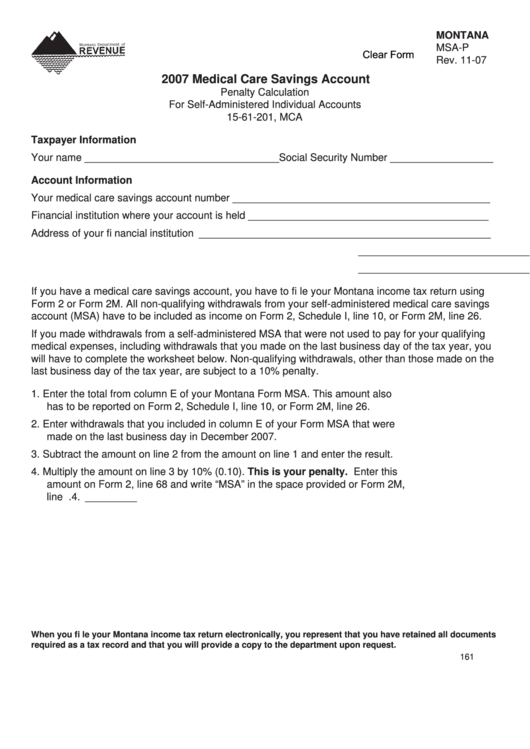

MONTANA

MSA-P

Clear Form

Rev. 11-07

2007 Medical Care Savings Account

Penalty Calculation

For Self-Administered Individual Accounts

15-61-201, MCA

Taxpayer Information

Your name __________________________________Social Security Number __________________

Account Information

Your medical care savings account number _____________________________________________

Financial institution where your account is held __________________________________________

Address of your fi nancial institution ___________________________________________________

___________________________________________________

___________________________________________________

If you have a medical care savings account, you have to fi le your Montana income tax return using

Form 2 or Form 2M. All non-qualifying withdrawals from your self-administered medical care savings

account (MSA) have to be included as income on Form 2, Schedule I, line 10, or Form 2M, line 26.

If you made withdrawals from a self-administered MSA that were not used to pay for your qualifying

medical expenses, including withdrawals that you made on the last business day of the tax year, you

will have to complete the worksheet below. Non-qualifying withdrawals, other than those made on the

last business day of the tax year, are subject to a 10% penalty.

1. Enter the total from column E of your Montana Form MSA. This amount also

has to be reported on Form 2, Schedule I, line 10, or Form 2M, line 26. ................... 1. _________

2. Enter withdrawals that you included in column E of your Form MSA that were

made on the last business day in December 2007. ................................................... 2. _________

3. Subtract the amount on line 2 from the amount on line 1 and enter the result. ......... 3. _________

4. Multiply the amount on line 3 by 10% (0.10). This is your penalty. Enter this

amount on Form 2, line 68 and write “MSA” in the space provided or Form 2M,

line 59......................................................................................................................... 4. _________

When you fi le your Montana income tax return electronically, you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

161

1

1