Form Rv-F0200401 - Instructions For Completing Form Oic-1 - Offer In Compromise Page 3

ADVERTISEMENT

OIC-1 INSTRUCTIONS

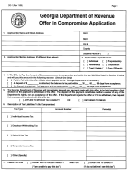

HOW TO CALCULATE AN OFFER

A statement of Financial Condition should be completed in order to determine the amount of the offer. Form CS-14-B for

individuals or Form CS-14C for businesses should be used for this purpose. The applicant’s net worth and disposable income

as determined by the financial statement should form the basis for the offer because these amounts are otherwise available to

the Department as sources of collection. Please use the worksheet below to assist in calculating the value of financial

resources upon which the offer may be based.

“DOUBT AS TO COLLECTABILITY” OFFER

Individual

1) Net Worth [Item 32, from Form CS 14B]

$ ______________

2) Net Monthly Household Disposable Income x 60 [Item 43, from Form CS-14B]

$ ______________

3) Total Value [Combine Items 1 and 2]

$ ______________

Business

1) Net Worth [Item 26, from Form CS 14C]

$ ______________

2) Net Monthly Income x 60 [Item 28, from Form CS-14C]

$ ______________

3) Total Value [Combine Items 1 and 2]

$ ______________

The total of Net Worth plus Net Household Disposable Income (Net Worth plus Net Income if a business) is an amount that

the Department considers a reasonable basis for an offer. If the Total Value is greater than the total tax liability then it should

be considered that the applicant has financial resources sufficient to pay in full and should not apply for an offer. (Note: If the

applicant is self-employed, combine the Total Value amounts for individual and business to determine a reasonable offer

amount.)

IF THE OFFER IS ACCEPTED

The Department will notify the applicant by mail if the offer is accepted. Payment of the accepted offer must be made by the

payment due date as indicated on the acceptance letter. Any issued and recorded tax lien subject to the accepted offer will be

released and mailed as promptly as possible upon full payment of the offer. Payment of the offer by cahier’s check or money

order will assure faster satisfaction of the lien. Compliance with all terms and conditions of the offer is required, including the

timely filing and payment of all required tax returns for a period of five years from the date the offer is accepted. Failure to

comply will result in the offer being voided and resumption of collection on the total balance due.

IF THE OFFER IS DECLINED

The applicant will be notified by mail if the offer is declined. The applicant should immediately contact the Department to

arrange payment of the entire liability. If immediate payment of the entire liability is not possible, the applicant may request

payment through a Department-approved installment payment agreement. Tennessee law makes no provision for appeal of

a declined offer.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5