Instructions For Schedule In-112 - Vermont Tax Adjustments And Credits, Schedule In-113 - Income Adjustment

ADVERTISEMENT

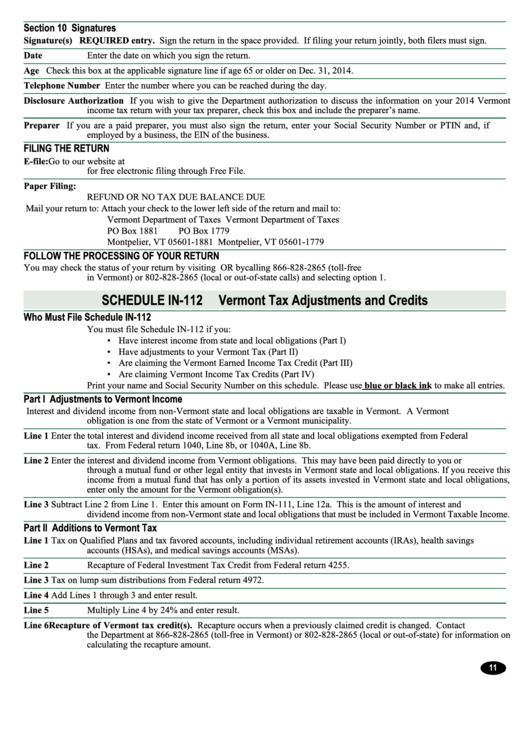

Section 10 Signatures

Signature(s)

REQUIRED entry . Sign the return in the space provided. If filing your return jointly, both filers must sign.

Date

Enter the date on which you sign the return.

Age

Check this box at the applicable signature line if age 65 or older on Dec. 31, 2014.

Telephone Number Enter the number where you can be reached during the day.

Disclosure Authorization If you wish to give the Department authorization to discuss the information on your 2014 Vermont

income tax return with your tax preparer, check this box and include the preparer’s name.

Preparer

If you are a paid preparer, you must also sign the return, enter your Social Security Number or PTIN and, if

employed by a business, the EIN of the business.

FILING THE RETURN

E-file:

Go to our website at for information on electronic filing. Some taxpayers may be eligible

for free electronic filing through Free File.

Paper Filing:

REFUND OR NO TAX DUE

BALANCE DUE

Mail your return to:

Attach your check to the lower left side of the return and mail to:

Vermont Department of Taxes

Vermont Department of Taxes

PO Box 1881

PO Box 1779

Montpelier, VT 05601-1881

Montpelier, VT 05601-1779

FOLLOW THE PROCESSING OF YOUR RETURN

You may check the status of your return by visiting OR by calling 866-828-2865 (toll-free

in Vermont) or 802-828-2865 (local or out-of-state calls) and selecting option 1.

SCHEDULE IN-112 Vermont Tax Adjustments and Credits

Who Must File Schedule IN-112

You must file Schedule IN-112 if you:

• Have interest income from state and local obligations (Part I)

• Have adjustments to your Vermont Tax (Part II)

• Are claiming the Vermont Earned Income Tax Credit (Part III)

• Are claiming Vermont Income Tax Credits (Part IV)

Print your name and Social Security Number on this schedule. Please use blue or black ink to make all entries.

Part I Adjustments to Vermont Income

Interest and dividend income from non-Vermont state and local obligations are taxable in Vermont. A Vermont

obligation is one from the state of Vermont or a Vermont municipality.

Line 1

Enter the total interest and dividend income received from all state and local obligations exempted from Federal

tax. From Federal return 1040, Line 8b, or 1040A, Line 8b.

Line 2

Enter the interest and dividend income from Vermont obligations. This may have been paid directly to you or

through a mutual fund or other legal entity that invests in Vermont state and local obligations. If you receive this

income from a mutual fund that has only a portion of its assets invested in Vermont state and local obligations,

enter only the amount for the Vermont obligation(s).

Line 3

Subtract Line 2 from Line 1. Enter this amount on Form IN-111, Line 12a. This is the amount of interest and

dividend income from non-Vermont state and local obligations that must be included in Vermont Taxable Income.

Part II Additions to Vermont Tax

Line 1

Tax on Qualified Plans and tax favored accounts, including individual retirement accounts (IRAs), health savings

accounts (HSAs), and medical savings accounts (MSAs).

Line 2

Recapture of Federal Investment Tax Credit from Federal return 4255.

Line 3

Tax on lump sum distributions from Federal return 4972.

Line 4

Add Lines 1 through 3 and enter result.

Line 5

Multiply Line 4 by 24% and enter result.

Line 6

Recapture of Vermont tax credit(s) . Recapture occurs when a previously claimed credit is changed. Contact

the Department at 866-828-2865 (toll-free in Vermont) or 802-828-2865 (local or out-of-state) for information on

calculating the recapture amount.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3