Form Nyc-222b - Underpayment Of Estimated Tax By Subchapter S Banking Corporations - 2017

ADVERTISEMENT

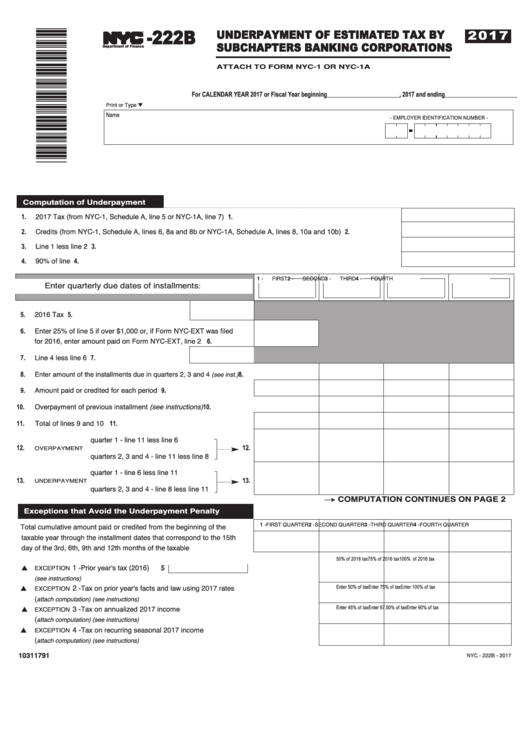

-222B

2 0 1 7

UNDERPAYMENT OF ESTIMATED TAX BY

SUBCHAPTER S BANKING CORPORATIONS

TM

Department of Finance

ATTACH TO FORM NYC-1 OR NYC-1A

For CALENDAR YEAR 2017 or Fiscal Year beginning_______________________, 2017 and ending_______________________

Print or Type t

Name

- EMPLOYER IDENTIFICATION NUMBER -

Computation of Underpayment

2017 Tax (from NYC-1, Schedule A, line 5 or NYC-1A, line 7) ........................................................................................1.

1.

2.

Credits (from NYC-1, Schedule A, lines 6, 8a and 8b or NYC-1A, Schedule A, lines 8, 10a and 10b) ...........................2.

Line 1 less line 2 .............................................................................................................................................................3.

3.

4.

90% of line 3 ....................................................................................................................................................................4.

1 -

FIRST

2 -

SECOND

3 -

THIRD

4 -

FOURTH

Enter quarterly due dates of installments:

5.

2016 Tax ............................................................5.

Enter 25% of line 5 if over $1,000 or, if Form NYC-EXT was filed

6.

for 2016, enter amount paid on Form NYC-EXT, line 2 ......................6.

7.

Line 4 less line 6 ................................................7.

8.

Enter amount of the installments due in quarters 2, 3 and 4

8.

(see inst.) ........................................

9.

Amount paid or credited for each period .............................................9.

Overpayment of previous installment (see instructions)

10.

10.

.............................................................

Total of lines 9 and 10 .......................................................................11.

11.

quarter 1 - line 11 less line 6

12.

12.

OVERPAYMENT

quarters 2, 3 and 4 - line 11 less line 8

quarter 1 - line 6 less line 11

13.

13.

UNDERPAYMENT

quarters 2, 3 and 4 - line 8 less line 11

COMPUTATION CONTINUES ON PAGE 2

’

Exceptions that Avoid the Underpayment Penalty

Total cumulative amount paid or credited from the beginning of the

1 -FIRST QUARTER

2 -SECOND QUARTER

3 -THIRD QUARTER

4 -FOURTH QUARTER

taxable year through the installment dates that correspond to the 15th

day of the 3rd, 6th, 9th and 12th months of the taxable year ....................

50% of 2016 tax

75% of 2016 tax

100% of 2016 tax

1

-

Prior year's tax (2016)

$

EXCEPTION

s

(see instructions) ...................................................................................................................................

2

-

Tax on prior year's facts and law using 2017 rates

Enter 50% of tax

Enter 75% of tax

Enter 100% of tax

EXCEPTION

s

.....................................................................................

(

attach computation) (see instructions)

3

-

Tax on annualized 2017 income

Enter 45% of tax

Enter 67.50% of tax

Enter 90% of tax

EXCEPTION

s

(

attach computation) (see instructions) .................................................................................................

4 -

Tax on recurring seasonal 2017 income

EXCEPTION

s

(

attach computation) (see instructions) .................................................................................................

10311791

NYC - 222B - 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4