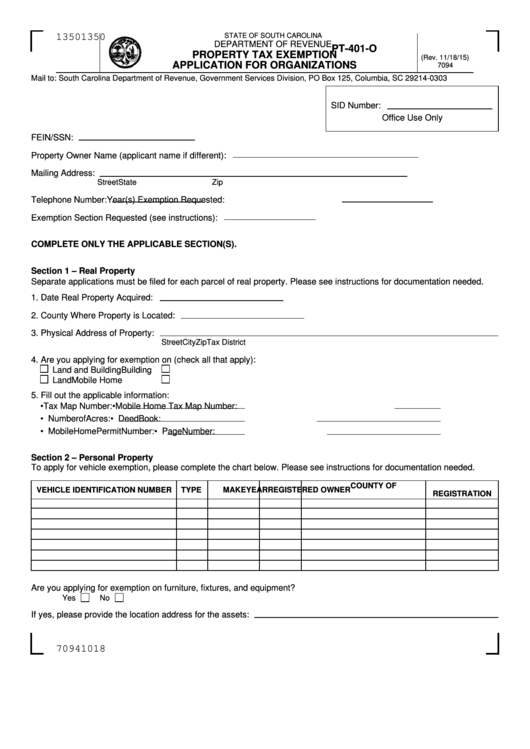

Property Tax Exemption Application For Organizations

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

PT-401-O

PROPERTY TAX EXEMPTION

(Rev. 11/18/15)

APPLICATION FOR ORGANIZATIONS

7094

Mail to: South Carolina Department of Revenue, Government Services Division, PO Box 125, Columbia, SC 29214-0303

SID Number:

Office Use Only

FEIN/SSN:

Property Owner Name (applicant name if different):

Mailing Address:

Street

State

Zip

Telephone Number:

Year(s) Exemption Requested:

Exemption Section Requested (see instructions):

COMPLETE ONLY THE APPLICABLE SECTION(S).

Section 1 – Real Property

Separate applications must be filed for each parcel of real property. Please see instructions for documentation needed.

1. Date Real Property Acquired:

2. County Where Property is Located:

3. Physical Address of Property:

Street

City

Zip

Tax District

4. Are you applying for exemption on (check all that apply):

Land and Building

Building

Land

Mobile Home

5. Fill out the applicable information:

• Tax Map Number:

• Mobile Home Tax Map Number:

• Number of Acres:

• Deed Book:

• Mobile Home Permit Number:

• Page Number:

Section 2 – Personal Property

To apply for vehicle exemption, please complete the chart below. Please see instructions for documentation needed.

COUNTY OF

VEHICLE IDENTIFICATION NUMBER

TYPE

MAKE

YEAR

REGISTERED OWNER

REGISTRATION

Are you applying for exemption on furniture, fixtures, and equipment?

Yes

No

If yes, please provide the location address for the assets:

70941018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2