Instructions For Schedule K-37 - Kansas Department Of Revenue

ADVERTISEMENT

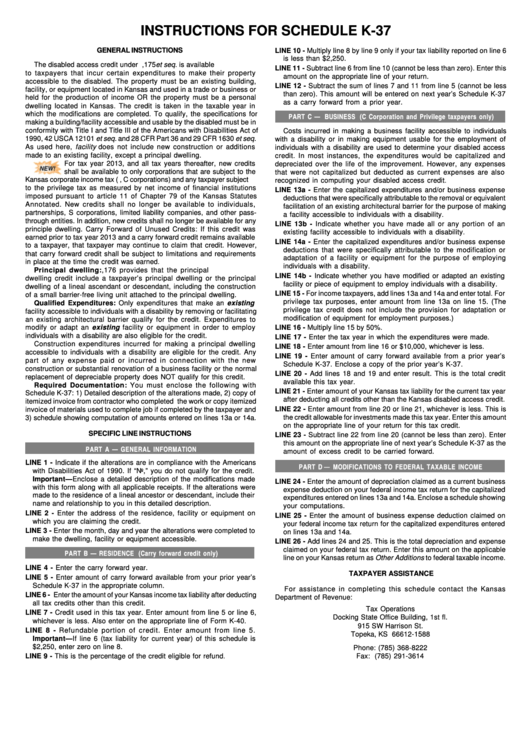

INSTRUCTIONS FOR SCHEDULE K-37

GENERAL INSTRUCTIONS

LINE 10 - Multiply line 8 by line 9 only if your tax liability reported on line 6

is less than $2,250.

The disabled access credit under K.S.A. 79-32,175 et seq. is available

LINE 11 - Subtract line 6 from line 10 (cannot be less than zero). Enter this

to taxpayers that incur certain expenditures to make their property

amount on the appropriate line of your return.

accessible to the disabled. The property must be an existing building,

LINE 12 - Subtract the sum of lines 7 and 11 from line 5 (cannot be less

facility, or equipment located in Kansas and used in a trade or business or

than zero). This amount will be entered on next year’s Schedule K-37

held for the production of income OR the property must be a personal

as a carry forward from a prior year.

dwelling located in Kansas. The credit is taken in the taxable year in

which the modifications are completed. To qualify, the specifications for

PART C — BUSINESS (C Corporation and Privilege taxpayers only)

making a building/facility accessible and usable by the disabled must be in

conformity with Title I and Title III of the Americans with Disabilities Act of

Costs incurred in making a business facility accessible to individuals

1990, 42 USCA 12101 et seq. and 28 CFR Part 36 and 29 CFR 1630 et seq.

with a disability or in making equipment usable for the employment of

As used here, facility does not include new construction or additions

individuals with a disability are used to determine your disabled access

made to an existing facility, except a principal dwelling.

credit. In most instances, the expenditures would be capitalized and

For tax year 2013, and all tax years thereafter, new credits

depreciated over the life of the improvement. However, any expenses

shall be available to only corporations that are subject to the

that were not capitalized but deducted as current expenses are also

Kansas corporate income tax (i.e., C corporations) and any taxpayer subject

recognized in computing your disabled access credit.

to the privilege tax as measured by net income of financial institutions

LINE 13a - Enter the capitalized expenditures and/or business expense

imposed pursuant to article 11 of Chapter 79 of the Kansas Statutes

deductions that were specifically attributable to the removal or equivalent

Annotated. New credits shall no longer be available to individuals,

facilitation of an existing architectural barrier for the purpose of making

partnerships, S corporations, limited liability companies, and other pass-

a facility accessible to individuals with a disability.

through entities. In addition, new credits shall no longer be available for any

LINE 13b - Indicate whether you have made all or any portion of an

principle dwelling. Carry Forward of Unused Credits: If this credit was

existing facility accessible to individuals with a disability.

earned prior to tax year 2013 and a carry forward credit remains available

LINE 14a - Enter the capitalized expenditures and/or business expense

to a taxpayer, that taxpayer may continue to claim that credit. However,

deductions that were specifically attributable to the modification or

that carry forward credit shall be subject to limitations and requirements

adaptation of a facility or equipment for the purpose of employing

in place at the time the credit was earned.

individuals with a disability.

Principal dwelling: K.S.A. 79-32,176 provides that the principal

LINE 14b - Indicate whether you have modified or adapted an existing

dwelling credit include a taxpayer’s principal dwelling or the principal

facility or piece of equipment to employ individuals with a disability.

dwelling of a lineal ascendant or descendant, including the construction

LINE 15 - For income taxpayers, add lines 13a and 14a and enter total. For

of a small barrier-free living unit attached to the principal dwelling.

privilege tax purposes, enter amount from line 13a on line 15. (The

Qualified Expenditures: Only expenditures that make an existing

privilege tax credit does not include the provision for adaptation or

facility accessible to individuals with a disability by removing or facilitating

modification of equipment for employment purposes.)

an existing architectural barrier qualify for the credit. Expenditures to

modify or adapt an existing facility or equipment in order to employ

LINE 16 - Multiply line 15 by 50%.

individuals with a disability are also eligible for the credit.

LINE 17 - Enter the tax year in which the expenditures were made.

Construction expenditures incurred for making a principal dwelling

LINE 18 - Enter amount from line 16 or $10,000, whichever is less.

accessible to individuals with a disability are eligible for the credit. Any

LINE 19 - Enter amount of carry forward available from a prior year’s

part of any expense paid or incurred in connection with the new

Schedule K-37. Enclose a copy of the prior year’s K-37.

construction or substantial renovation of a business facility or the normal

LINE 20 - Add lines 18 and 19 and enter result. This is the total credit

replacement of depreciable property does NOT qualify for this credit.

available this tax year.

Required Documentation: You must enclose the following with

LINE 21 - Enter amount of your Kansas tax liability for the current tax year

Schedule K-37: 1) Detailed description of the alterations made, 2) copy of

after deducting all credits other than the Kansas disabled access credit.

itemized invoice from contractor who completed the work or copy itemized

LINE 22 - Enter amount from line 20 or line 21, whichever is less. This is

invoice of materials used to complete job if completed by the taxpayer and

the credit allowable for investments made this tax year. Enter this amount

3) schedule showing computation of amounts entered on lines 13a or 14a.

on the appropriate line of your return for this tax credit.

SPECIFIC LINE INSTRUCTIONS

LINE 23 - Subtract line 22 from line 20 (cannot be less than zero). Enter

this amount on the appropriate line of next year’s Schedule K-37 as the

PART A — GENERAL INFORMATION

amount of excess credit to be carried forward.

LINE 1 - Indicate if the alterations are in compliance with the Americans

PART D — MODIFICATIONS TO FEDERAL TAXABLE INCOME

with Disabilities Act of 1990. If “No,” you do not qualify for the credit.

Important—Enclose a detailed description of the modifications made

LINE 24 - Enter the amount of depreciation claimed as a current business

with this form along with all applicable receipts. If the alterations were

expense deduction on your federal income tax return for the capitalized

made to the residence of a lineal ancestor or descendant, include their

expenditures entered on lines 13a and 14a. Enclose a schedule showing

name and relationship to you in this detailed description.

your computations.

LINE 2 - Enter the address of the residence, facility or equipment on

LINE 25 - Enter the amount of business expense deduction claimed on

which you are claiming the credit.

your federal income tax return for the capitalized expenditures entered

LINE 3 - Enter the month, day and year the alterations were completed to

on lines 13a and 14a.

make the dwelling, facility or equipment accessible.

LINE 26 - Add lines 24 and 25. This is the total depreciation and expense

claimed on your federal tax return. Enter this amount on the applicable

PART B — RESIDENCE (Carry forward credit only)

line on your Kansas return as Other Additions to federal taxable income.

LINE 4 - Enter the carry forward year.

TAXPAYER ASSISTANCE

LINE 5 - Enter amount of carry forward available from your prior year’s

Schedule K-37 in the appropriate column.

For assistance in completing this schedule contact the Kansas

LINE 6 - Enter the amount of your Kansas income tax liability after deducting

Department of Revenue:

all tax credits other than this credit.

Tax Operations

LINE 7 - Credit used in this tax year. Enter amount from line 5 or line 6,

Docking State Office Building, 1st fl.

whichever is less. Also enter on the appropriate line of Form K-40.

915 SW Harrison St.

LINE 8 - Refundable portion of credit. Enter amount from line 5.

Topeka, KS 66612-1588

Important—If line 6 (tax liability for current year) of this schedule is

$2,250, enter zero on line 8.

Phone: (785) 368-8222

LINE 9 - This is the percentage of the credit eligible for refund.

Fax: (785) 291-3614

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1