Form K-41 - Fiduciary Income Tax Instructions - 2013 Page 6

ADVERTISEMENT

share of the Kansas fiduciary modification shall be in proportion

or partnerships should be modified, if necessary, before the item

to each share of the estate or trust income distributed. Any balance

is entered in Column C.

of the Kansas fiduciary modification not allocated to the

Do not carry over any administration expenses from Column B

beneficiaries is allocable to the fiduciary.

to Column C if these expenses were claimed on both the Kansas

When the allocation of the Kansas fiduciary modification, as

Estate Tax Return and the federal fiduciary tax return.

provided by law, would result in an amount that is substantially

Capital gains from Kansas sources should be entered in

inequitable, the fiduciary may, with the permission of the Director

Column C only if the gain is distributed to the beneficiaries.

of Taxation, use such other methods of allocation that will produce

Depreciation, depletion, and federal estate tax not included on

a fair and equitable result to both the fiduciary and the beneficiary.

Federal Form 1041 and passed directly to the beneficiaries should

Kansas law does not permit the fiduciary to elect to pay the tax on

be entered on the appropriate lines of Column C (e.g., line 41a).

income properly applicable to a beneficiary by including such

Enter on line 41a other deductions not provided for on lines 36

income in its share of the modification. The estate or trust must

through 40. These deductions should be directly allocated where

advise each beneficiary of their share of the Kansas fiduciary

possible. If it is not possible to directly relate those deductions to

modification. The amount reported in Column D is the amount

income from Kansas sources, they should be apportioned by

which the fiduciary is required to submit to each beneficiary.

multiplying the deductions by the ratio of total Kansas income

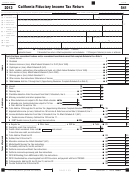

Column A. Enter on lines (a), (b), (c) and (d) the names and

(line 35, Column C) divided by total federal income (line 35,

addresses of Kansas resident beneficiaries. Nonresident

Column B).

beneficiaries should be listed on lines (e), (f), (g) and (h).

Net income of the estate or trust from Kansas sources, after all

Column B. Enter the Social Security numbers of the

modifications, is to be entered on line 48, Column C.

beneficiaries.

Enter on line 49, Column C, the total percentages of all

Column C. Enter the percentage of the estate or trust to be

nonresident beneficiaries only. These percentages are

distributed to each beneficiary in accordance with the documents

determined by the documents or laws controlling distribution of

or the laws controlling distribution of the estate or trust. The

the estate or trust.

percentage allocated to charitable beneficiaries and to the fiduciary

Enter on line 50, Column C, the total income from Kansas

itself should be shown on the appropriate lines. Total allocation

sources of all nonresident beneficiaries. This amount is computed

must equal 100%.

by multiplying line 48, Column C, by the percentage entered on

line 49, Column C.

Column D. Enter on lines (a) through (i) each beneficiary’s

share of the Kansas fiduciary modification. Enter on line (j) the

Column D. Column D is to be completed by nonresident

resident fiduciary’s share of the modification. To determine each

fiduciaries only. Enter in Column D that part of Column C

individual’s and the fiduciary’s share of the Kansas fiduciary

applicable to the fiduciary. The amount to be entered in Column D

modification, multiply the amount on line 26, Part I, by the

is computed by multiplying each entry in +Column C by the

percentage in Column C.

fiduciary’s percentage of the Kansas fiduciary adjustment as

shown in Part II.

Important — You need not complete Parts III and IV if you are filing a

A capital gain from Kansas sources that is not distributed to the

resident estate or trust where all beneficiaries are Kansas residents. If

there are nonresident beneficiaries, you must complete Parts III and IV.

beneficiaries should be entered on line 30, Column D.

Nonresident Fiduciary Exemption. Enter on line 46, Part III,

PART III

Column D, the amount of the nonresident fiduciary exemption

determined by the following formula:

Part III is used to compute the federal taxable income of the

estate or trust from Kansas sources. It is to be completed by all

1) Exemption on federal Form 1041 ..................... $ _____________

resident estates and trusts which have nonresident beneficiaries

2) Kansas income of nonresident estate

and by all nonresident estates and trusts with income or gain

or trust (Part III, line 43, Column D) .................. $ _____________

from Kansas sources. Nonresident estates or trusts should report

3) Federal income

to Kansas only that part of their federal taxable income derived

(Part III, line 43, Column B) ................................ $ _____________

from Kansas sources. The income to be reported, and the

4) Ratio (Divide line 2 by line 3) ............................

__________ %

modifications to that income, are determined in this part.

5) Nonresident fiduciary exemption

Column A. Column A lists the items of income and modifications

(multiply line 1 by line 4) ................................... $ _____________

that correspond to those shown on the federal fiduciary tax return.

Column B. Enter total income or deductions reported or claimed

Line 48, Column D, is the net income of the nonresident estate

on the federal fiduciary tax return for each item listed in Column A.

or trust from Kansas sources applicable to the fiduciary which

Column C. Enter that part of each item of income reported in

should be entered on line 1 of Form K-41.

Column B that is derived from Kansas sources. Use direct

accounting whenever possible. Intangible income will not be

PART IV

considered to be from Kansas sources except where it is part of

a business, trade, or occupation carried on in Kansas. Any item

Part IV is used to compute the nonresident beneficiaries’

shares of income and to compute the amount of tax to be withheld

entered in Column C should reflect the amount that remains after

all modifications have been performed.

by the fiduciary of a resident estate or trust from the amount

FOR EXAMPLE: State or local income taxes deducted on the

distributed or distributable to the nonresident beneficiaries.

Fiduciaries must provide to each nonresident beneficiary the

federal return would not be included in Column C. State income

tax refunds reported as income on the federal return would not be

amount of the nonresident beneficiary’s share of income. In

included in Column C. Also, any income from other estates, trusts,

addition, Kansas law requires the fiduciary of a resident estate or

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8