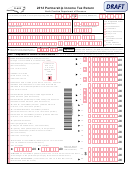

Form D-403 - 2014 Partnership Income Tax Return Page 4

ADVERTISEMENT

Page 4

Legal Name (First 10 Characters)

Federal Employer ID Number

D-403

2014

Part 4. North Carolina Adjustments to Income

(See instructions)

Additions to Income

.

00

1. Interest income from obligations of states other than North Carolina

1.

.

2. Other additions to income (See Form D-401, Individual Income Tax Instructions, for other additions

00

2.

that may be applicable to partnerships)

.

00

3. Total additions to income (Add Lines 1 and 2 and enter total here and on Part 1, Line 4)

3.

Deductions from Income

.

00

4.

4. Interest income from obligations of the United States or United States’ possessions

.

00

5. State, local, or foreign income tax refunds reported as income on federal return

5.

6. Adjustment for bonus depreciation added back in 2009, 2010, 2011, 2012, and 2013

(Add Lines 6a, 6b, 6c, 6d, and 6e, and enter total on Line 6f)

6a. 2009

6b. 2010

6c. 2011

6d. 2012

6e. 2013

.

.

.

.

.

00

00

00

00

00

.

00

6f.

.

7. Other deductions from income (See Form D-401, Individual Income Tax Instructions, for other deductions that

00

7.

may be applicable to partnerships)

.

00

8. Total deductions from income (Add Lines 4, 5, 6f, and 7 and enter total here and on Part 1, Line 6)

8.

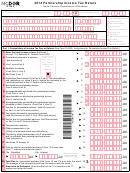

Part 5. Nonapportionable Net Distributive Partnership Income

Complete this schedule only if you apportion income to North Carolina and to other states AND you have income classified as nonapportionable income.

See the instructions for an explanation of what is apportionable income and what is nonapportionable income.

(A) Nonapportionable Net Distributive

(B) Net Income

(C) Net Income Allocated

Partnership Income

from Activity

Directly to N.C.

.

1.

Nonapportionable Income

(Enter the total of Column B here and on Part 1, Line 8)

00

2.

Nonapportionable Income Allocated to N.C.

(Enter the total of Column C here

.

00

and on Part 1, Line 10)

Explanation

of why income listed in chart is nonapportionable income rather than apportionable income:

(Attach additional sheets if necessary)

If prepared by a person other than the managing partner, this certification is based on

I certify that, to the best of my knowledge, this return is accurate and complete.

all information of which preparer has any knowledge.

Signature of Managing Partner

Date

Signature of Preparer Other Than Managing Partner

Date

Address

Daytime Telephone Number (Include area code)

If entity is an LLC and it converted to an LLC during the tax year, enter entity

name prior to conversion:

Preparer’s Daytime Telephone Number (Include area code)

FEIN

SSN

PTIN:

(Fill in applicable circle)

Preparer’s FEIN, SSN, or PTIN

MAIL TO: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0640

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5