Instructions For L-Bw-602

ADVERTISEMENT

Instructions for L-BW-602

Beer or Wine Tax

Enter the total number cases of beer or wine purchased in the column labeled "Number of Cases Not to Exceed 10".

In the column labeled "size in ounces or liters", multiply the total number of cans or bottles per case by the number of

ounces or liters per can or bottle to get the total number of ounces or liters purchased per case. Enter this amount in the

column labeled "size in ounces or liters".

To get the total number of ounces of beer or liters of wine purchased, multiply the total number of ounces or liters per

case by the number of cases. To calculate the tax due, multiply the total number of ounces of beer by $.006 per ounce

(beer tax rate) or liters of wine by $.3042 per liter (wine tax rate) purchased.

Use Tax

Purchases of wine, beer and other tangible personal property for use in South Carolina are subject to this state's use tax

when no South Carolina sales or use tax has been paid. The State's basic use tax rate is five percent (5%) of the sales

price. Some counties impose a local tax in addition to the State's basic rate. To verify a county's tax rate or to determine

if a county tax rate is applicable, please call (803) 898-5788.

To calculate the tax due, multiply the total sales price by five percent (5%) (State's basic tax rate) and the sales or use

tax rate for the county (currently from 1% to 2%) where the beer or wine will be delivered for storage, use or consumption

in this state.

This form must be made in triplicate, original retained by SC Department of Revenue, one copy to be left with Collector

of Customs (where applicable) and one copy retained by individual as proof of payment of taxes due.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form, if you are an individual. 42 U.S.C

405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of

any tax. SC Regulation 117-1 mandates that any person required to make a return to the SC Department of Revenue

shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

Mail to: SC Department of Revenue, License Tax, Columbia SC 29214-0137.

Phone: (803) 898-5743

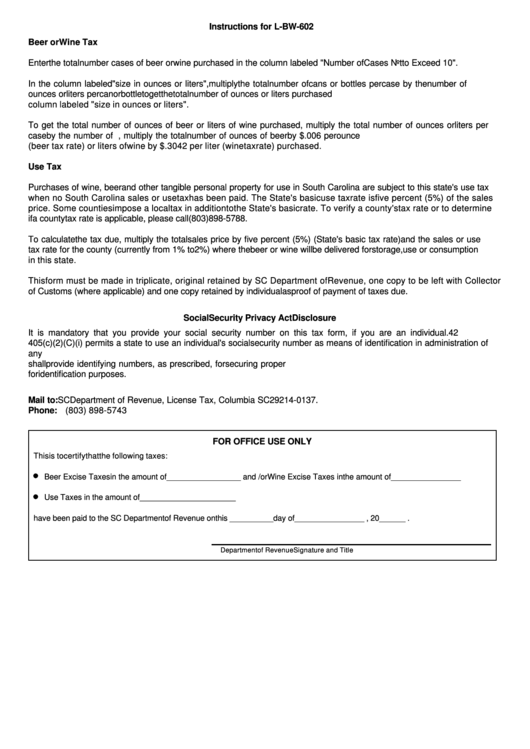

FOR OFFICE USE ONLY

This is to certify that the following taxes:

Beer Excise Taxes in the amount of

_________________ and /or Wine Excise Taxes in the amount of

________________

Use Taxes in the amount of ______________________

have been paid to the SC Department of Revenue on this __________ day of ________________ , 20 ______ .

Department of Revenue

Signature and Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1