Click Here to Print Document

CLICK HERE TO CLEAR FORM

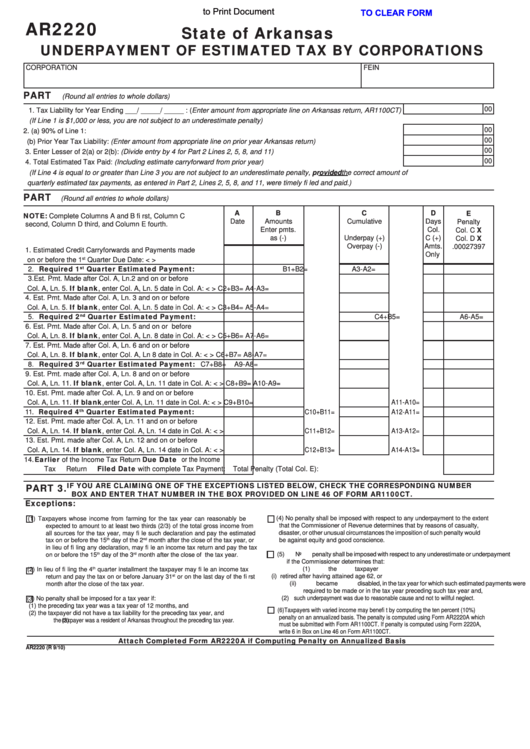

AR2220

State of Arkansas

UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS

CORPORATION

FEIN

PART 1.DETERMINING TAX AMOUNT REQUIRED TO BE ESTIMATED

(Round all entries to whole dollars)

00

1. Tax Liability for Year Ending ___ / _____ / _____ : (Enter amount from appropriate line on Arkansas return, AR1100CT)

(If Line 1 is $1,000 or less, you are not subject to an underestimate penalty)

00

2. (a) 90% of Line 1: ..............................................................................................................................................................

00

(b) Prior Year Tax Liability: (Enter amount from appropriate line on prior year Arkansas return) ......................................

00

3. Enter Lesser of 2(a) or 2(b): (Divide entry by 4 for Part 2 Lines 2, 5, 8, and 11) ...............................................................

00

4. Total Estimated Tax Paid: (Including estimate carryforward from prior year) ....................................................................

(If Line 4 is equal to or greater than Line 3 you are not subject to an underestimate penalty, provided the correct amount of

quarterly estimated tax payments, as entered in Part 2, Lines 2, 5, 8, and 11, were timely fi led and paid.)

PART 2.COMPUTATION OF UNDERESTIMATED PENALTY

(Round all entries to whole dollars)

A

B

C

D

E

NOTE: Complete Columns A and B fi rst, Column C

Date

Amounts

Cumulative

Days

Penalty

second, Column D third, and Column E fourth.

Col. C X

Enter pmts.

Col.

Col. D X

as (-)

Underpay (+)

C (+)

Overpay (-)

Amts.

.00027397

1. Estimated Credit Carryforwards and Payments made

Only

on or before the 1

st

Quarter Due Date:

<

>

2. Required 1

Quarter Estimated Payment:

st

B1+B2=

A3-A2=

3. Est. Pmt. Made after Col. A, Ln.2 and on or before

Col. A, Ln. 5. If blank, enter Col. A, Ln. 5 date in Col. A:

<

>

C2+B3=

A4-A3=

4. Est. Pmt. Made after Col. A, Ln. 3 and on or before

Col. A, Ln. 5. If blank, enter Col. A, Ln. 5 date in Col. A:

<

>

C3+B4=

A5-A4=

5. Required 2

Quarter Estimated Payment:

nd

C4+B5=

A6-A5=

6. Est. Pmt. Made after Col. A, Ln. 5 and on or before

Col. A, Ln. 8. If blank, enter Col. A, Ln. 8 date in Col. A:

<

>

C5+B6=

A7-A6=

7. Est. Pmt. Made after Col. A, Ln. 6 and on or before

Col. A, Ln. 8. If blank, enter Col. A, Ln 8 date in Col. A:

<

>

C6+B7=

A8-A7=

8. Required 3

Quarter Estimated Payment:

rd

C7+B8=

A9-A8=

9. Est. Pmt. made after Col. A, Ln. 8 and on or before

Col. A, Ln. 11. If blank, enter Col. A, Ln. 11 date in Col. A:

<

>

C8+B9=

A10-A9=

10. Est. Pmt. made after Col. A, Ln. 9 and on or before

Col. A, Ln. 11. If blank, enter Col. A, Ln. 11 date in Col. A:

<

> C9+B10=

A11-A10=

11. Required 4

Quarter Estimated Payment:

th

C10+B11=

A12-A11=

12. Est. Pmt. made after Col. A, Ln. 11 and on or before

Col. A, Ln. 14. If blank, enter Col. A, Ln. 14 date in Col. A:

<

> C11+B12=

A13-A12=

13. Est. Pmt. made after Col. A, Ln. 12 and on or before

Col. A, Ln. 14. If blank, enter Col. A, Ln. 14 date in Col. A:

<

> C12+B13=

A14-A13=

14. Earlier of the Income Tax Return Due Date or the Income

Tax Return Filed Date with complete Tax Payment:

Total Penalty (Total Col. E):

IF YOU ARE CLAIMING ONE OF THE EXCEPTIONS LISTED BELOW, CHECK THE CORRESPONDING NUMBER

PART 3.

BOX AND ENTER THAT NUMBER IN THE BOX PROVIDED ON LINE 46 OF FORM AR1100CT.

Exceptions:

(4) No penalty shall be imposed with respect to any underpayment to the extent

(1) Taxpayers whose income from farming for the tax year can reasonably be

that the Commissioner of Revenue determines that by reasons of casualty,

expected to amount to at least two thirds (2/3) of the total gross income from

disaster, or other unusual circumstances the imposition of such penalty would

all sources for the tax year, may fi le such declaration and pay the estimated

th

nd

be against equity and good conscience.

tax on or before the 15

day of the 2

month after the close of the tax year, or

in lieu of fi ling any declaration, may fi le an income tax return and pay the tax

th

rd

(5) No penalty shall be imposed with respect to any underestimate or underpayment

on or before the 15

day of the 3

month after the close of the tax year.

if the Commissioner determines that:

th

(1) the taxpayer

(2) In lieu of fi ling the 4

quarter installment the taxpayer may fi le an income tax

(i) retired after having attained age 62, or

return and pay the tax on or before January 31

st

or on the last day of the fi rst

(ii) became disabled, in the tax year for which such estimated payments were

month after the close of the tax year.

required to be made or in the tax year preceding such tax year and,

(2)such underpayment was due to reasonable cause and not to willful neglect.

(3) No penalty shall be imposed for a tax year if:

(1) the preceding tax year was a tax year of 12 months, and

(6) Taxpayers with varied income may benefi t by computing the ten percent (10%)

(2) the taxpayer did not have a tax liability for the preceding tax year, and

penalty on an annualized basis. The penalty is computed using Form AR2220A which

(3) the taxpayer was a resident of Arkansas throughout the preceding tax year.

must be submitted with Form AR1100CT. If penalty is computed using Form 2220A,

write 6 in Box on Line 46 on Form AR1100CT.

Attach Completed Form AR2220A if Computing Penalty on Annualized Basis

AR2220 (R 9/10)

1

1 2

2