Instructions For Schedule K (Form 990) - Supplemental Information On Tax-Exempt Bonds - 2016 Page 3

ADVERTISEMENT

“office equipment.” Alternatively, if

been retired, but have been legally

buildings, and equipment. See

proceeds are used to construct and equip

defeased through the establishment of a

Regulations section 1.150-1(b). However,

a single facility, the expenditures should

defeasance escrow or a refunding

don't report capital expenditures financed

be aggregated and identified with the

escrow, as of the end of the 12-month

by a prior issue that was refunded by the

stated purpose of “construct & equip

period.

bond issue or capitalized interest that was

facility” where the identification of the

reported on line 5.

Line 3. Enter the total amount of

facility is distinguishable from other

proceeds of the bond issue as of the end

Line 11. Enter the cumulative amount of

bond-financed facilities, if any. Use Part VI

of the 12-month period. If the total

proceeds used for any item not reported

if additional space is needed for this

proceeds aren't identical to the issue price

on lines 4 through 10 as of the end of the

purpose.

listed in Part I, column (e), use Part VI to

12-month period. Include any proceeds

Column (g). Check “Yes” or “No” to

explain the difference (for example,

used or irrevocably held to redeem or

indicate whether a defeasance escrow

investment earnings).

legally defease bonds of the issue.

or refunding escrow has been

Line 4. Enter the amount of gross

Line 12. Enter the amount of unspent

established to irrevocably defease any

proceeds held in a reasonably required

proceeds as of the end of the 12-month

bonds of the bond issue.

reserve or replacement fund, sinking fund,

period other than those amounts identified

Column (h). Check “Yes” if the

or pledged fund as of the end of the

in lines 4, 6, and 11.

organization acted as an “on behalf of

12-month period. See Regulations

Line 13. Enter the year in which

issuer” in issuing the bond issue. Check

sections 1.148-1(c)(2), 1.148-1(c)(3), and

construction, acquisition, or rehabilitation

“No” if the organization only acted as the

1.148-2(f).

of the financed project was substantially

borrower of the bond proceeds under the

Line 5. Enter the cumulative amount of

completed. A project can be treated as

terms of a conduit loan with the

proceeds used, as of the end of the

substantially completed when, based

governmental issuer of the bond issue.

12-month period, to pay interest on the

upon all the facts and circumstances, the

An “on behalf of issuer” is a corporation

applicable portion of the bond issue

project has reached a degree of

organized under the general nonprofit

during construction of a financed capital

completion which would permit its

corporation law of a state whose

project.

operation at substantially its design level

obligations are considered obligations of a

and it is, in fact, in operation at such level.

Line 6. Enter the amount of proceeds

state or local governmental unit. See

See Regulations section 1.150-2(c). If the

held in a refunding escrow as of the end

Rev. Proc. 82-26, 1982-1 C.B. 476, for a

bond issue financed multiple projects,

of the 12-month period. For this purpose

description of the circumstances under

enter the latest year in which construction,

only, include investment proceeds without

which the IRS will ordinarily issue a letter

acquisition, or rehabilitation of each of the

regard to the project period limitation

ruling that the obligations of a nonprofit

financed projects was substantially

found in the definition of proceeds.

corporation will be issued on behalf of a

completed. For example, if a bond issue

state or local governmental unit. See also

Line 7. Enter the cumulative amount of

financed the construction of three projects

Rev. Rul. 63-20, 1963-1 C.B. 24; Rev. Rul.

proceeds used to pay bond issuance

which were substantially completed in

59-41, 1959-1 C.B. 13; and Rev. Rul.

costs, including (but not limited to)

2014, 2015, and 2016, respectively, then

54-296, 1954-2 C.B. 59. An “on behalf of

underwriters' spread as well as fees for

enter “2016.” If the bond issue financed

issuer” also includes a constituted

trustees and bond counsel as of the end of

working capital expenditures, provide the

authority organized by a state or local

the 12-month period. Issuance costs are

latest year in which the proceeds of the

governmental unit and empowered to

costs incurred in connection with, and

issue were allocated to those

issue debt obligations in order to further

allocable to, the issuance of a bond

expenditures.

public purposes. See Rev. Rul. 57-187,

issue. See Regulations section 1.150-1(b)

Line 14. Check “Yes” or “No” to indicate if

1957-1 C.B. 65.

for an example list of issuance costs.

the bond issue is a current refunding

Column (i). Check “Yes” or “No” to

Line 8. Enter the cumulative amount of

issue.

indicate if the bond issue was a pooled

proceeds used to pay fees for credit

Line 15. Check “Yes” or “No” to indicate if

financing issue.

enhancement that are taken into account

the bond issue is an advance refunding

in determining the yield on the issue for

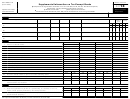

Part II. Proceeds

issue.

purposes of section 148(h) (for example,

bond insurance premiums and certain

Line 16. Check “Yes” or “No” to indicate if

Complete for each bond issue listed in

fees for letters of credit) as of the end of

the final allocation of proceeds has been

rows A through D of Part I. Complete

the 12-month period.

made. Proceeds of a bond issue must be

multiple schedules if necessary to account

accounted for using any reasonable,

for all outstanding tax-exempt bond

Line 9. Enter the cumulative amount of

consistently applied accounting method.

issues. Note that lines 3 and 5 through 12

proceeds used to finance working capital

Allocations must be made by certain

concern the amount of proceeds of the

expenditures as of the end of the

applicable due dates and are generally not

bond issue, but line 4 concerns the

12-month period. However, don't report

considered final until the expiration of

amount of gross proceeds of the bond

expenditures reported in lines 4, 6, 7, and

such due dates. See Regulations section

issue. Because of this, the aggregate of

8. A working capital expenditure is any

1.148-6.

the amounts entered on lines 4 through 12

cost that isn't a capital expenditure (for

may not equal the amount entered on

example, current operating expenses).

Line 17. Check “Yes” or “No” to indicate if

line 3.

See Regulations section 1.150-1(b).

the organization maintains adequate

books and records to support the final

Line 1. Enter the cumulative principal

Line 10. Enter the cumulative amount of

allocation of proceeds. Answer this

amount of bonds of the issue that have

proceeds used to finance capital

question only with respect to the tax year

been retired as of the end of the 12-month

expenditures as of the end of the

applicable to this schedule.

period used in completing this schedule.

12-month period. Capital expenditures

generally include costs incurred to

Line 2. Enter the cumulative principal

acquire, construct, or improve land,

amount of bonds of the issue that haven't

2016 Instructions for Schedule K (Form 990)

-3-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5