Form It-205-A - Fiduciary Allocation - 1999 Page 4

ADVERTISEMENT

Page 4 IT-205-A (1999)

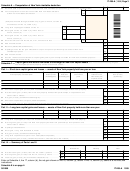

Schedule 8 — Supplemental schedule of gains and losses from New York property

Part I — Sales or exchanges of New York property used in a trade or business and involuntary conversions from other than

casualty and theft — property held more than 1 year

Attach a copy of federal Schedule 4684 to report involuntary conversions of New York property from casualty and theft.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Kind of property

Date acquired

Date sold

Gross sales

Federal

Federal cost or

Loss

Gain

price

depreciation

other basis, plus

(if necessary, attach

(month/day/year)

(month/day/year)

((f) minus

((d) plus (e)

allowed (or

improvements and

statement of descriptive

the sum of

minus (f))

allowable) since

expense of sale

details not shown below)

(d) and (e))

acquisition

76

77

Gain, if any, from federal Form 4684, line 39 ..............................................................................................................

77

78

Section 1231 gain from installment sales from federal Form 6252, line 26 or 37 .......................................................

78

79

Gain, if any, from federal Form 4797, line 32, from other than casualty or theft .........................................................

79

80

Add line 76, column (g) amounts, and lines 76 through 79, column (h) amounts .......................................................

80

81

Combine columns (g) and (h) of line 80. Enter gain (or loss) here, and on appropriate line as follows:

81

a) If line 81 is a gain, enter the gain as a long-term capital gain on Schedule 7, line 69.

b) If line 81 is zero or a loss, enter that amount on line 83.

Part II — Ordinary gains and losses from New York property

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Kind of property

Date acquired

Date sold

Gross sales

Federal

Federal cost or

Loss

Gain

price

depreciation

other basis, plus

(if necessary, attach

(month/day/year)

(month/day/year)

((f) minus

((d) plus (e)

allowed (or

improvements and

statement of descriptive

the sum of

minus (f))

allowable) since

expense of sale

details not shown below)

(d) and (e))

acquisition

82

Ordinary gains and losses not included on lines 83 through 87

(include property held 1 year or less)

83

Loss, if any, from line 81 ..............................................................................................................................................

83

84

Gain, if any, from federal Form 4797, line 31 ..............................................................................................................

84

85

Net gain (or loss) from federal Form 4684, lines 31 and 38(a) ....................................................................................

85

86

Ordinary gain from installment sales from federal Form 6252, line 25 and/or line 36 ................................................

86

87

Recapture of section 179 deduction ............................................................................................................................

87

88 (

)

88

Add lines 82, 83, and 85, column (g) amounts, and lines 82 and lines 84 through 87, column (h) amounts .............

89

Combine columns (g) and (h) of line 88. Enter gain (or loss) here and on Schedule 4, line 20, column (b) ..........................................

89

If schedules on pages 3 and 4 do not apply, detach and discard pages 3 and 4.

082999

IT-205-A 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4