Instructions For Schedule K-47 - Kansas Department Of Revenue

ADVERTISEMENT

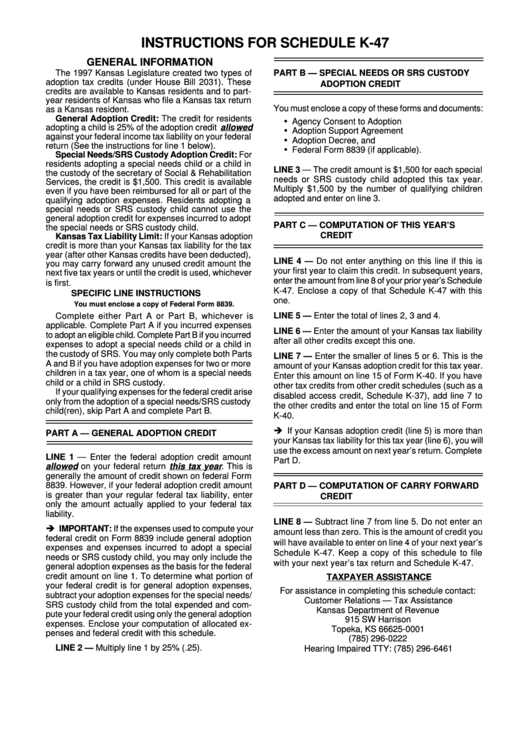

INSTRUCTIONS FOR SCHEDULE K-47

GENERAL INFORMATION

The 1997 Kansas Legislature created two types of

PART B — SPECIAL NEEDS OR SRS CUSTODY

adoption tax credits (under House Bill 2031). These

ADOPTION CREDIT

credits are available to Kansas residents and to part-

year residents of Kansas who file a Kansas tax return

You must enclose a copy of these forms and documents:

as a Kansas resident.

General Adoption Credit: The credit for residents

Agency Consent to Adoption

adopting a child is 25% of the adoption credit allowed

Adoption Support Agreement

against your federal income tax liability on your federal

Adoption Decree, and

return (See the instructions for line 1 below).

Federal Form 8839 (if applicable).

Special Needs/SRS Custody Adoption Credit: For

residents adopting a special needs child or a child in

LINE 3 — The credit amount is $1,500 for each special

the custody of the secretary of Social & Rehabilitation

needs or SRS custody child adopted this tax year.

Services, the credit is $1,500. This credit is available

Multiply $1,500 by the number of qualifying children

even if you have been reimbursed for all or part of the

adopted and enter on line 3.

qualifying adoption expenses. Residents adopting a

special needs or SRS custody child cannot use the

general adoption credit for expenses incurred to adopt

PART C — COMPUTATION OF THIS YEAR’S

the special needs or SRS custody child.

CREDIT

Kansas Tax Liability Limit: If your Kansas adoption

credit is more than your Kansas tax liability for the tax

year (after other Kansas credits have been deducted),

LINE 4 — Do not enter anything on this line if this is

you may carry forward any unused credit amount the

your first year to claim this credit. In subsequent years,

next five tax years or until the credit is used, whichever

enter the amount from line 8 of your prior year’s Schedule

is first.

K-47. Enclose a copy of that Schedule K-47 with this

SPECIFIC LINE INSTRUCTIONS

one.

You must enclose a copy of Federal Form 8839.

Complete either Part A or Part B, whichever is

LINE 5 — Enter the total of lines 2, 3 and 4.

applicable. Complete Part A if you incurred expenses

LINE 6 — Enter the amount of your Kansas tax liability

to adopt an eligible child. Complete Part B if you incurred

after all other credits except this one.

expenses to adopt a special needs child or a child in

the custody of SRS. You may only complete both Parts

LINE 7 — Enter the smaller of lines 5 or 6. This is the

A and B if you have adoption expenses for two or more

amount of your Kansas adoption credit for this tax year.

children in a tax year, one of whom is a special needs

Enter this amount on line 15 of Form K-40. If you have

child or a child in SRS custody.

other tax credits from other credit schedules (such as a

If your qualifying expenses for the federal credit arise

disabled access credit, Schedule K-37), add line 7 to

only from the adoption of a special needs/SRS custody

the other credits and enter the total on line 15 of Form

child(ren), skip Part A and complete Part B.

K-40.

If your Kansas adoption credit (line 5) is more than

PART A — GENERAL ADOPTION CREDIT

your Kansas tax liability for this tax year (line 6), you will

use the excess amount on next year’s return. Complete

LINE 1 — Enter the federal adoption credit amount

Part D.

allowed on your federal return this tax year . This is

generally the amount of credit shown on federal Form

8839. However, if your federal adoption credit amount

PART D — COMPUTATION OF CARRY FORWARD

is greater than your regular federal tax liability, enter

CREDIT

only the amount actually applied to your federal tax

liability.

LINE 8 — Subtract line 7 from line 5. Do not enter an

IMPORTANT: If the expenses used to compute your

amount less than zero. This is the amount of credit you

federal credit on Form 8839 include general adoption

will have available to enter on line 4 of your next year’s

expenses and expenses incurred to adopt a special

Schedule K-47. Keep a copy of this schedule to file

needs or SRS custody child, you may only include the

with your next year’s tax return and Schedule K-47.

general adoption expenses as the basis for the federal

credit amount on line 1. To determine what portion of

TAXPAYER ASSISTANCE

your federal credit is for general adoption expenses,

For assistance in completing this schedule contact:

subtract your adoption expenses for the special needs/

Customer Relations — Tax Assistance

SRS custody child from the total expended and com-

Kansas Department of Revenue

pute your federal credit using only the general adoption

915 SW Harrison

expenses. Enclose your computation of allocated ex-

Topeka, KS 66625-0001

penses and federal credit with this schedule.

(785) 296-0222

LINE 2 — Multiply line 1 by 25% (.25).

Hearing Impaired TTY: (785) 296-6461

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1