Instructions For Schedule K (Form 990) - Supplemental Information On Tax-Exempt Bonds - 2016 Page 2

ADVERTISEMENT

Defeasance escrow. This is an

after December 31, 2002, to refund

corresponding information included on

irrevocable escrow established in an

directly or through a series of refunding

Form 8038, Information Return for

amount that, together with investment

bonds that were also originally issued after

Tax-Exempt Private Activity Bond Issues,

earnings, is sufficient to pay all the

2002.

filed by the governmental issuer upon the

principal of, and interest and call premium

issuance of the bond issue. Complete

Example 1. Refunding of pre-2003

on, bonds from the date the escrow is

multiple schedules if necessary to account

bonds. Bonds issued in 2002 to construct

established. See Regulations section

for all outstanding post-December 31,

a facility were current refunded in 2011. In

1.141-12(d)(5). A defeasance escrow

2002, tax-exempt bond issues. In this

2014, bonds were issued to current refund

can be established for several purposes,

case, describe in the first Schedule K, Part

the 2011 bonds. As of December 31,

including the remediation of nonqualified

VI, that additional schedules are included.

2016, the last day of the organization's tax

bonds when the defeasance provides for

year, the 2014 refunding bonds had an

Columns (a) and (b). Enter the name

redemption of bonds on the earliest call

outstanding principal amount exceeding

and employer identification number (EIN)

date. However, for purposes of completing

$100,000. The organization must list the

of the issuer of the bond issue. The

this schedule, an escrow established with

refunding bond issue in Part I for each

issuer's name is the name of the entity

proceeds of a refunding issue to defease

year the outstanding principal amount

which issued the bond issue (typically a

a prior issue is referred to as a refunding

exceeds $100,000 as of the last day of

state or local governmental unit). The

escrow.

such year, and must provide all Part I, Part

issuer's name and EIN should be identical

II, and Part IV information for such

to the name and EIN listed on Form 8038,

Refunding escrow. This is one or

refunding issue. Because the original

Part I, lines 1 and 2, filed for the bond

more funds established as part of a single

bonds were issued prior to 2003, the

issue.

transaction or a series of related

organization need not complete Part III for

transactions, containing proceeds of a

Column (c). Enter the Committee on

the refunding bond issue.

refunding issue and any other amounts

Uniform Securities Identification

to provide for payment of principal or

Example 2. Refunding of post-2002

Procedures (CUSIP) number on the bond

interest on one or more prior issues. See

bonds. Bonds issued in 2011 were

with the latest maturity. The CUSIP

Regulations section 1.148-1(b).

advance refunded in 2014. As of

number should be identical to the CUSIP

December 31, 2016, the last day of the

number listed on Form 8038, Part I, line 9,

Refunding issue. This is an issue of

organization's tax year, the refunding

filed for the bond issue. If the bond issue

obligations the proceeds of which are

issue had an outstanding principal

wasn't publicly offered and there is no

used to pay principal, interest, or

amount exceeding $100,000. The

assigned CUSIP number, enter zeros in

redemption price on another issue (a prior

organization must list the refunding issue

place of the CUSIP number.

issue), including the issuance costs,

in Part I for each year the outstanding

accrued interest, capitalized interest on

Column (d). Enter the issue date of the

principal amount exceeds $100,000 as of

the refunding issue, a reserve or

obligation. The issue date should be

the last day of the year, and must provide

replacement fund, or similar costs, if any,

identical to the issue date listed on Form

all Part I, Part II, Part III, and Part IV

properly allocable to that refunding issue.

8038, Part I, line 7, filed for the bond

information for such refunding issue. If any

A current refunding issue is a refunding

issue. The issue date generally is the date

outstanding bonds of the 2011 bond issue

issue that is issued not more than 90 days

on which the issuer receives the purchase

weren't legally defeased, the organization

before the last expenditure of any

price in exchange for delivery of the

also must list the 2011 bond issue in Part

proceeds of the refunding issue for the

evidence of indebtedness (for example, a

I, and must provide all Part I, Part II, Part

payment of principal or interest on the

bond). In no event is the issue date earlier

III, and Part IV information for such bond

prior issue. An advance refunding issue is

than the first day on which interest begins

issue.

a refunding issue that isn't a current

to accrue on the bond for federal income

refunding issue. See Regulations sections

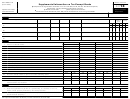

Part I. Bond Issues

tax purposes. See Regulations section

1.150-1(d)(1), (3), and (4).

1.150-1(b).

In Part I, provide the requested information

Private business use. Private

Column (e). Enter the issue price of the

for each outstanding tax-exempt bond

business use means use of the proceeds

obligation. The issue price generally

issue (including a refunding issue) that:

of an issue by the organization or another

should be identical to the issue price listed

Had an outstanding principal amount in

section 501(c)(3) organization in an

on Form 8038, Part III, line 21(b), filed for

excess of $100,000 as of the last day of

unrelated trade or business as defined by

the bond issue. The issue price generally

the tax year (or other selected 12-month

section 513. Private business use also

is determined under Regulations section

period), and

generally includes any use by a

1.148-1(b). If the issue price isn't identical

Was issued after December 31, 2002.

nongovernmental person other than a

to the issue price listed on the filed Form

For this purpose, bond issues that have

section 501(c)(3) organization unless

8038, use Part VI to explain the difference.

been legally defeased in whole, and as a

otherwise permitted through an exception

Column (f). Describe the purpose of the

result are no longer treated as a liability of

or safe harbor provided under the

bond issue, such as to construct a

the organization, need not be listed in Part

regulations or a revenue procedure.

hospital or provide funds to refund a prior

I and aren't subject to the generally

Special rules for refunding of pre-2003

issue. If any of the bond proceeds were

applicable reporting requirements of Parts

issues. Bonds issued after December 31,

used to refund a prior issue, enter the date

I, II, III, and IV. Organizations are

2002, to refund bonds issued before

of issue for each of the refunded issues. If

reminded, however, that continued

January 1, 2003, have special reporting

the issue has multiple purposes, enter

compliance with federal tax law

requirements. Such refunding bonds are

each purpose. If the issue financed

requirements is required with respect to

subject to the generally applicable

various projects or activities

defeased bonds.

reporting requirements of Parts I, II, and

corresponding to a related purpose, only

Use one row for each issue, and use

IV. However, the organization need not

enter the purpose once. For example, if

the Part I row designation for a particular

complete lines 1 through 9 of Part III to

proceeds are used to acquire various

issue (for example, “A” or “B”) consistently

report private business use information for

items of office equipment, the amount of

throughout Parts I through IV. The

the issue for such refunding bonds. These

such expenditures should be aggregated

information provided in columns (a)

special rules don't apply to bonds issued

and identified with the stated purpose of

through (d) should be consistent with the

2016 Instructions for Schedule K (Form 990)

-2-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5