Lodging Tax Program - State Of Oregon Page 2

ADVERTISEMENT

4

5

6

7

8

9

10

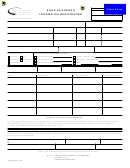

Region (circle):

1

2

3

4

5

6

7

8

9

10

_______________________________________

Name of facility:

________________________________________________

(if applicable)

How and when do I pay the tax?

Do you have questions or need help?

_______________________________________

Physical address: ________________________________________________

_______________________________________

________________________________________________

You must file a quarterly return and submit the tax

Lodging tax

on or before the last day of April, July, October, and

information ...................

_______________________________________

________________________________________________

January. You must file a zero return even if you didn’t

General tax information ................

4

5

6

7

8

9

10

Region (circle):

1

2

3

4

5

6

7

8

9

10

collect any tax for the reporting period.

(503) 378-4988 or (800) 356-4222

You’ll need to report your taxable gross receipts for

each region in which you conduct business as a tran-

questions.dor@ oregon.gov

_______________________________________

Name of facility:

________________________________________________

sient lodging tax collector. Include gross receipts from

(if applicable)

Contact us for ADA accommodations or assistance in

all regions on the same return. Do not file separate

other languages.

_______________________________________

Physical address: ________________________________________________

returns for each region or facility address. To deter-

_______________________________________

________________________________________________

mine the region in which a specific property is located,

visit us at . Look for the

_______________________________________

________________________________________________

ZIP code/region directory.

4

5

6

7

8

9

10

Region (circle):

1

2

3

4

5

6

7

8

9

10

File and pay electronically using Revenue Online at

Revenue Online will calculate

the tax you owe, allow for payment, and verify when

_______________________________________

Name of facility:

________________________________________________

we receive your filing and payment.

(if applicable)

For more information on how to file and pay the state

_______________________________________

Physical address: ________________________________________________

lodging tax, see our publication, Filing State Lodging

_______________________________________

________________________________________________

Tax Returns, or contact us at spa.help@oregon.gov or

_______________________________________

________________________________________________

(503) 945-8247.

4

5

6

7

8

9

10

Region (circle):

1

2

3

4

5

6

7

8

9

10

OREGON’S TEN REGIONS

_______________________________________

1. North Coast

4. Willamette Valley

8. Mt. Hood / Gorge

2. Central Coast

5. Portland Metro

9. Northeastern

3. South Coast

6. Southern

10. Southeastern

_______________________________________

7. Central

_______________________________________

Astoria •

5

1

_______________________________________

Pendleton •

The Dalles •

Tillamook •

Portland •

8

4

5

6

7

8

9

10

Oregon City •

La Grande •

9

Salem •

Newport •

Baker City •

Corvallis •

Madras •

4

_______________________________________

Prineville •

Eugene •

7

Bend •

Ontario •

2

• Cottage Grove

Reedsport •

_______________________________________

Coos Bay •

Burns •

_______________________________________

Roseburg •

_______________________________________

3

10

Jordan Valley •

6

Port Orford •

4

5

6

7

8

9

10

Medford •

Klamath Falls •

Brookings •

150-604-401 (Rev. 01-17)

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2