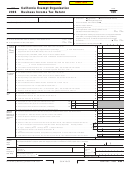

Form N-70np - Exempt Organization Business Income Tax Return - 2006 Page 2

ADVERTISEMENT

FORM N-70NP

(REV. 2006)

Page 2

TAX COMPUTATION SCHEDULE

— Corporations

PART I

1

Enter the amount of unrelated business taxable income as shown on page 1, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Enter the total of other deductions (see instructions, attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Difference — line 1 minus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Hawaii additions to income (see instructions, attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Sum of lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Enter the amount of taxable net capital gain as shown on page 1, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Difference — line 5 minus line 6 (if less than zero, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

(a) Tax on net capital gain — 4% of amount on line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8(a)

(b) Tax on all other taxable income — If amount on line 7 is:

(i)

Not over $25,000 — Enter 4.4% of line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8(b)(i)

(ii)

Over $25,000 but not over $100,000 — Enter 5.4%

of line 7 $

. Subtract $250 and enter difference. . . . . . . . . . . . . . . . . . . . . . . . . . 8(b)(ii)

(iii) Over $100,000 — Enter 6.4%

of line 7 $

. Subtract $1,250 and enter difference . . . . . . . . . . . . . . . . . . . . . . . . 8(b)(iii)

(c) Total of lines 8(a) and 8(b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8(c)

(d) Using the rates listed on line 8(b), compute tax on unrelated business taxable income as shown on line 3. . . . . . . . . . .

8(d)

9

Total tax (enter lesser of amount on line 8(c) or 8(d)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Also, enter this amount on page 1, line 9.

— Charitable Trusts

PART II

1

Unrelated business taxable income (page 1, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Enter the total of other deductions (see instructions, attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Difference — line 1 minus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Hawaii additions to income (see instructions, attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Sum of lines 3 and 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6

Net cap. gain taxable to the trust. Enter the smaller of line 16 or 17, col. (b), Sch. D (N-40) . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Difference — line 5 minus line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Enter the greater of line 6 or $20,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Tax on amount on line 8. If line 8 is $20,000, enter $1,128.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10

Difference — line 3 minus line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Multiply the amount on line 10 by 7.25% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Tax. Add lines 9 and 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Tax on amount on line 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Enter the lesser of line 12 or line 13 here and on page 1, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

TRUST TAX RATES FOR PERIODS AFTER 12/31/01

If the taxable income is:

The tax shall be:

Not over $2,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.4% of taxable income

Over $2,000 but not over $4,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $28.00 plus 3.20% of excess over $2,000

Over $4,000 but not over $8,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $92.00 plus 5.50% of excess over $4,000

Over $8,000 but not over $12,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $312.00 plus 6.40% of excess over $8,000

Over $12,000 but not over $16,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $568.00 plus 6.80% of excess over $12,000

Over $16,000 but not over $20,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $840.00 plus 7.20% of excess over $16,000

Over $20,000 but not over $30,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,128.00 plus 7.60% of excess over $20,000

Over $30,000 but not over $40,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,888.00 plus 7.90% of excess over $30,000

Over $40,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,678.00 plus 8.25% of excess over $40,000

FORM N-70NP

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2