Property Tax Relief Application For 2001 - City Of Pittsburgh Page 2

ADVERTISEMENT

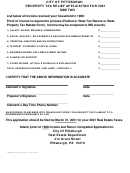

CITY OF PITTSBURGH

PROPERTY TAX RELIEF APPLICATION FOR 2001

SIDE TWO

List below all income received your household in 1999:

Proof of income is required to process (Federal or State Tax Retuns or State

). I

Property Tax Rebate Form

ncome may be compared to IRS records.

1) SALARY, WAGES, BONUSES, COMMISSIONS

$ _______________

2) SOCIAL SECURITY, SSI PAYMENTS & RAILROAD RETIREMENT BENEFITS

$ _______________

3) PENSIONS, ANNUITIES AND IRA DISRIBUTIONS

$ _______________

4) INTEREST, DIVIDENDS & CAPITAL GAINS

$ _______________

5) BUSINESS INCOME, SELF-EMPLOYMENT INCOME

$ _______________

6) ALIMONY OR SUPPORT

$ _______________

7) OTHER INCOME (ATTACH A SCHEDULE & EXPLANATION)

$ _______________

TOTAL HOUSEHOLD INCOME (ADD LINES 1 THROUGH 7

$ _______________

)

I CERTIFY THAT THE ABOVE INFORMATION IS ACCURATE

Claimant’ s Signature

Date

Preparer’ s Signature

Date

Claimant’ s Day Time Phone Number

AN EXCESSIVE CLAIM MADE WITH FRAUDULENT INTENT CAN SUBJECT THE CLAIMANT TO A

MISDEMEANOR PUNISHABLE BY LAW

This application should be filed by March 31, 2001 for your 2001 Real Estate Taxes.

Attach proof of 1999 income and Return Completed Application to:

City Of Pittsburgh

Real Estate Department

414 Grant Street

Pittsburgh, PA 15219

C:\WINNT\senior tax relief application year 2001 revised.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2