Form Bus 417 - Business Tax Return - Industrial Loan And Thrift Companies - Tennessee Department Of Revenue

ADVERTISEMENT

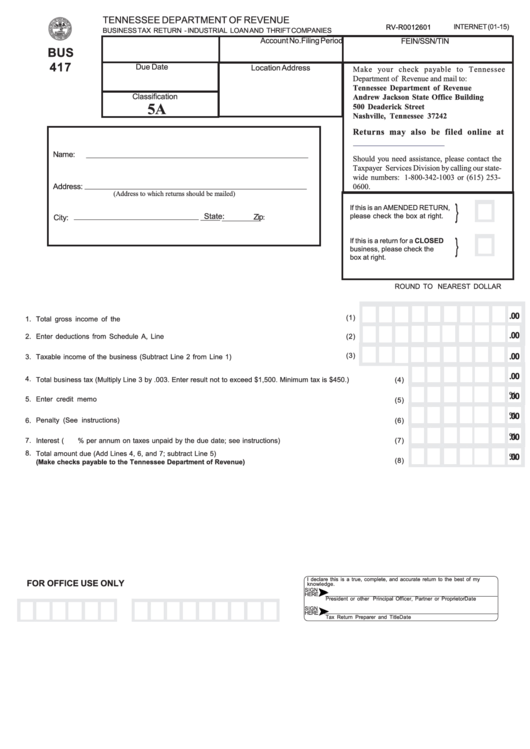

TENNESSEE DEPARTMENT OF REVENUE

INTERNET (01-15)

RV-R0012601

BUSINESS TAX RETURN - INDUSTRIAL LOAN AND THRIFT COMPANIES

Filing Period

Account No.

FEIN/SSN/TIN

BUS

417

Due Date

Location Address

Make your check payable to Tennessee

Department of Revenue and mail to:

Tennessee Department of Revenue

Classification

Andrew Jackson State Office Building

5A

500 Deaderick Street

Nashville, Tennessee 37242

Returns may also be filed online at

https://apps.tn.gov/biztax/.

_________________________________________________________

Name:

Should you need assistance, please contact the

Taxpayer Services Division by calling our state-

wide numbers: 1-800-342-1003 or (615) 253-

_________________________________________________________

Address:

0600.

(Address to which returns should be mailed)

}

If this is an AMENDED RETURN,

________________________________

State:

_____

__________

please check the box at right.

Zip:

City:

}

If this is a return for a CLOSED

business, please check the

box at right.

ROUND TO NEAREST DOLLAR

.00

(1)

1.

Total gross income of the business............................................................................................. ........

.00

2.

Enter deductions from Schedule A, Line 18.....................................................................................

(2)

.00

(3)

3.

Taxable income of the business (Subtract Line 2 from Line 1)...........................................................

.00

4.

Total business tax (Multiply Line 3 by .003. Enter result not to exceed $1,500. Minimum tax is $450.)......................

(4)

%

.00

5.

Enter credit memo balance...................................................................................................... ............................

(5)

% . 00

6.

Penalty (See instructions)..................................................................................................... ......................................

(6)

%

.00

7.

Interest (

% per annum on taxes unpaid by the due date; see instructions)................................................

........

(7)

8.

Total amount due (Add Lines 4, 6, and 7; subtract Line 5)

%

.00

(8)

(Make checks payable to the Tennessee Department of Revenue).............................................................

I declare this is a true, complete, and accurate return to the best of my

FOR OFFICE USE ONLY

knowledge.

SIGN

HERE

President or other Principal Officer, Partner or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2