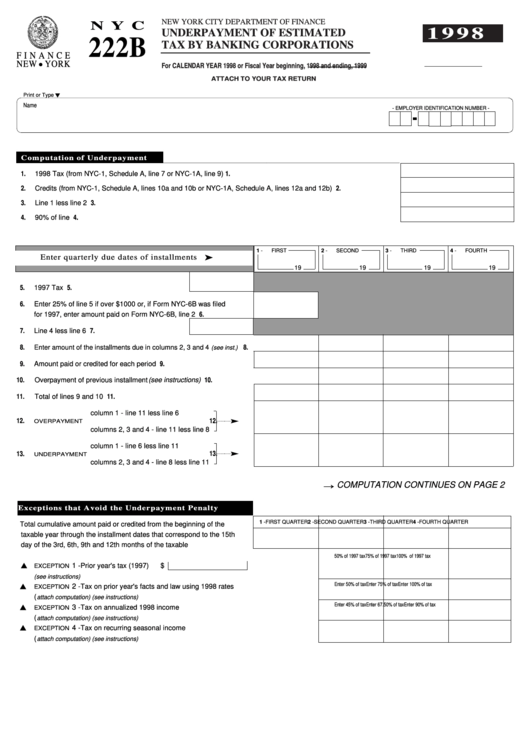

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

1 9 9 8

UNDERPAYMENT OF ESTIMATED

222B

TAX BY BANKING CORPORATIONS

F I N A N C E

NEW

YORK

l

For CALENDAR YEAR 1998 or Fiscal Year beginning

, 1998 and ending

, 1999

ATTACH TO YOUR TAX RETURN

Print or Type t

Name

- EMPLOYER IDENTIFICATION NUMBER -

Computation of Underpayment

1.

1998 Tax (from NYC-1, Schedule A, line 7 or NYC-1A, line 9)........................................................................................1.

2.

Credits (from NYC-1, Schedule A, lines 10a and 10b or NYC-1A, Schedule A, lines 12a and 12b) ..............................2.

3.

Line 1 less line 2 .............................................................................................................................................................3.

4.

90% of line 3 ....................................................................................................................................................................4.

1 -

FIRST

2 -

SECOND

3 -

THIRD

4 -

FOURTH

ä

Enter quarterly due dates of installments

19

19

19

19

5.

1997 Tax ...........................................................5.

6.

Enter 25% of line 5 if over $1000 or, if Form NYC-6B was filed

for 1997, enter amount paid on Form NYC-6B, line 2 .........................6.

7.

Line 4 less line 6 ................................................7.

8.

Enter amount of the installments due in columns 2, 3 and 4

8.

(see inst.) .......................................

9.

Amount paid or credited for each period .............................................9.

Overpayment of previous installment (see instructions)

10.

10.

............................................................

11.

Total of lines 9 and 10 .......................................................................11.

column 1 - line 11 less line 6

12.

12.

OVERPAYMENT

columns 2, 3 and 4 - line 11 less line 8

column 1 - line 6 less line 11

13.

13.

UNDERPAYMENT

columns 2, 3 and 4 - line 8 less line 11

Õ

COMPUTATION CONTINUES ON PAGE 2

Exceptions that Avoid the Underpayment Penalty

1 -FIRST QUARTER

2 -SECOND QUARTER

3 -THIRD QUARTER

4 -FOURTH QUARTER

Total cumulative amount paid or credited from the beginning of the

taxable year through the installment dates that correspond to the 15th

day of the 3rd, 6th, 9th and 12th months of the taxable year ....................

50% of 1997 tax

75% of 1997 tax

100% of 1997 tax

s

1

-

Prior year's tax (1997)

$

EXCEPTION

(see instructions) ...................................................................................................................................

Enter 50% of tax

Enter 75% of tax

Enter 100% of tax

s

2

-

Tax on prior year's facts and law using 1998 rates

EXCEPTION

(

.....................................................................................

attach computation) (see instructions)

Enter 45% of tax

Enter 67.50% of tax

Enter 90% of tax

s

3

-

Tax on annualized 1998 income

EXCEPTION

(

attach computation) (see instructions) .................................................................................................

s

4 -

Tax on recurring seasonal income

EXCEPTION

(

attach computation) (see instructions) .................................................................................................

1

1 2

2