Form Sd 100 - School District Income Tax Return - Draft 10/16/06 Page 2

ADVERTISEMENT

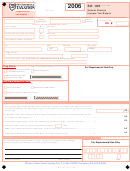

SD 100

Rev. 10/06

2006

School District

06020200

Income Tax Return

Social Security number (required)

School district number

.

0 0

,

,

.

6. School district tax (multiply the amount on line 5 by the decimal rate

on pages 9-10) ........ 6.

0 0

,

,

.

7. Senior citizen credit ($50 limit per return) .................................................................................................... 7.

0 0

,

,

.

8. School district tax less credit (line 6 minus line 7 – cannot be less than -0-) ........................................... 8.

0 0

,

,

.

9. Interest penalty on underpayment of estimated tax. Enclose form SD 2210-100 ..................................... 9.

0 0

,

,

.

10. Total due before withholding and payments (add line 8 and line 9) ......................................................... 10.

0 0

,

,

.

11. School district tax withheld (enclosed W-2s must show and agree with SD number on page 1) ........ 11.

12. Add your estimated 2006 SD 100ES ($

), your 2006 SD 40P payments ($

)

0 0

,

,

.

and your 2005 overpayment credited to 2006 ($

) ............................................................... 12.

0 0

,

,

.

13. Total payments (add line 11 and line 12) .................................................................................................... 13.

0 0

,

,

.

14. If line 13 is less than line 10, subtract line 13 from line 10 and enter the AMOUNT YOU OWE

........ 14.

Check here

if you have paid or will pay with an electronic check or a credit card (see page 7).

Check here

and enclose form SD 40P (see page 7) with the return if you are enclosing a

paper check or money order (make payable to School District Income Tax).

0 0

,

,

.

15. If line 13 is greater than line 10, subtract line 10 from line 13 and enter AMOUNT OVERPAID

........ 15.

0 0

,

,

.

16. Enter the amount of school district overpayment on line 15 that you want CREDITED TO 2007

...... 16.

Draft 10/16/06

0 0

,

,

.

17. Subtract line 16 from line 15 and enter the amount that you want REFUNDED

................................... 17.

If line 17 is less than $1.01, no refund will be issued.

SCHEDULE A – PART-YEAR OR NONRESIDENT ADJUSTMENTS

Note: Do not complete this schedule if you entered school district number 6501 on the front of this form.

18.

Enter on line 18 the amount of Ohio adjusted gross income, line 1, that was earned while not a resident of

the taxing district whose number you entered on page 1 of this return. Be sure you reduce this amount by

0 0

,

,

.

the related deductions (see instructions on page 3). Enter on line 2 the amount you show on line 18 .......

18.

SCHEDULE B – CIRCLEVILLE CITY SCHOOL DISTRICT (6501) ADJUSTMENTS

ONLY

Complete this schedule only if you entered school district number 6501 on page 1 of this form.

19. Enter the amount shown on line 1 on page 1 of this return. If you shaded in the negative

0 0

,

,

.

in the box on line 1, please shade in the negative sign in the box on this line, too ...................

... 19.

20.

Enter on line 20 the qualifying income you earned while a resident of the Circleville City

School District. “Qualifying income you earned” means wages, tips and other employee

compensation as shown on your W-2 (as shown on line 7 of your IRS form 1040 or on line 7

of your IRS form 1040A or on line 1 of your IRS form 1040EZ), and net earnings from self-

employment that you reported on IRS Schedule SE, Section A, line 4 or on Section B, line

0 0

,

,

.

6 (Schedule SE is an attachment to IRS form 1040) ..................................................................................

20.

Is the amount shown on line 19 the same amount as shown on line 20? Yes

No

If yes, do not complete the remainder of this schedule and enter -0- on line 2.

If no, please answer the following: Is the amount shown on line 19 more than the amount

shown on line 20?

Yes.

If yes, go to line 21 of this schedule and leave line 22 blank.

No.

If no, skip line 21 and go to line 22 of this schedule.

21.

If the amount on line 19 is more than the amount on line 20, subtract the amount on line 20 from the

amount on line 19. Enter the difference here. If you show an amount on line 21, place the same

amount on line 2 on the front page of this return. IMPORTANT: If you show an amount on this line,

0 0

,

,

.

shade the negative sign “–” in the box provided on line 2 on the front page of this return .......................

21.

22.

If the amount on line 19 is not more than the amount on line 20, subtract the amount on line 19 from

the amount on line 20. Enter the difference here. Otherwise, leave this line blank. If you show an

0 0

,

,

.

amount on line 22, place the same amount on line 2 on the front page of this return. ...........................

22.

SD 100 – pg. 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4