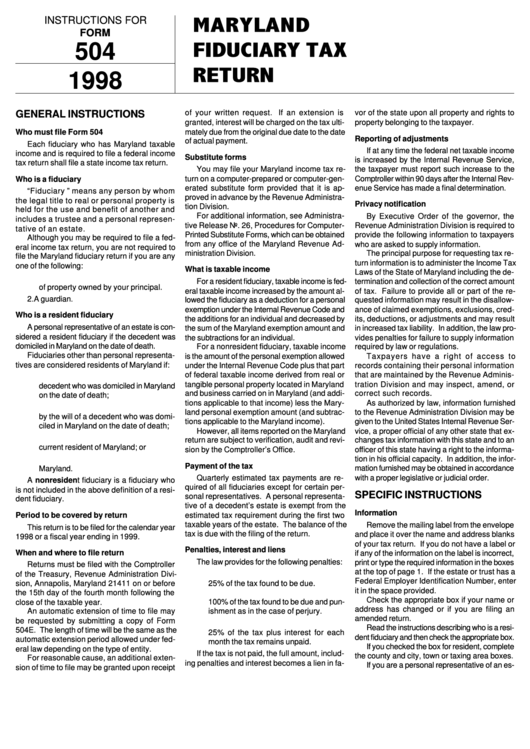

Instructions For Form 504 - Maryland Fiduciary Tax Return - 1998

ADVERTISEMENT

MARYLAND

INSTRUCTIONS FOR

FORM

FIDUCIARY TAX

504

RETURN

1998

GENERAL INSTRUCTIONS

of your written request. If an extension is

vor of the state upon all property and rights to

granted, interest will be charged on the tax ulti-

property belonging to the taxpayer.

Who must file Form 504

mately due from the original due date to the date

Reporting of adjustments

of actual payment.

Each fiduciary who has Maryland taxable

If at any time the federal net taxable income

income and is required to file a federal income

Substitute forms

is increased by the Internal Revenue Service,

tax return shall file a state income tax return.

You may file your Maryland income tax re-

the taxpayer must report such increase to the

turn on a computer-prepared or computer-gen-

Comptroller within 90 days after the Internal Rev-

Who is a fiduciary

erated substitute form provided that it is ap-

enue Service has made a final determination.

“Fiduciary ” means any person by whom

proved in advance by the Revenue Administra-

the legal title to real or personal proper ty is

Privacy notification

tion Division.

held for the use and benefit of another and

For additional information, see Administra-

By Executive Order of the governor, the

includes a trustee and a personal represen-

tive Release No. 26, Procedures for Computer-

Revenue Administration Division is required to

tative of an estate.

Printed Substitute Forms, which can be obtained

provide the following information to taxpayers

Although you may be required to file a fed-

from any office of the Maryland Revenue Ad-

who are asked to supply information.

eral income tax return, you are not required to

ministration Division.

The principal purpose for requesting tax re-

file the Maryland fiduciary return if you are any

turn information is to administer the Income Tax

one of the following:

What is taxable income

Laws of the State of Maryland including the de-

1. An agent holding custody or possession

For a resident fiduciary, taxable income is fed-

termination and collection of the correct amount

of property owned by your principal.

eral taxable income increased by the amount al-

of tax. Failure to provide all or part of the re-

2. A guardian.

lowed the fiduciary as a deduction for a personal

quested information may result in the disallow-

exemption under the Internal Revenue Code and

ance of claimed exemptions, exclusions, cred-

Who is a resident fiduciary

the additions for an individual and decreased by

its, deductions, or adjustments and may result

A personal representative of an estate is con-

the sum of the Maryland exemption amount and

in increased tax liability. In addition, the law pro-

sidered a resident fiduciary if the decedent was

the subtractions for an individual.

vides penalties for failure to supply information

domiciled in Maryland on the date of death.

For a nonresident fiduciary, taxable income

required by law or regulations.

Fiduciaries other than personal representa-

is the amount of the personal exemption allowed

Taxpayers have a r ight of access to

tives are considered residents of Maryland if:

under the Internal Revenue Code plus that part

records containing their personal information

of federal taxable income derived from real or

that are maintained by the Revenue Adminis-

1. The trust was created by the will of a

tangible personal property located in Maryland

tration Division and may inspect, amend, or

decedent who was domiciled in Maryland

and business carried on in Maryland (and addi-

correct such records.

on the date of death;

tions applicable to that income) less the Mary-

As authorized by law, information furnished

2. The trust consists of property transferred

land personal exemption amount (and subtrac-

to the Revenue Administration Division may be

by the will of a decedent who was domi-

tions applicable to the Maryland income).

given to the United States Internal Revenue Ser-

ciled in Maryland on the date of death;

However, all items reported on the Maryland

vice, a proper official of any other state that ex-

3. The creator or grantor of the trust is a

return are subject to verification, audit and revi-

changes tax information with this state and to an

current resident of Maryland; or

sion by the Comptroller’s Office.

officer of this state having a right to the informa-

4. The trust is principally administered in

tion in his official capacity. In addition, the infor-

Payment of the tax

Maryland.

mation furnished may be obtained in accordance

Quarterly estimated tax payments are re-

with a proper legislative or judicial order.

A nonresident fiduciary is a fiduciary who

quired of all fiduciaries except for certain per-

is not included in the above definition of a resi-

SPECIFIC INSTRUCTIONS

sonal representatives. A personal representa-

dent fiduciary.

tive of a decedent’s estate is exempt from the

Information

Period to be covered by return

estimated tax requirement during the first two

taxable years of the estate. The balance of the

Remove the mailing label from the envelope

This return is to be filed for the calendar year

tax is due with the filing of the return.

and place it over the name and address blanks

1998 or a fiscal year ending in 1999.

of your tax return. If you do not have a label or

Penalties, interest and liens

When and where to file return

if any of the information on the label is incorrect,

The law provides for the following penalties:

print or type the required information in the boxes

Returns must be filed with the Comptroller

at the top of page 1. If the estate or trust has a

of the Treasury, Revenue Administration Divi-

1. For failure to file a return on time - up to

Federal Employer Identification Number, enter

sion, Annapolis, Maryland 21411 on or before

25% of the tax found to be due.

it in the space provided.

the 15th day of the fourth month following the

2. For making a fraudulent return - up to

Check the appropriate box if your name or

100% of the tax found to be due and pun-

close of the taxable year.

address has changed or if you are filing an

An automatic extension of time to file may

ishment as in the case of perjury.

amended return.

be requested by submitting a copy of Form

3. For failure to pay tax when due - up to

Read the instructions describing who is a resi-

504E. The length of time will be the same as the

25% of the tax plus interest for each

dent fiduciary and then check the appropriate box.

automatic extension period allowed under fed-

month the tax remains unpaid.

If you checked the box for resident, complete

eral law depending on the type of entity.

If the tax is not paid, the full amount, includ-

the county and city, town or taxing area boxes.

For reasonable cause, an additional exten-

ing penalties and interest becomes a lien in fa-

If you are a personal representative of an es-

sion of time to file may be granted upon receipt

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2