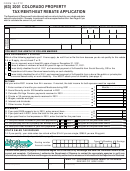

FORM 104 PTC

(63)

1998 COLORADO PROPERTY

TAX/RENT/HEAT REBATE

I was disabled for all of 1998.

My disability payments are paid by Social Security or SSI

FIRST NAME & MIDDLE INITIAL

LAST NAME

DATE OF BIRTH

SOCIAL SECURITY NUMBER

Month Day Year

Yourself

Your spouse

Phone

Address

(

)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

State

ZIP

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

City

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

YOU MUST COMPLETE THE REVERSE SIDE OF THIS FORM BEFORE CALCULATING YOUR REBATE BELOW.

THIS FORM MUST BE JOINTLY COMPLETED FOR A MARRIED COUPLE.

COMPUTATION OF THE PROPERTY TAX OR RENT CREDIT

INCOME SCHEDULE - List your entire 1998 income

Do not complete this section if the property is tax exempt.

from all sources. If married, the total income of both

$500

.00

13

Maximum credit allowable.

spouses must be reported.

.00

14

Enter 20% of line 12.

ROUND TO NEAREST DOLLAR. (Drop amounts under

Your property tax/rent credit lim-

49 cents and increase amounts from 50 to 99 cents.)

15

itation, subtract line 14 from line 13.

.00

•

Salaries, wages, tips and other

Enter amount of 1997 property

1

.00

16

employee compensation

•

tax you paid in 1998, if any.

.00

•

Total interest and dividend

Enter the rent, if any, you paid

2

.00

17

•

income from all sources

in 1998 for your living quarters.

.00

Business income including farm

Enter the amount on line 16 and/

18

income, rents, and royalties-

.00

or 20% of the amount on line 17.

attach federal schedule.

•

3

19

Enter the smaller of line 15 or line 18.

.00

(Be sure to include rental pay-

COMPUTATION OF THE HEAT OR FUEL EXPENSE CREDIT

ments received from person(s)

.00

20 Maximum credit allowable

sharing your residence.)

$160

.00

Social security and/or SSI ben-

21

Enter 6.4% of line 12.

.00

•

4

.00

efits received in 1998

Your heat or fuel credit limitation,

22

subtract line 21 from line 20.

Medicare premiums paid in

.00

•

5

.00

1998

Enter amount of heat or fuel ex-

23

•

pense you paid during 1998, if any.

Colorado Old Age Pension pay-

.00

•

6

.00

ments received in 1998

Enter the rent, if any, you paid

•

during 1998 for your living

24

Private pensions and annuities

7

•

quarters.

.00

received in 1998

.00

If you pay your own heat, enter

•

VA pension received in 1998

8

.00

25

the amount from line 23. Other-

Other income - see page 6 for

wise, enter 10% of line 24.

.00

9

reportable and non-reportable

•

Enter the smaller of line 22 or

income.

.00

26

line 25.

.00

Total income: add lines 1 through 9.

10

REBATE

.00

n

Add lines 19 & 26.

Single persons enter $5,000

n

27

11

n

.00

This is your REBATE.

.00

Married couples enter $8,700

Claim your sales tax refund here if you

Subtract line 11 from line 10. If 11

•

28

were 19 or older on Dec. 31, 1998.

12

is larger, enter 0. Do not enter less

.00

Single enter $142. Joint enter $284

.00

than zero.

Add lines 27 and 28. This is your

29

n

.00

total refund.

I declare under penalty of perjury in the second degree that to the best of my knowledge and belief the information herein is true,

correct and complete. Furthermore, I authorize the Department of Revenue to contact the appropriate agencies to verify any

information provided on this form and the agencies are hereby authorized to release such information to the Department of Revenue.

Your Signature

Date

MAIL TO: COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0005

Spouse's Signature

Date

Prepared by

NOTE: Please allow 12 weeks for processing. Rebate inquiries will not be accepted before then.

PTC 104 Booklet Page 4

1

1 2

2