Annualized Income Installment Worksheet For Underpayment Of Estimated Tax

ADVERTISEMENT

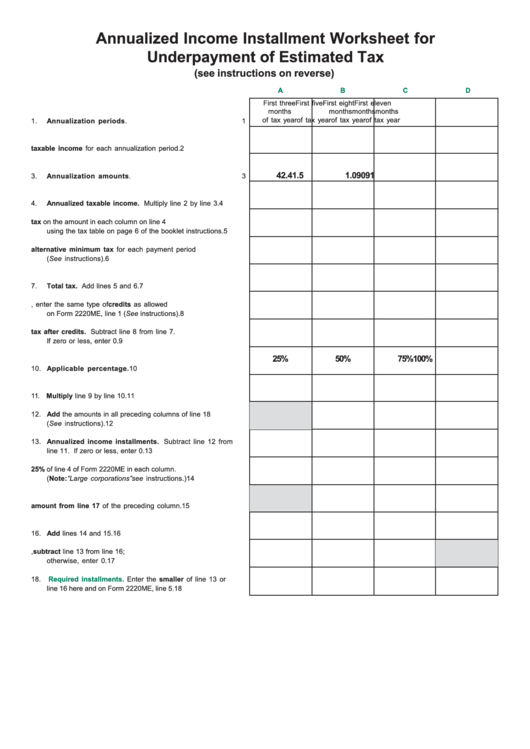

Annualized Income Installment Worksheet for

Underpayment of Estimated Tax

(see instructions on reverse)

A

B

C

D

First three

First five

First eight

First eleven

months

months

months

months

of tax year

of tax year

of tax year

of tax year

1.

Annualization periods.

1

2.

Enter taxable income for each annualization period.

2

4

2.4

1.5

1.09091

3.

Annualization amounts.

3

4.

Annualized taxable income. Multiply line 2 by line 3.

4

5.

Calculate the tax on the amount in each column on line 4

using the tax table on page 6 of the booklet instructions.

5

6.

Enter alternative minimum tax for each payment period

(See instructions).

6

7.

Total tax. Add lines 5 and 6.

7

8.

For each period, enter the same type of credits as allowed

on Form 2220ME, line 1 (See instructions).

8

9.

Total tax after credits. Subtract line 8 from line 7.

If zero or less, enter 0.

9

25%

50%

75%

100%

10. Applicable percentage.

10

11. Multiply line 9 by line 10.

11

12. Add the amounts in all preceding columns of line 18

(See instructions).

12

13. Annualized income installments. Subtract line 12 from

line 11. If zero or less, enter 0.

13

14. Enter 25% of line 4 of Form 2220ME in each column.

(Note: “Large corporations” see instructions.)

14

15. Enter the amount from line 17 of the preceding column.

15

16. Add lines 14 and 15.

16

17. If line 16 is more than line 13, subtract line 13 from line 16;

otherwise, enter 0.

17

18.

Required installments.

Enter the smaller of line 13 or

line 16 here and on Form 2220ME, line 5.

18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3