Form Nyc 400b - Declaration Of Estimated Tax By Banking Corporations - 2000

ADVERTISEMENT

-

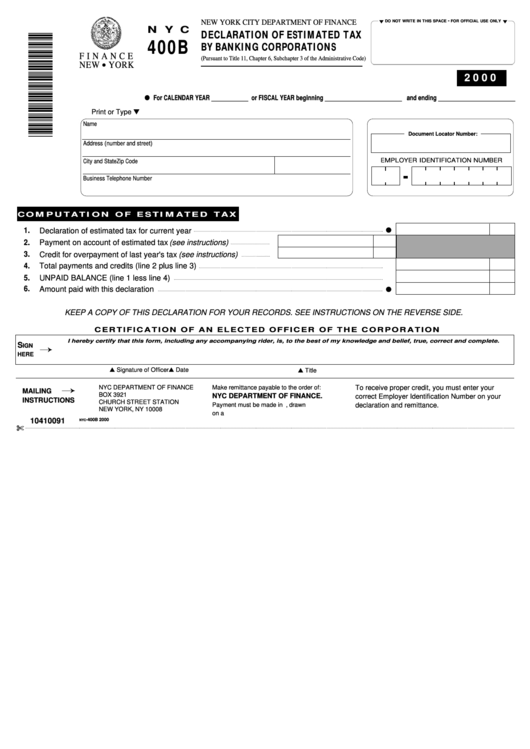

NEW YORK CITY DEPARTMENT OF FINANCE

DO NOT WRITE IN THIS SPACE

FOR OFFICIAL USE ONLY

N Y C

DECLARATION OF ESTIMATED TAX

400B

BY BANKING CORPORATIONS

F I N A N C E

(Pursuant to Title 11, Chapter 6, Subchapter 3 of the Administrative Code)

NEW YORK

2000

For CALENDAR YEAR ___________ or FISCAL YEAR beginning _______________________ and ending _______________________

Print or Type

Name

Document Locator Number:

Address (number and street)

EMPLOYER IDENTIFICATION NUMBER

City and State

Zip Code

Business Telephone Number

C O M P U T A T I O N O F E S T I M A T E D T A X

•

1.

Declaration of estimated tax for current year

2.

Payment on account of estimated tax (see instructions)

3.

Credit for overpayment of last year's tax (see instructions)

4.

Total payments and credits (line 2 plus line 3)

5.

UNPAID BALANCE (line 1 less line 4)

•

6.

Amount paid with this declaration

KEEP A COPY OF THIS DECLARATION FOR YOUR RECORDS. SEE INSTRUCTIONS ON THE REVERSE SIDE.

C E R T I F I C A T I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R A T I O N

I hereby certify that this form, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

S

IGN

HERE

Signature of Officer

Date

Title

NYC DEPARTMENT OF FINANCE

Make remittance payable to the order of:

To receive proper credit, you must enter your

MAILING

BOX 3921

NYC DEPARTMENT OF FINANCE.

correct Employer Identification Number on your

INSTRUCTIONS

CHURCH STREET STATION

Payment must be made in U.S. dollars, drawn

declaration and remittance.

NEW YORK, NY 10008

on a U.S. bank.

10410091

-400B 2000

NYC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1