Form It-205-A - Fiduciary Allocation - 1999 Page 3

ADVERTISEMENT

IT-205-A (1999) Page 3

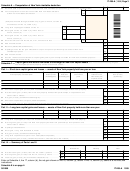

Schedule 6 — Computation of New York charitable deduction

47

Amounts paid or permanently set aside for New York charitable purposes from gross income

..................

47

(see instructions)

48

Tax-exempt income from sources outside New York State allocable

to New York charitable contribution ..........................................................................................

48

(Complete lines 49 through 52 below only if gain on line 74, column (2),

exceeds loss on line 73, column (2).)

49

Long-term capital gain included on line 47 ...........................................

49

50

Enter gain on line 74, column (2), minus loss on

line 73, column (2) .............................................................................

50

51

Enter gain on line 74, column (3), minus loss on

line 73, column (3) .............................................................................

51

52

Enter the amount from line 49, 50, or 51, whichever is less ........................................................

52

53

Add lines 48 and 52 .................................................................................................................................................................

53

54

Balance

.........................................................................................................................................

54

(subtract line 53 from line 47)

55

Capital gains for the tax year allocated to corpus and paid or permanently set aside for New York

charitable purposes .............................................................................................................................................................

55

56

Add lines 54 and 55 .................................................................................................................................................................

56

57

Section 1202 exclusion allocable to capital gains paid or permanently set aside for New York charitable purposes ...........

57

58

Total

..............................................................................................................................................

58

(subtract line 57 from line 56)

Schedule 7 — Capital gains and losses from sales or exchanges of New York capital assets

(See instructions concerning tangible

and intangible personal property carried as business assets.)

Part I — Short-term capital gains and losses — assets of New York property held one year or less

(a)

(b)

(c)

(d)

(e)

(f)

Kind of property and description

Date acquired

Date sold

Gross sales

Federal cost or

Gain (or loss)

price

other basis, plus

(month/day/year)

(month/day/year)

((d) minus (e))

expense of sale

59

60

Short-term capital gain (or loss) from installment sales and like-kind exchanges of New York property ...............................

60

61

Net short-term gain (or loss) from New York property derived from partnerships, S corporations and

other trusts or estates ..........................................................................................................................................................

61

62

Net gain (or loss)

.........................................................................................................................

62

(combine lines 59 through 61)

63

Short-term capital loss carryover

..............................................................................................................

63

(attach computation)

64

Net short-term gain (or loss)

...............................................................

64

(combine lines 62 and 63; enter here and on line 73 below)

Part II — Long-term capital gains and losses — assets of New York property held more than one year

65

66

Long-term capital gain (or loss) from installment sales and like-kind exchanges of New York property ...............................

66

67

Net long-term gain (or loss) from New York property derived from partnerships, S corporations and

other trusts or estates ..........................................................................................................................................................

67

68

Capital gain distributions .........................................................................................................................................................

68

69

Enter gain, if any, from Schedule 8, line 81 ............................................................................................................................

69

70

Net gain (or loss)

.........................................................................................................................

70

(combine lines 65 through 69)

71

Long-term capital loss carryover from 1998

.............................................................................................

71

(attach computation)

72

Net long-term gain (or loss)

.................................................................

72

(combine lines 70 and 71; enter here and on line 74 below)

Part III — Summary of Parts I and II

(1)

(2)

(3)

Beneficiaries

Fiduciary

Total

73

Net short-term gain (or loss) from line 64, column (f) above ...........

73

74

Net long-term gain (or loss) from line 72, column (f) above ............

74

75

Total net gain (or loss)

..................

75

(line 73 and add or subtract line 74)

Enter on Schedule 4, line 17, column (b), the net gain shown on line 75, column (3), above. If line 75, column (3), above is a net loss, see

instructions.

Schedule 8 is on page 4.

081999

IT-205-A 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4