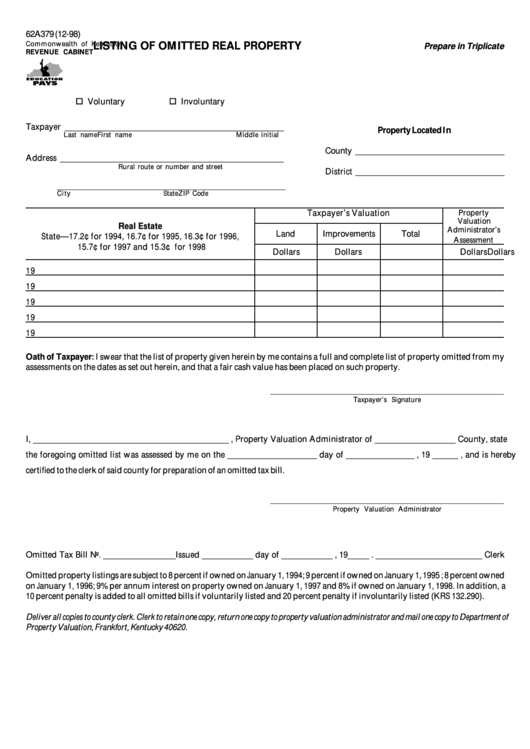

62A379 (12-98)

Commonwealth of Kentucky

LISTING OF OMITTED REAL PROPERTY

Prepare in Triplicate

REVENUE CABINET

Voluntary

Involuntary

Taxpayer __________________________________________________

Property Located In

Last name

First name

Middle initial

County __________________________________

Address ___________________________________________________

Rural route or number and street

District __________________________________

City

State

ZIP Code

Property

Taxpayer’s Valuation

Valuation

Real Estate

Administrator’s

Land

Improvements

Total

State—17.2¢ for 1994, 16.7¢ for 1995, 16.3¢ for 1996,

Assessment

15.7¢ for 1997 and 15.3¢ for 1998

Dollars

Dollars

Dollars

Dollars

19

19

19

19

19

Oath of Taxpayer: I swear that the list of property given herein by me contains a full and complete list of property omitted from my

assessments on the dates as set out herein, and that a fair cash value has been placed on such property.

Taxpayer’s Signature

I, ______________________________________________ , Property Valuation Administrator of ___________________ County, state

the foregoing omitted list was assessed by me on the _____________________ day of ________________ , 19 ______ , and is hereby

certified to the clerk of said county for preparation of an omitted tax bill.

Property Valuation Administrator

Omitted Tax Bill No. _________________Issued ____________ day of ____________ , 19_____ . _________________________ Clerk

Omitted property listings are subject to 8 percent if owned on January 1, 1994; 9 percent if owned on January 1, 1995 ; 8 percent owned

on January 1, 1996; 9% per annum interest on property owned on January 1, 1997 and 8% if owned on January 1, 1998. In addition, a

10 percent penalty is added to all omitted bills if voluntarily listed and 20 percent penalty if involuntarily listed (KRS 132.290).

Deliver all copies to county clerk. Clerk to retain one copy, return one copy to property valuation administrator and mail one copy to Department of

Property Valuation, Frankfort, Kentucky 40620.

1

1 2

2