Print

Reset form

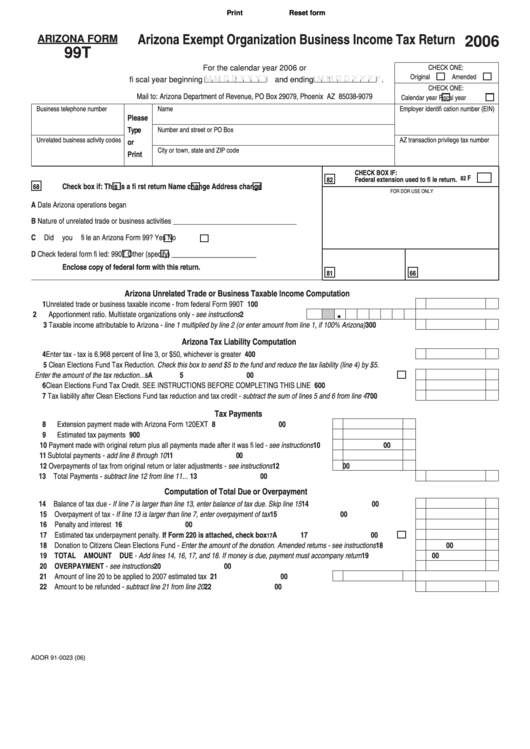

Arizona Exempt Organization Business Income Tax Return

ARIZONA FORM

2006

99T

CHECK ONE:

For the calendar year 2006 or

Original

Amended

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

CHECK ONE:

Mail to: Arizona Department of Revenue, PO Box 29079, Phoenix AZ 85038-9079

Calendar year

Fiscal year

Business telephone number

Name

Employer identifi cation number (EIN)

Please

Type

Number and street or PO Box

Unrelated business activity codes

AZ transaction privilege tax number

or

City or town, state and ZIP code

Print

CHECK BOX IF:

F

82

82

Federal extension used to fi le return.

Check box if:

This is a fi rst return

Name change

Address change

68

FOR DOR USE ONLY

A

Date Arizona operations began

B

Nature of unrelated trade or business activities ___________________________________

C

Did you fi le an Arizona Form 99?

Yes

No

D

Check federal form fi led:

990T

Other (specify) ________________________

Enclose copy of federal form with this return.

81

66

Arizona Unrelated Trade or Business Taxable Income Computation

1 Unrelated trade or business taxable income - from federal Form 990T ...........................................................................................

1

00

2 Apportionment ratio. Multistate organizations only - see instructions .................................

2

•

3 Taxable income attributable to Arizona - line 1 multiplied by line 2 (or enter amount from line 1, if 100% Arizona) ........................

3

00

Arizona Tax Liability Computation

4 Enter tax - tax is 6.968 percent of line 3, or $50, whichever is greater ............................................................................................

4

00

5 Clean Elections Fund Tax Reduction. Check this box to send $5 to the fund and reduce the tax liability (line 4) by $5.

Enter the amount of the tax reduction .................................................................................................................................

A

5

00

5

6 Clean Elections Fund Tax Credit. SEE INSTRUCTIONS BEFORE COMPLETING THIS LINE ......................................................

6

00

7 Tax liability after Clean Elections Fund tax reduction and tax credit - subtract the sum of lines 5 and 6 from line 4 .......................

7

00

Tax Payments

8 Extension payment made with Arizona Form 120EXT ......................................................................

8

00

9 Estimated tax payments ...................................................................................................................

9

00

10 Payment made with original return plus all payments made after it was fi led - see instructions ......

10

00

11 Subtotal payments - add line 8 through 10 .......................................................................................

11

00

12 Overpayments of tax from original return or later adjustments - see instructions .............................

12

00

13 Total Payments - subtract line 12 from line 11 .................................................................................................................................

13

00

Computation of Total Due or Overpayment

14 Balance of tax due - If line 7 is larger than line 13, enter balance of tax due. Skip line 15 ..............................................................

14

00

15 Overpayment of tax - If line 13 is larger than line 7, enter overpayment of tax ...............................................................................

15

00

16 Penalty and interest .........................................................................................................................................................................

16

00

17 Estimated tax underpayment penalty. If Form 220 is attached, check box ...................................................................

A

17

00

17

18 Donation to Citizens Clean Elections Fund - Enter the amount of the donation. Amended returns - see instructions ....................

18

00

19 TOTAL AMOUNT DUE - Add lines 14, 16, 17, and 18. If money is due, payment must accompany return ...................................

19

00

20 OVERPAYMENT - see instructions .................................................................................................................................................

20

00

21 Amount of line 20 to be applied to 2007 estimated tax .....................................................................

21

00

22 Amount to be refunded - subtract line 21 from line 20 .....................................................................................................................

22

00

ADOR 91-0023 (06)

1

1 2

2