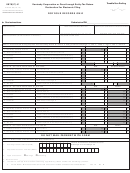

Form 8879(C)-K Draft - Kentucky Corporation Or Pass-Through Entity Tax Return Declaration For Electronic Filing - 2017 Page 4

ADVERTISEMENT

FORM 8879(C)-K

INSTRUCTIONS — Form 8879(C)-K

Page 4 of 4

(2017)

The entity must ensure that the following information

PART IV – Declaration and Signature of Electronic

relating to the financial institution’s account is provided

Return Originator (ERO) and Paid Preparer

in the tax preparation software: Routing transit number

(RTN), Depositor account number (DAN), Type of

The ERO must sign and date Form 8879(C)-K.

account (Savings or Checking) and Debit amount.

If the ERO is also the paid preparer, the ERO must check

The payment amount will be processed (debited from

the paid preparer box but is not required to complete

the designated bank account) upon acceptance of the

and sign the paid preparer’s section. If self-employed,

tax return for processing. Direct debit is not available

check the self-employed box.

for Form 765-GP.

A paid preparer who is not the ERO must complete and

PART III – Declaration of Authorized Representative of

sign the paid preparer’s section.

Entity

The authorized representative of the entity must sign

If the ERO cannot obtain the paid preparer’s signature

on Form 8879(C)-K, a copy of the tax return with the

and date Form 8879(C)-K after reviewing the tax return

and before it is transmitted to the Kentucky Department

paid preparer’s signature should be attached to the

of Revenue.

8879(C)-K.

41A720-S8 (16JUN17-DRAFT)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4