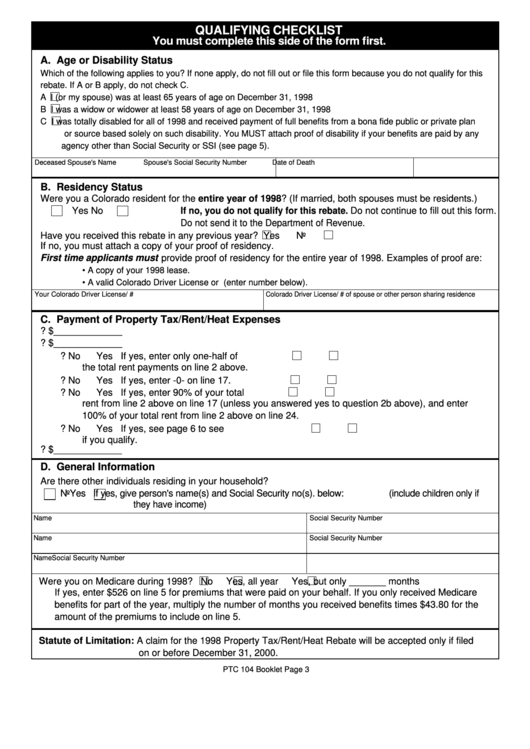

QUALIFYING CHECKLIST

You must complete this side of the form first.

A. Age or Disability Status

Which of the following applies to you? If none apply, do not fill out or file this form because you do not qualify for this

rebate. If A or B apply, do not check C.

A

I (or my spouse) was at least 65 years of age on December 31, 1998

B

I was a widow or widower at least 58 years of age on December 31, 1998

C

I was totally disabled for all of 1998 and received payment of full benefits from a bona fide public or private plan

or source based solely on such disability. You MUST attach proof of disability if your benefits are paid by any

agency other than Social Security or SSI (see page 5).

Deceased Spouse's Name

Spouse's Social Security Number

Date of Death

B. Residency Status

Were you a Colorado resident for the entire year of 1998? (If married, both spouses must be residents.)

Yes

No

If no, you do not qualify for this rebate. Do not continue to fill out this form.

Do not send it to the Department of Revenue.

Have you received this rebate in any previous year?

Yes

No

If no, you must attach a copy of your proof of residency.

First time applicants must provide proof of residency for the entire year of 1998. Examples of proof are:

• A copy of your 1998 lease.

• A valid Colorado Driver License or I.D. for all of 1998 (enter number below).

Your Colorado Driver License/I.D.#

Colorado Driver License/I.D.# of spouse or other person sharing residence

C. Payment of Property Tax/Rent/Heat Expenses

1. What were the 1997 property taxes you paid in 1998? $_____________

2. What were the total rent payments you paid for your house/apartment in 1998? $_____________

2a. Are your meals included in your rent payments ?

No

Yes If yes, enter only one-half of

the total rent payments on line 2 above.

2b. Did you pay rent for a property tax exempt unit?

No

Yes If yes, enter -0- on line 17.

2c. Was your heat included in your rent payments?

No

Yes If yes, enter 90% of your total

rent from line 2 above on line 17 (unless you answered yes to question 2b above), and enter

100% of your total rent from line 2 above on line 24.

2d. Were you a resident in a nursing home during 1998?

No

Yes If yes, see page 6 to see

if you qualify.

3. How much did you pay for your heat or fuel bills in 1998? $_____________

D. General Information

Are there other individuals residing in your household?

No

Yes If yes, give person's name(s) and Social Security no(s). below: (include children only if

they have income)

Name

Social Security Number

Name

Social Security Number

Name

Social Security Number

Were you on Medicare during 1998?

No

Yes, all year

Yes, but only _______ months

If yes, enter $526 on line 5 for premiums that were paid on your behalf. If you only received Medicare

benefits for part of the year, multiply the number of months you received benefits times $43.80 for the

amount of the premiums to include on line 5.

Statute of Limitation: A claim for the 1998 Property Tax/Rent/Heat Rebate will be accepted only if filed

on or before December 31, 2000.

PTC 104 Booklet Page 3

1

1 2

2