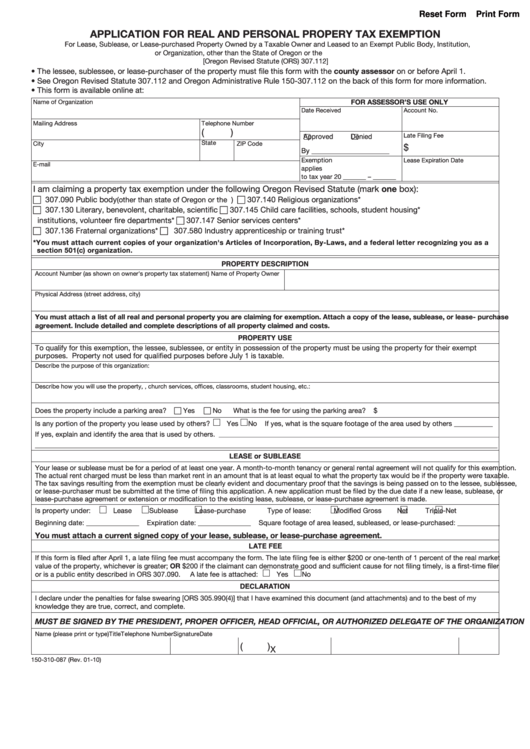

APPLICATION FOR REAL AND PERSONAL PROPERY TAX EXEMPTION

For Lease, Sublease, or Lease-purchased Property Owned by a Taxable Owner and Leased to an Exempt Public Body, Institution,

or Organization, other than the State of Oregon or the U.S. Government

[Oregon Revised Statute (ORS) 307.112]

• The lessee, sublessee, or lease-purchaser of the property must file this form with the county assessor on or before April 1.

• See Oregon Revised Statute 307.112 and Oregon Administrative Rule 150-307.112 on the back of this form for more information.

• This form is available online at:

Name of Organization

FOR ASSESSOR’S USE ONLY

Date Received

Account No.

Mailing Address

Telephone Number

(

)

Approved

Denied

Late Filing Fee

State

City

ZIP Code

$

By ____________________

Exemption

Lease Expiration Date

E-mail

applies

to tax year 20 _______ – _______

I am claiming a property tax exemption under the following Oregon Revised Statute (mark one box):

c 307.090 Public body

c 307.140 Religious organizations*

(other than state of Oregon or the U.S. government)

c 307.130 Literary, benevolent, charitable, scientific

c 307.145 Child care facilities, schools, student housing*

institutions, volunteer fire departments*

c 307.147 Senior services centers*

c 307.136 Fraternal organizations*

c 307.580 Industry apprenticeship or training trust*

*You must attach current copies of your organization's Articles of Incorporation, By-Laws, and a federal letter recognizing you as a

section 501(c) organization.

PROPERTY DESCRIPTION

Account Number (as shown on owner's property tax statement)

Name of Property Owner

Physical Address (street address, city)

You must attach a list of all real and personal property you are claiming for exemption. Attach a copy of the lease, sublease, or lease- purchase

agreement. Include detailed and complete descriptions of all property claimed and costs.

PROPERTY USE

To qualify for this exemption, the lessee, sublessee, or entity in possession of the property must be using the property for their exempt

purposes. Property not used for qualified purposes before July 1 is taxable.

Describe the purpose of this organization:

Describe how you will use the property, e.g., church services, offices, classrooms, student housing, etc.:

Does the property include a parking area? c Yes c No What is the fee for using the parking area? $

Is any portion of the property you lease used by others?

Yes

No

If yes, what is the square footage of the area used by others ___________

If yes, explain and identify the area that is used by others.

____________________________________________________________________________________________

________________________________________________________________________________________________________________________________________________________

LEASE or SUBLEASE

Your lease or sublease must be for a period of at least one year. A month-to-month tenancy or general rental agreement will not qualify for this exemption.

The actual rent charged must be less than market rent in an amount that is at least equal to what the property tax would be if the property were taxable.

The tax savings resulting from the exemption must be clearly evident and documentary proof that the savings is being passed on to the lessee, sublessee,

or lease-purchaser must be submitted at the time of filing this application. A new application must be filed by the due date if a new lease, sublease, or

lease-purchase agreement or extension or modification to the existing lease, sublease, or lease-purchase agreement is made.

Is property under:

Lease

Sublease

Lease-purchase Type of lease:

Modified Gross

Net

Triple-Net

Beginning date: _______________ Expiration date: _______________ Square footage of area leased, subleased, or lease-purchased: ____________

You must attach a current signed copy of your lease, sublease, or lease-purchase agreement.

LATE FEE

If this form is filed after April 1, a late filing fee must accompany the form. The late filing fee is either $200 or one-tenth of 1 percent of the real market

value of the property, whichever is greater; OR $200 if the claimant can demonstrate good and sufficient cause for not filing timely, is a first-time filer

or is a public entity described in ORS 307.090. A late fee is attached:

Yes

No

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document (and attachments) and to the best of my

knowledge they are true, correct, and complete.

MUST BE SIGNED BY THE PRESIDENT, PROPER OFFICER, HEAD OFFICIAL, OR AUTHORIZED DELEGATE OF THE ORGANIZATION

Name (please print or type)

Title

Telephone Number

Signature

Date

(

)

X

150-310-087 (Rev. 01-10)

1

1 2

2