Form Nyc-4sez Draft - General Corporation Tax Return - 2015 Page 2

ADVERTISEMENT

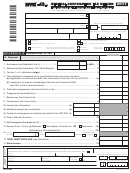

Form NYC-4S-EZ - 2015

Page 2

NAME _______________________________________________________________________

EIN _______________________________________

SCHEDULE B

1. Federal Taxable Income before net operating loss deduction and

special deductions ............................................................................................. 1.

2. State and local income and MTA taxes deducted on federal return

(see instructions)................................................................................................ 2.

3. Total of lines 1 and 2 .......................................................................................... 3.

4. New York City net operating loss deduction (see instructions) .......................... 4.

5. New York City and New York State income tax refunds included in line1...........5.

6. Taxable net income. line 3 less the sum of lines 4 and 5

(enter on page 1, Schedule A, line 1) ............................................................... 6.

ADDITIONAL REQUIRED INFORMATION - See Instructions

1. Does this taxpayer pay rent greater than $200,000 for any premises in NYC in the borough

of Manhattan south of 96th Street for the purpose of carrying on any trade, business,

n

n

profession, vocation or commercial activity?....................................................................................

YES

NO

n

n

2. If "YES", were all required Commercial Rent Tax Returns filed?...............................................

YES

NO

Please enter Employer Identification Number which was used on the Commercial Rent Tax Return:___________________________

MAILING INSTRUCTIONS

Attach copy of all pages of your federal tax return or 1120S.

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE. Payment must be made in U.S. dollars and drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

The due date for the calendar year 2015 return is on or before March 15, 2016.

For fiscal years beginning in 2015, file on or before the 15th day of the 3rd month following the close of the fiscal year.

ALL RETURNS EXCEPT REFUND RETURNS

REMITTANCES

RETURNS CLAIMING REFUNDS

PAY ONLINE WITH FORM NYC-200V

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

AT NYC GOV/ESERVICES

GENERAl CORPORATION TAX

GENERAl CORPORATION TAX

OR

P.O. BOX 5563

P.O. BOX 5564

Mail Payment and Form NYC-200V ONLY to:

BINGhAMTON, NY 13902-5564

BINGhAMTON, NY 13902-5563

NYC DEPARTMENT OF FINANCE

P.O. BOX 3646

NEW YORK, NY 10008-3646

31121591

31121591

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2